Question: Instruction: Create separate tabs for each problem. Submit your finished work in Excel. Questions on HWs should be sent to my email (iv58@nyu.edu) least 12

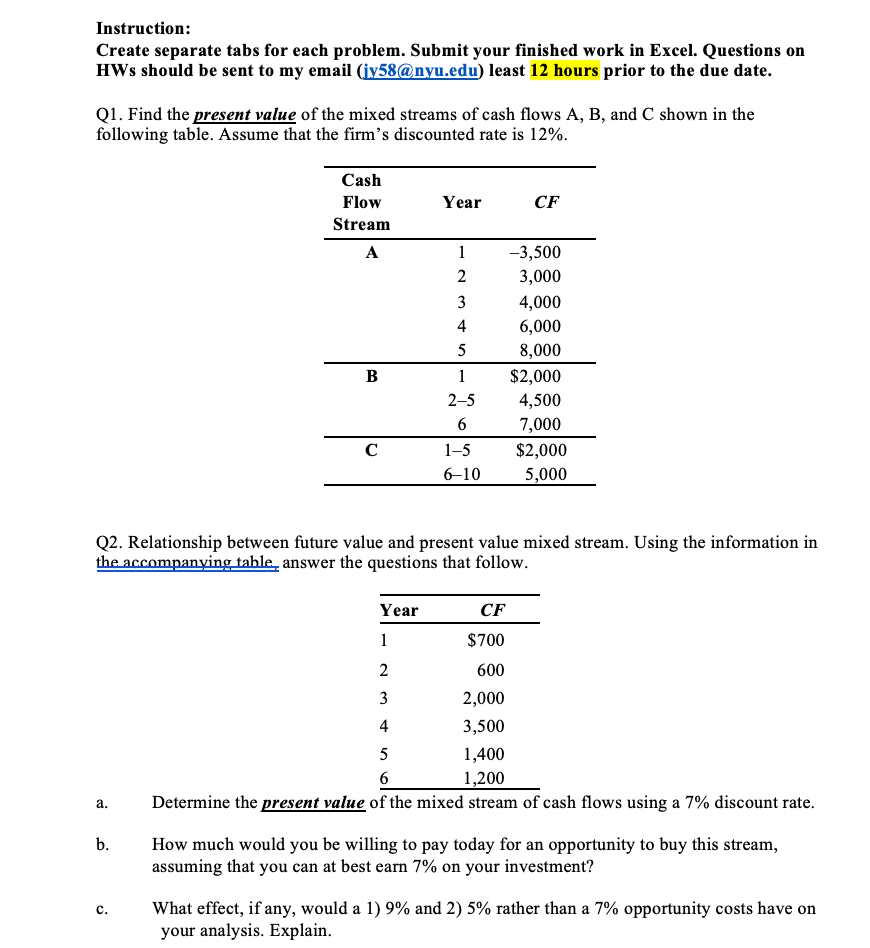

Instruction: Create separate tabs for each problem. Submit your finished work in Excel. Questions on HWs should be sent to my email (iv58@nyu.edu) least 12 hours prior to the due date. Q1. Find the present value of the mixed streams of cash flows A, B, and C shown in the following table. Assume that the firm's discounted rate is 12%. Cash Flow Stream Year CF 3 -3,500 3,000 4,000 6,000 8,000 $2,000 4,500 7,000 $2,000 5,000 1 2-5 6 1-5 6-10 Q2. Relationship between future value and present value mixed stream. Using the information in the accompanying table answer the questions that follow. Year CF $700 600 2,000 3,500 1,400 1,200 Determine the present value of the mixed stream of cash flows using a 7% discount rate. How much would you be willing to pay today for an opportunity to buy this stream, assuming that you can at best earn 7% on your investment? What effect, if any, would a 1) 9% and 2) 5% rather than a 7% opportunity costs have on your analysis. Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts