Question: Instructions: Answer ALL questions. This problem set is due on November 12,2022 , at 4:45pm (note: due time is 4:30pm but I have added an

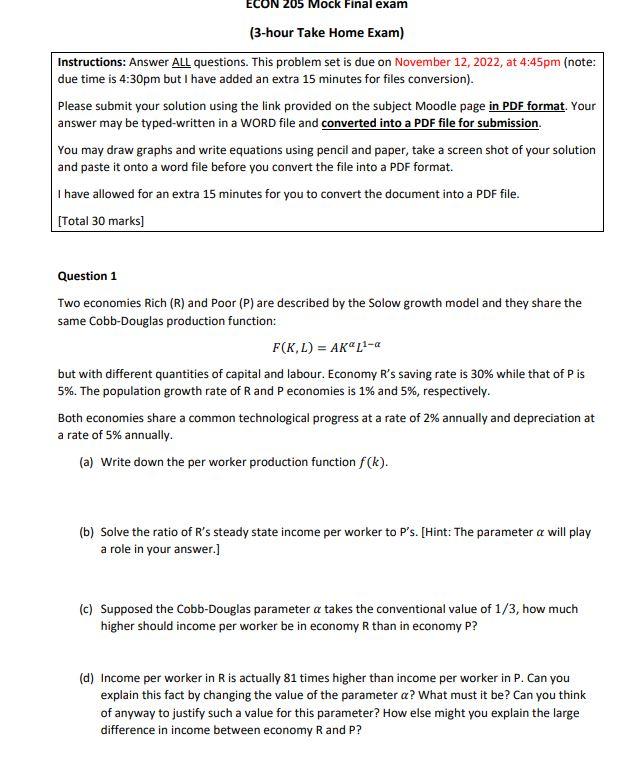

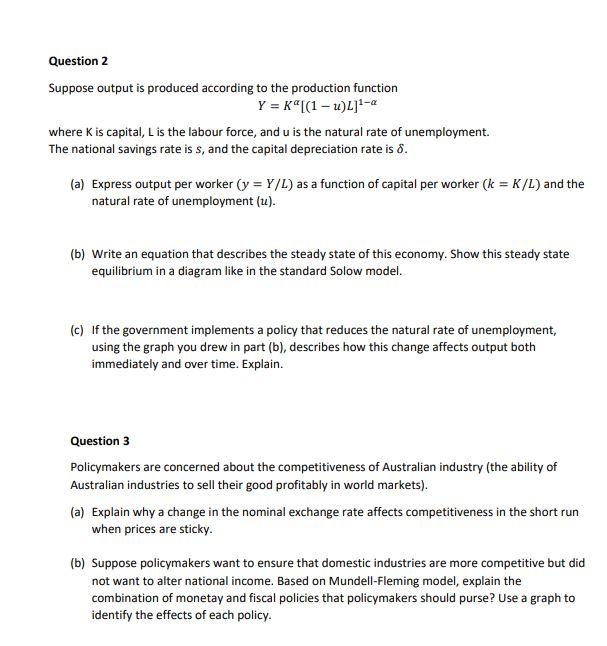

Instructions: Answer ALL questions. This problem set is due on November 12,2022 , at 4:45pm (note: due time is 4:30pm but I have added an extra 15 minutes for files conversion). Please submit your solution using the link provided on the subject Moodle page in PDF format. Your answer may be typed-written in a WORD file and converted into a PDF file for submission. You may draw graphs and write equations using pencil and paper, take a screen shot of your solution and paste it onto a word file before you convert the file into a PDF format. I have allowed for an extra 15 minutes for you to convert the document into a PDF file. [Total 30 marks] Question 1 Two economies Rich (R) and Poor (P) are described by the Solow growth model and they share the same Cobb-Douglas production function: F(K,L)=AKL1 but with different quantities of capital and labour. Economy R's saving rate is 30% while that of P is 5%. The population growth rate of R and P economies is 1% and 5%, respectively. Both economies share a common technological progress at a rate of 2% annually and depreciation at a rate of 5% annually. (a) Write down the per worker production function f(k). (b) Solve the ratio of R's steady state income per worker to P's. [Hint: The parameter will play a role in your answer.] (c) Supposed the Cobb-Douglas parameter takes the conventional value of 1/3, how much higher should income per worker be in economy R than in economy P ? (d) Income per worker in R is actually 81 times higher than income per worker in P. Can you explain this fact by changing the value of the parameter ? What must it be? Can you think of anyway to justify such a value for this parameter? How else might you explain the large difference in income between economy R and P ? Y=K[(1u)L]1 where K is capital, L is the labour force, and u is the natural rate of unemployment. The national savings rate is s, and the capital depreciation rate is . (a) Express output per worker (y=Y/L) as a function of capital per worker (k=K/L) and the natural rate of unemployment (u). (b) Write an equation that describes the steady state of this economy. Show this steady state equilibrium in a diagram like in the standard Solow model. (c) If the government implements a policy that reduces the natural rate of unemployment, using the graph you drew in part (b), describes how this change affects output both immediately and over time. Explain. Question 3 Policymakers are concerned about the competitiveness of Australian industry (the ability of Australian industries to sell their good profitably in world markets). (a) Explain why a change in the nominal exchange rate affects competitiveness in the short run when prices are sticky. (b) Suppose policymakers want to ensure that domestic industries are more competitive but did not want to alter national income. Based on Mundell-Fleming model, explain the combination of monetay and fiscal policies that policymakers should purse? Use a graph to identify the effects of each policy. Instructions: Answer ALL questions. This problem set is due on November 12,2022 , at 4:45pm (note: due time is 4:30pm but I have added an extra 15 minutes for files conversion). Please submit your solution using the link provided on the subject Moodle page in PDF format. Your answer may be typed-written in a WORD file and converted into a PDF file for submission. You may draw graphs and write equations using pencil and paper, take a screen shot of your solution and paste it onto a word file before you convert the file into a PDF format. I have allowed for an extra 15 minutes for you to convert the document into a PDF file. [Total 30 marks] Question 1 Two economies Rich (R) and Poor (P) are described by the Solow growth model and they share the same Cobb-Douglas production function: F(K,L)=AKL1 but with different quantities of capital and labour. Economy R's saving rate is 30% while that of P is 5%. The population growth rate of R and P economies is 1% and 5%, respectively. Both economies share a common technological progress at a rate of 2% annually and depreciation at a rate of 5% annually. (a) Write down the per worker production function f(k). (b) Solve the ratio of R's steady state income per worker to P's. [Hint: The parameter will play a role in your answer.] (c) Supposed the Cobb-Douglas parameter takes the conventional value of 1/3, how much higher should income per worker be in economy R than in economy P ? (d) Income per worker in R is actually 81 times higher than income per worker in P. Can you explain this fact by changing the value of the parameter ? What must it be? Can you think of anyway to justify such a value for this parameter? How else might you explain the large difference in income between economy R and P ? Y=K[(1u)L]1 where K is capital, L is the labour force, and u is the natural rate of unemployment. The national savings rate is s, and the capital depreciation rate is . (a) Express output per worker (y=Y/L) as a function of capital per worker (k=K/L) and the natural rate of unemployment (u). (b) Write an equation that describes the steady state of this economy. Show this steady state equilibrium in a diagram like in the standard Solow model. (c) If the government implements a policy that reduces the natural rate of unemployment, using the graph you drew in part (b), describes how this change affects output both immediately and over time. Explain. Question 3 Policymakers are concerned about the competitiveness of Australian industry (the ability of Australian industries to sell their good profitably in world markets). (a) Explain why a change in the nominal exchange rate affects competitiveness in the short run when prices are sticky. (b) Suppose policymakers want to ensure that domestic industries are more competitive but did not want to alter national income. Based on Mundell-Fleming model, explain the combination of monetay and fiscal policies that policymakers should purse? Use a graph to identify the effects of each policy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts