Question: Instructions 1 ) Show ALL the formulas and computations 2 ) In your computations, use the $M scale ( where required ) . For example,

Instructions

Show ALL the formulas and computations

In your computations, use the $M scale where required For example, use $ for $M and NOT $ Roundoff your figuresnumbers to TWO decimal points where necessary.

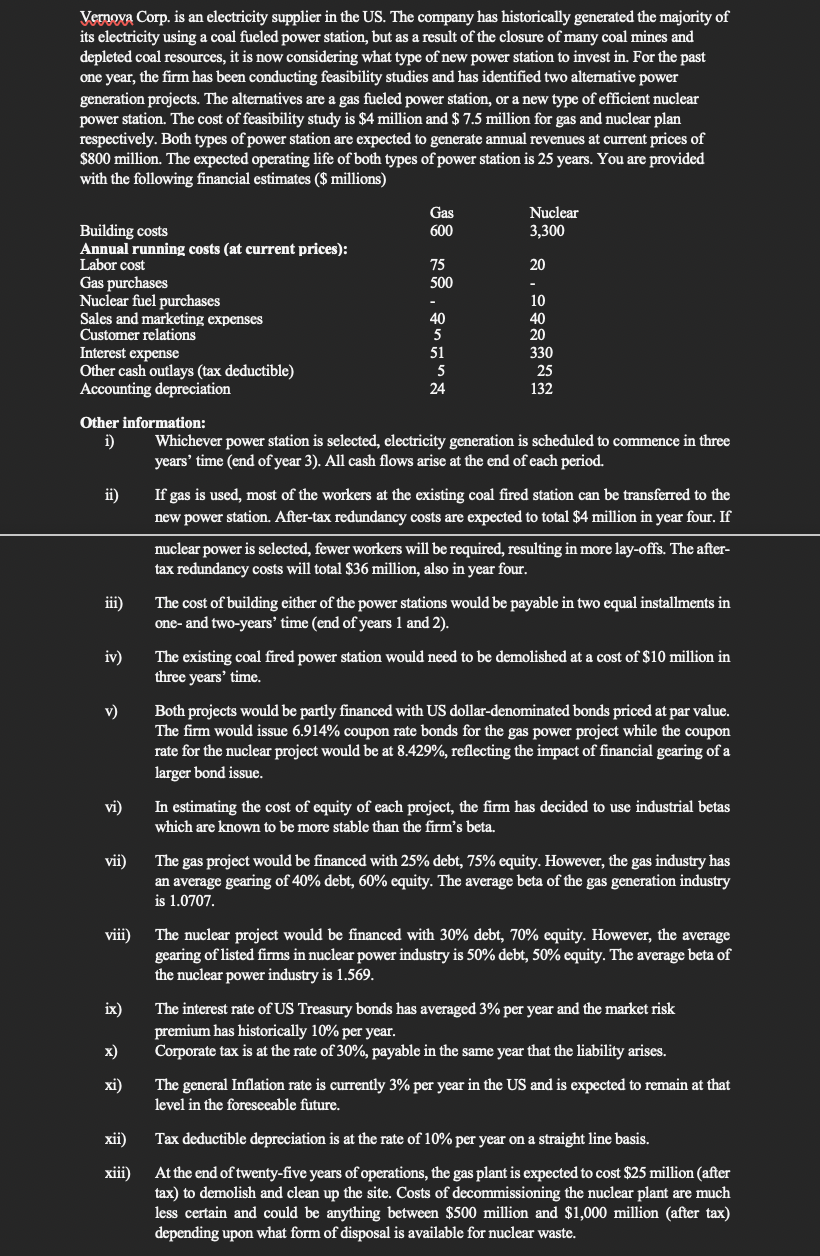

Vemoxa Corp. is an electricity supplier in the US The company has historically generated the majority of

its electricity using a coal fueled power station, but as a result of the closure of many coal mines and

depleted coal resources, it is now considering what type of new power station to invest in For the past

one year, the firm has been conducting feasibility studies and has identified two alternative power

generation projects. The alternatives are a gas fueled power station, or a new type of efficient nuclear

power station. The cost of feasibility study is $ million and $ million for gas and nuclear plan

respectively. Both types of power station are expected to generate annual revenues at current prices of

$ million. The expected operating life of both types of power station is years. You are provided

with the following financial estimates $ millions

Other information:

i Whichever power station is selected, electricity generation is scheduled to commence in three

years' time end of year All cash flows arise at the end of each period.

ii If gas is used, most of the workers at the existing coal fired station can be transferred to the

new power station. Aftertax redundancy costs are expected to total $ million in year four. If

nuclear power is selected, fewer workers will be required, resulting in more layoffs. The after

tax redundancy costs will total $ million, also in year four.

iii The cost of building either of the power stations would be payable in two equal installments in

one and twoyears' time end of years and

iv The existing coal fired power station would need to be demolished at a cost of $ million in

three years' time.

v Both projects would be partly financed with US dollardenominated bonds priced at par value.

The firm would issue coupon rate bonds for the gas power project while the coupon

rate for the nuclear project would be at reflecting the impact of financial gearing of a

larger bond issue.

vi In estimating the cost of equity of each project, the firm has decided to use industrial betas

which are known to be more stable than the firm's beta.

vii The gas project would be financed with debt, equity. However, the gas industry has

an average gearing of debt, equity. The average beta of the gas generation industry

is

viii The nuclear project would be financed with debt, equity. However, the average

gearing of listed firms in nuclear power industry is debt, equity. The average beta of

the nuclear power industry is

ix The interest rate of US Treasury bonds has averaged per year and the market risk

premium has historically per year.

x Corporate tax is at the rate of payable in the same year that the liability arises.

xi The general Inflation rate is currently per year in the US and is expected to remain at that

level in the foreseeable future.

xii Tax deductible depreciation is at the rate of per year on a straight line basis.

xiii At the end of twentyfive years of operations, the gas plant is expected to cost $ million after

tax to demolish and clean up the site. Costs of decommissioning the nuclear plant are much

less certain and could be anything between $ million and $ million after tax

depending upon what form of disposal is available for nuclear waste.

Required:

a Compute the WACC or discounting rate to be used to evaluate the free cash flows FCF of each project. In computing betas and WACC use decimal points accuracy but the final WACC should be rounded to a whole number.

b Generate the FCF of each investment alternative. Estimate the expected NPV of EACH investment alternative. HINT: It is recommended that annuity FCF be used as much as possible and wherever possible.

c State qualitative factors you must consider when making the final decision regarding the two alternatives

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock