Question: Instructions: After studying the educational resources assigned in this module related to the analysis of risk and performance in companies, solve the following case study.

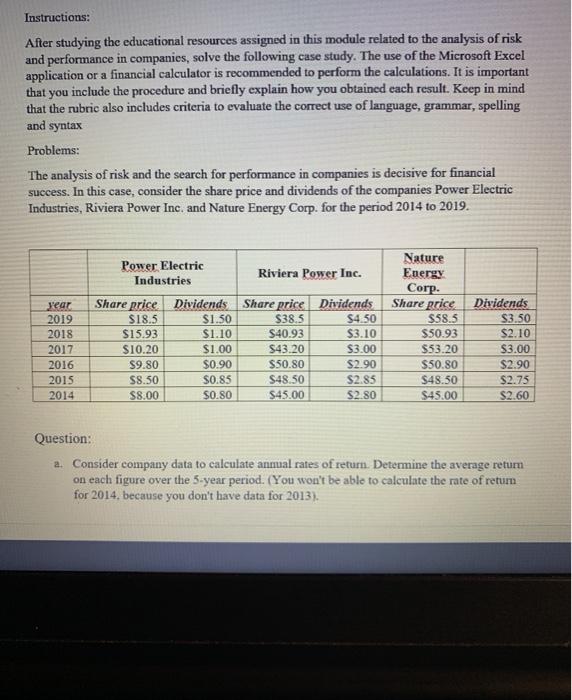

Instructions: After studying the educational resources assigned in this module related to the analysis of risk and performance in companies, solve the following case study. The use of the Microsoft Excel application or a financial calculator is recommended to perform the calculations. It is important that you include the procedure and briefly explain how you obtained each result. Keep in mind that the rubric also includes criteria to evaluate the correct use of language, grammar, spelling and syntax Problems: The analysis of risk and the search for performance in companies is decisive for financial success. In this case, consider the share price and dividends of the companies Power Electric Industries, Riviera Power Inc. and Nature Energy Corp. for the period 2014 to 2019. Power Electric Industries Riviera Power Inc. year 2019 2018 2017 2016 2015 2014 Share price Dividends $18.5 $1.50 $15.93 $1.10 $10.20 $1.00 $9.80 $0.90 S8.50 S0.85 58.00 $0.80 Share price Dividends $38.5 $4.50 $40.93 $3.10 S43.20 $3.00 S50.80 $2.90 $48.50 S2.85 $45.00 S2.so Nature Energy Corp. Share price $58.5 $50.93 $53.20 $50.80 $48.50 $45.00 Dividends $3.50 $2.10 $3.00 $2.90 $2.75 S2.60 Question: 2. Consider company data to calculate annual rates of return. Determine the average retum on each figure over the 5-year period. (You won't be able to calculate the rate of retum for 2014, because you don't have data for 2013)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts