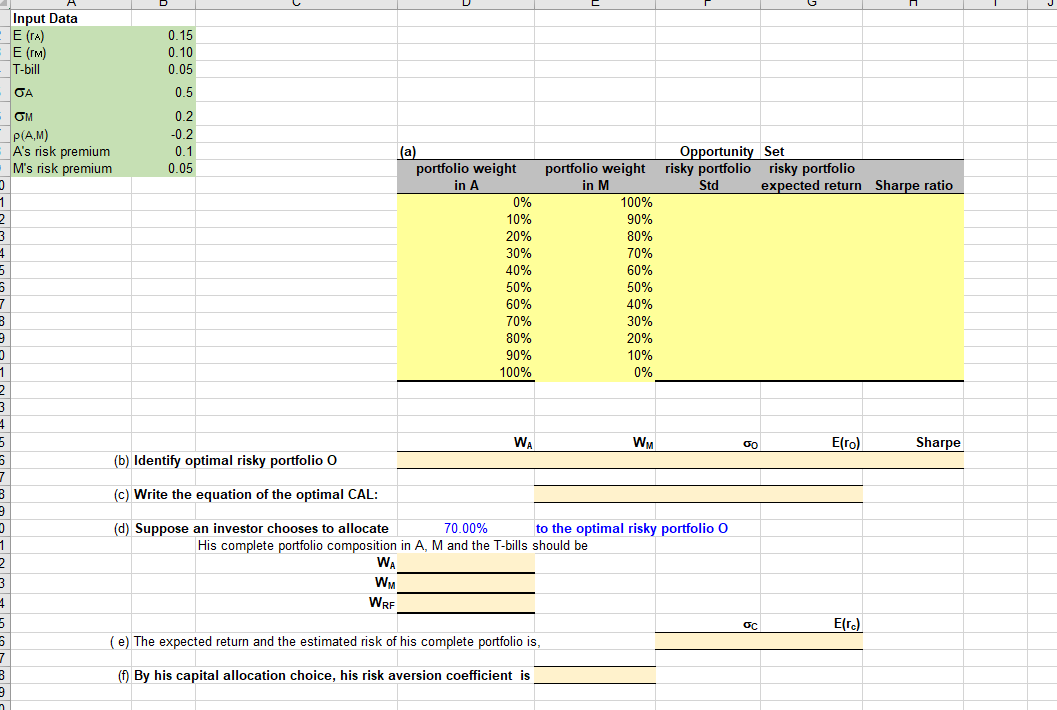

Question: Input Data E (TA) E (TM) T-bill 0.15 0.10 0.05 GA 0.5 OM P(AM) A's risk premium M's risk premium 0.2 -0.2 0.1 0.05 1

Input Data E (TA) E (TM) T-bill 0.15 0.10 0.05 GA 0.5 OM P(AM) A's risk premium M's risk premium 0.2 -0.2 0.1 0.05 1 3 4 (a) portfolio weight in A 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Opportunity Set portfolio weight risky portfolio risky portfolio in M Std expected return Sharpe ratio 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 3 3 3 1 3 WA WM 00 E(ro) Sharpe (b) Identify optimal risky portfolio O 3 1 2 3 4 (c) Write the equation of the optimal CAL: (d) Suppose an investor chooses to allocate 70.00% to the optimal risky portfolio O His complete portfolio composition in A, M and the T-bills should be WA WM WRF OC E(rc) (e) The expected return and the estimated risk of his complete portfolio is, (f) By his capital allocation choice, his risk aversion coefficient is Input Data E (TA) E (TM) T-bill 0.15 0.10 0.05 GA 0.5 OM P(AM) A's risk premium M's risk premium 0.2 -0.2 0.1 0.05 1 3 4 (a) portfolio weight in A 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Opportunity Set portfolio weight risky portfolio risky portfolio in M Std expected return Sharpe ratio 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 3 3 3 1 3 WA WM 00 E(ro) Sharpe (b) Identify optimal risky portfolio O 3 1 2 3 4 (c) Write the equation of the optimal CAL: (d) Suppose an investor chooses to allocate 70.00% to the optimal risky portfolio O His complete portfolio composition in A, M and the T-bills should be WA WM WRF OC E(rc) (e) The expected return and the estimated risk of his complete portfolio is, (f) By his capital allocation choice, his risk aversion coefficient is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts