Question: Instruct ions 0 For hypothesis testing problems, please indicate critical value (or values), state rejection rule, evaluate test statistic, and nally, formulate your decision in

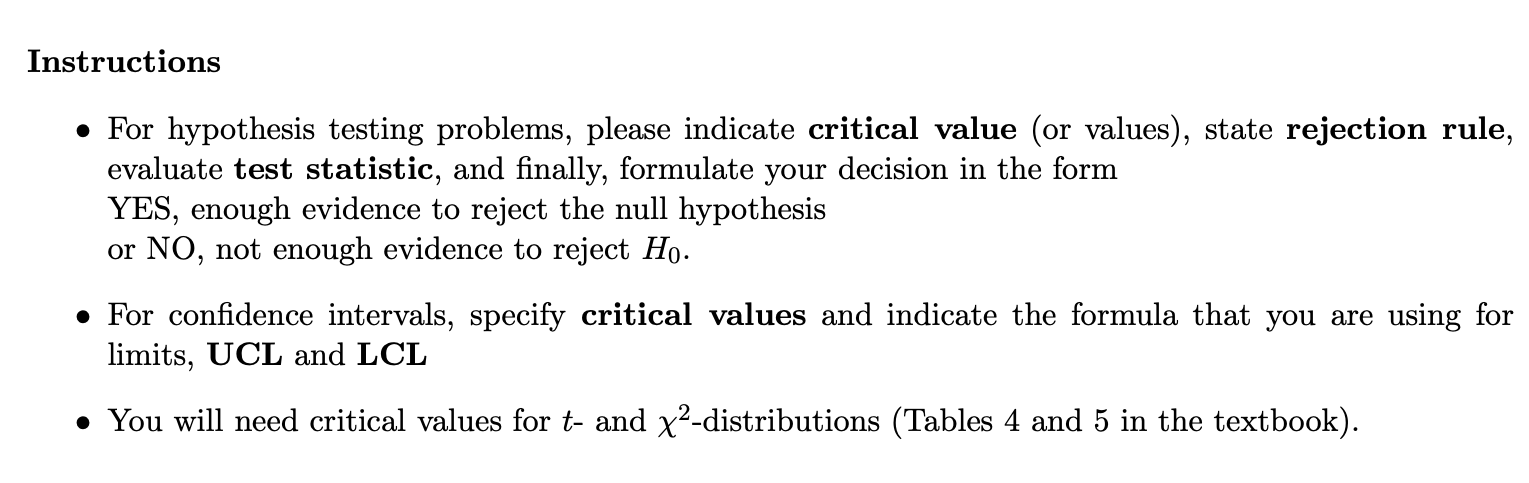

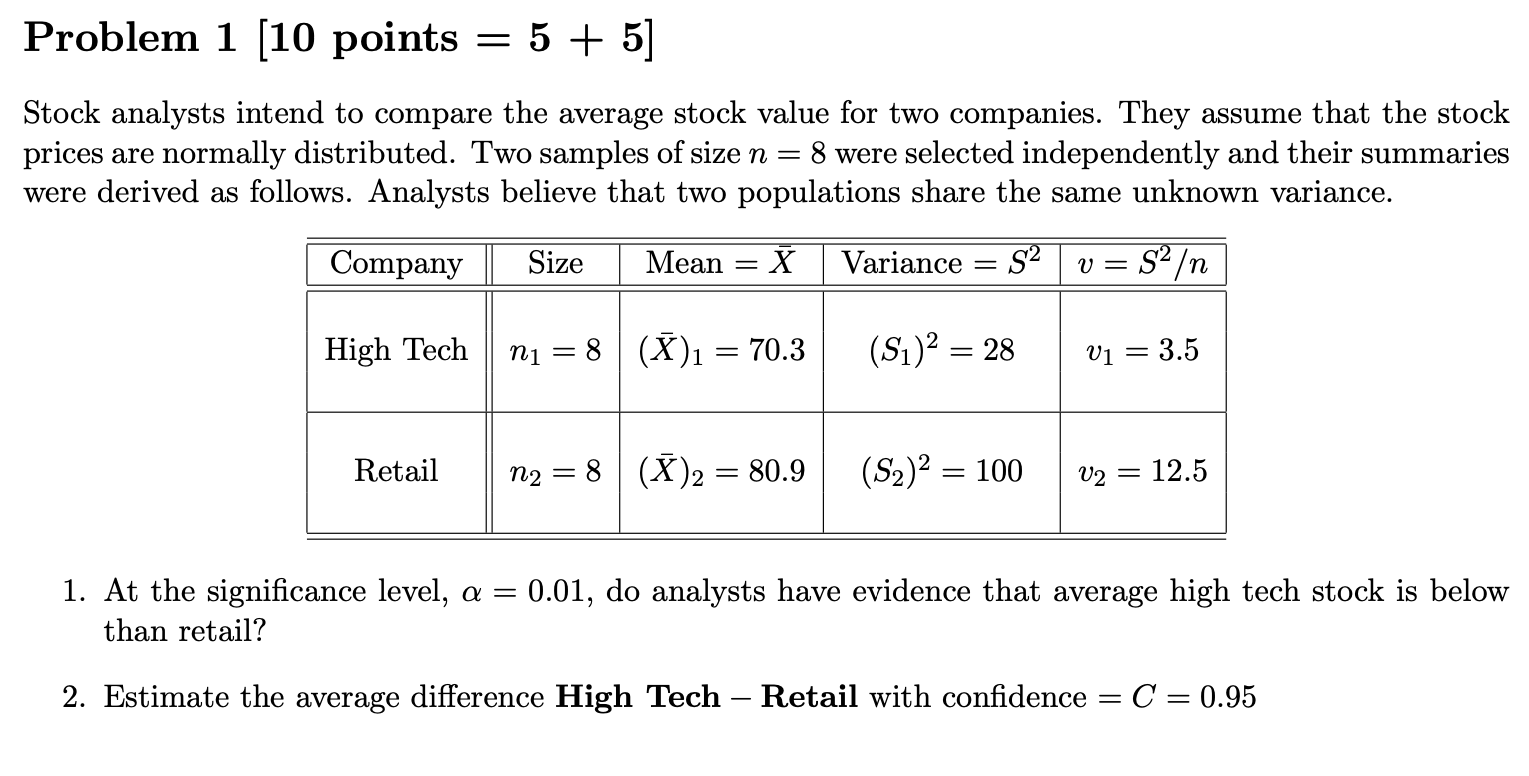

Instruct ions 0 For hypothesis testing problems, please indicate critical value (or values), state rejection rule, evaluate test statistic, and nally, formulate your decision in the form YES, enough evidence to reject the null hypothesis or NO, not enough evidence to reject H0. 0 For condence intervals, specify critical values and indicate the formula that you are using for limits, UCL and LCL 0 You Will need critical values for t and x2-distributions (Tables 4 and 5 in the textbook). Problem 1 [10 points = 5 + 5] Stock analysts intend to compare the average stock value for two companies. They assume that the stock prices are normally distributed. Two samples of size n = 8 were selected independently and their summaries were derived as follows. Analysts believe that two populations share the same unknown variance. Company Size Mean = X Variance = $2 v = S2 High Tech n1 = 8 (X)1 = 70.3 (S1)2 = 28 V1 = 3.5 Retail n2 = 8 (X)2 = 80.9 (S2)2 = 100 V2 = 12.5 1. At the significance level, a = 0.01, do analysts have evidence that average high tech stock is below than retail? 2. Estimate the average difference High Tech - Retail with confidence = C = 0.95

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts