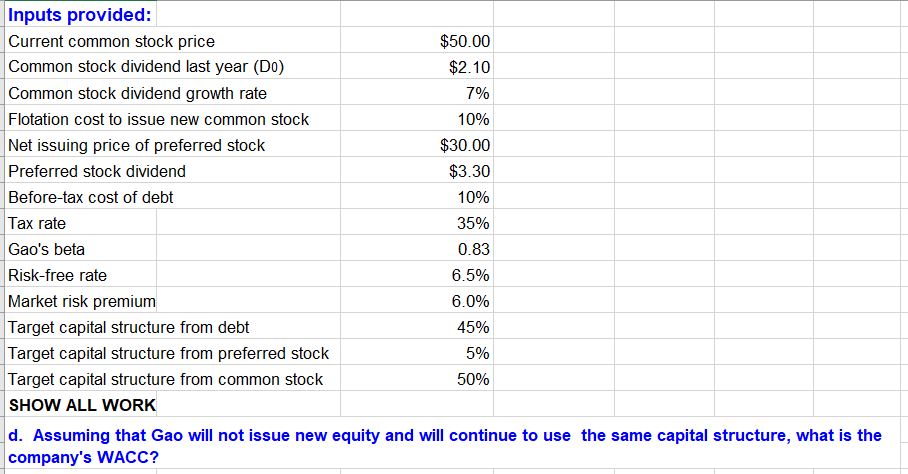

Question: Inputs provided: Current common stock price $50.00 Common stock dividend last year (Do) $2.10 Common stock dividend growth rate 7% Flotation cost to issue

Inputs provided: Current common stock price $50.00 Common stock dividend last year (Do) $2.10 Common stock dividend growth rate 7% Flotation cost to issue new common stock 10% Net issuing price of preferred stock $30.00 Preferred stock dividend $3.30 Before-tax cost of debt 10% Tax rate Gao's beta 35% 0.83 Risk-free rate Market risk premium Target capital structure from debt 6.5% 6.0% 45% Target capital structure from preferred stock 5% Target capital structure from common stock SHOW ALL WORK 50% d. Assuming that Gao will not issue new equity and will continue to use the same capital structure, what is the company's WACC?

Step by Step Solution

There are 3 Steps involved in it

The image you sent is a weighted average cost of capital WACC problem The WACC is a calculation of a companys cost of capital It is the average rate that a company expects to pay to finance its operat... View full answer

Get step-by-step solutions from verified subject matter experts