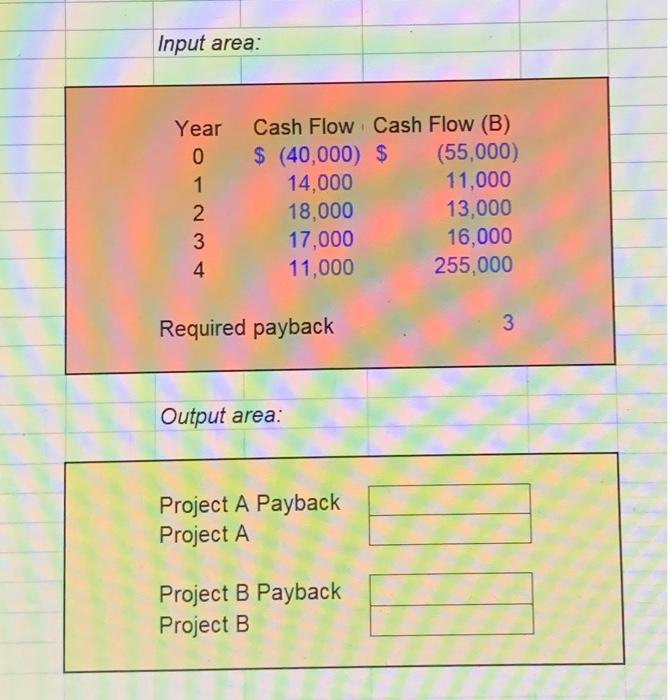

Question: Input area: Required payback 3 Output area: Project A Payback Project A Project B Payback Project B Input area: Required Re 14% Year 0 Year

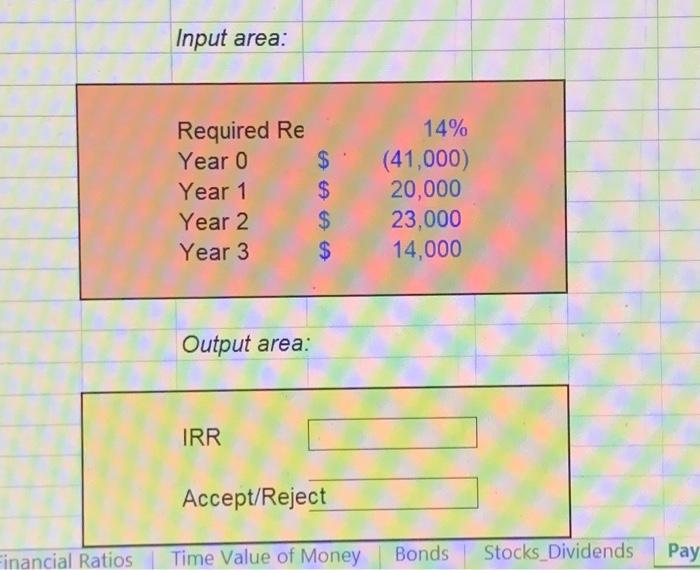

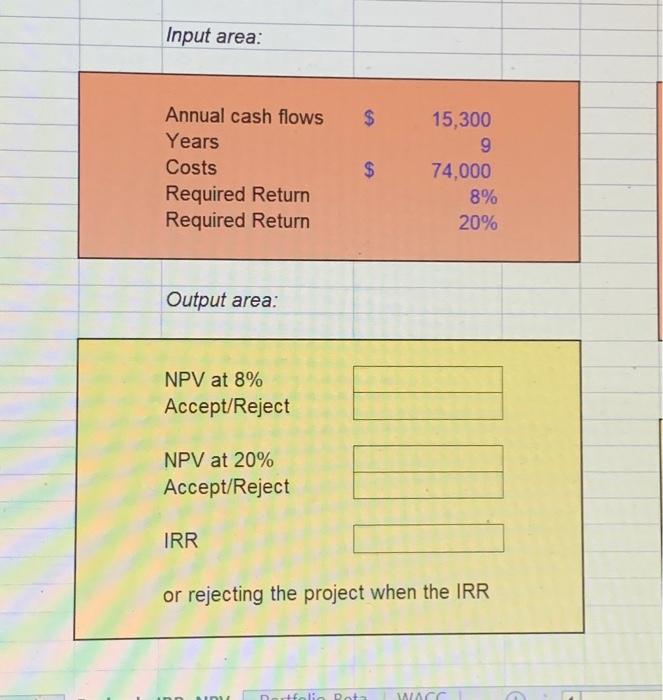

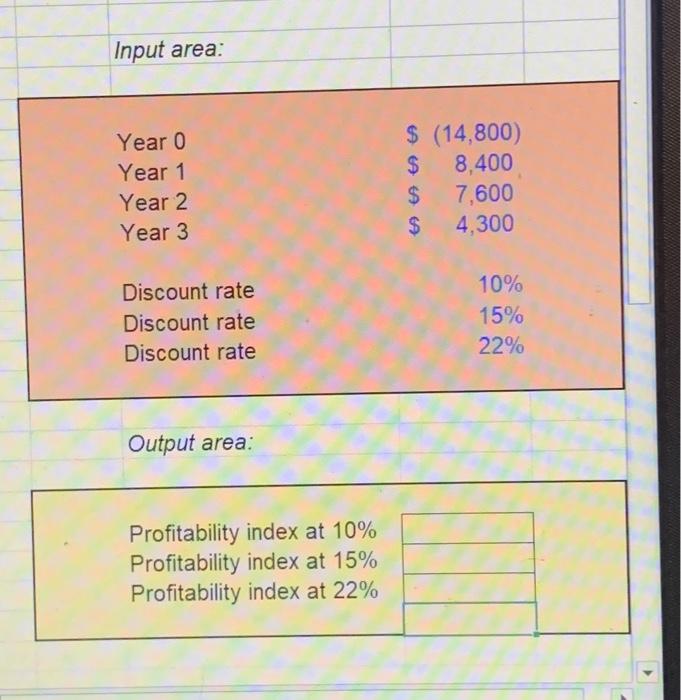

Input area: Required payback 3 Output area: Project A Payback Project A Project B Payback Project B Input area: Required Re 14% Year 0 Year 1 Year 2 Year 3 (41,000) 20,000 23,000 14,000 Output area: IRR Accept/Reject Input area: Annual cash flows Years Costs Required Return Required Return 15,300 9 74,000 Output area: NPV at 8% Accept/Reject NPV at 20% Accept/Reject IRR or rejecting the project when the IRR Input area: Year 0 Year 1 Year 2 Year 3 Discount rate Discount rate Discount rate $$$$(14,800)8,4007,6004,300 10% 15% 22% Output area: Profitability index at 10% Profitability index at 15% Profitability index at 22% \begin{tabular}{|l|} \hline \\ \hline \\ \hline \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts