Question: Instructions: Calculate cost-effectiveness for two elevation scenarios for a coastal home built in Charleston, SC. Using the results from Activity 2 we will consider a

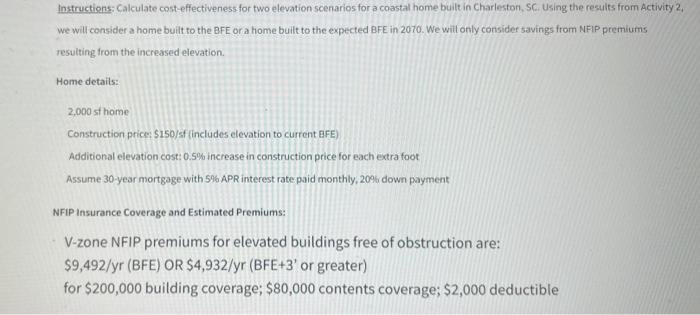

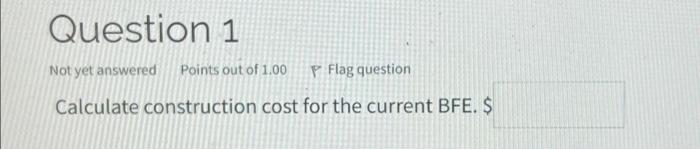

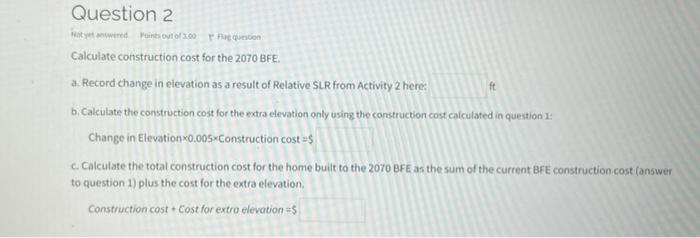

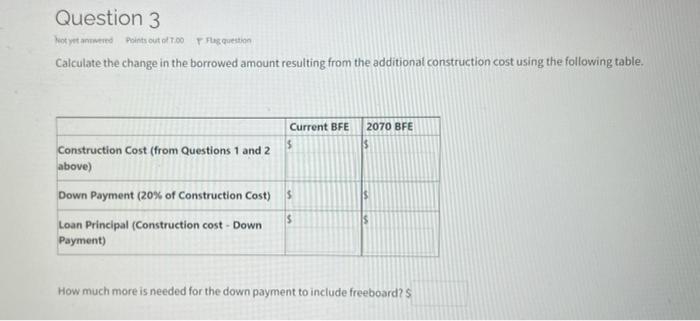

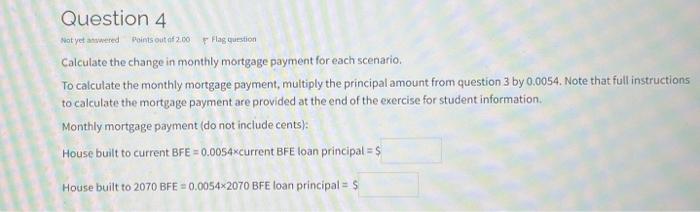

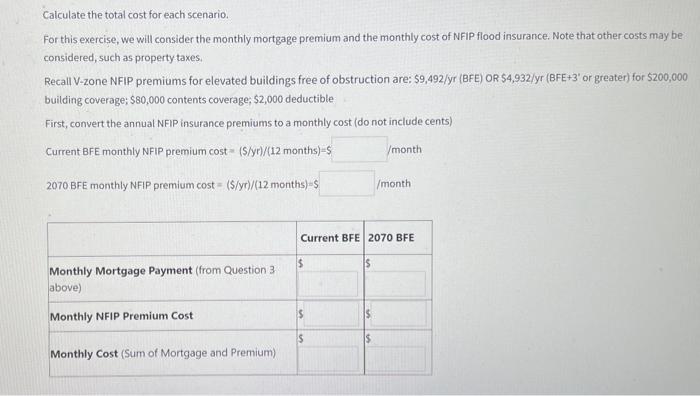

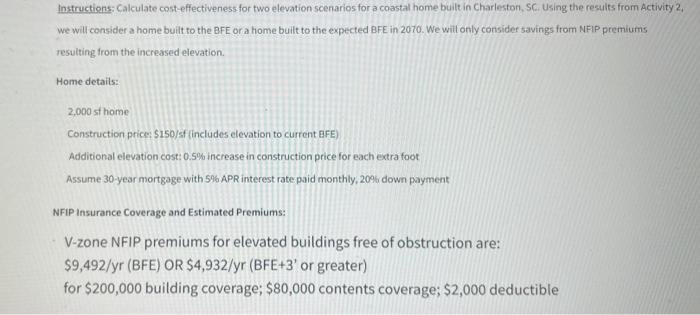

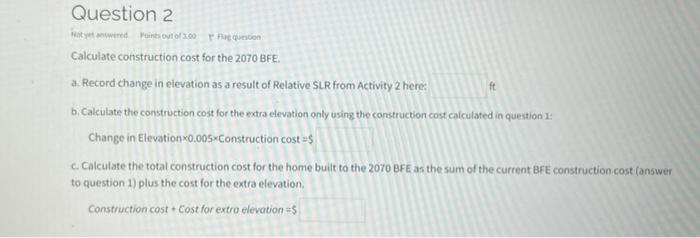

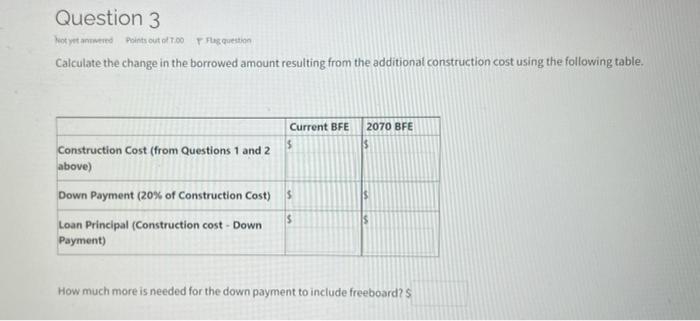

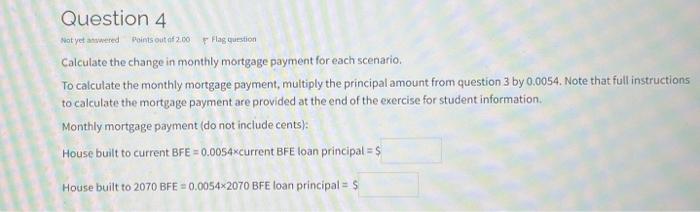

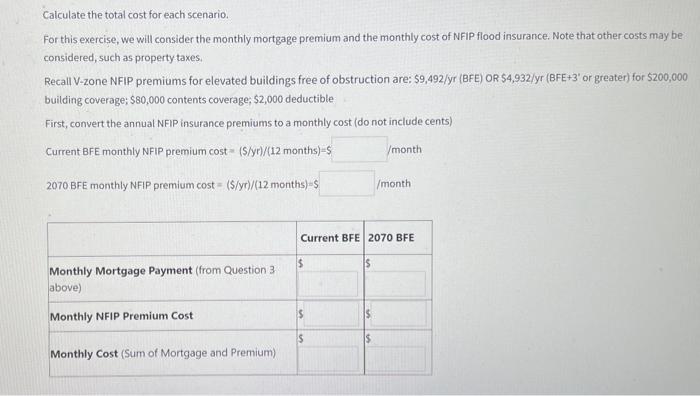

Instructions: Calculate cost-effectiveness for two elevation scenarios for a coastal home built in Charleston, SC. Using the results from Activity 2 we will consider a home built to the BFE or a home built to the expected BFE in 2070. We will only consider savings from NFIP premiums resulting from the increased elevation Home details: 2,000 st home Construction price: $150/sf (includes elevation to current EFE) Additional elevation cost: 0.5% increase in construction price for each extra foot Assume 30-year mortgage with 5% APR interest rate paid monthly, 20% down payment NFIP Insurance Coverage and Estimated Premiums: V-zone NFIP premiums for elevated buildings free of obstruction are: $9,492/yr (BFE) OR $4,932/yr (BFE+3' or greater) for $200,000 building coverage; $80,000 contents coverage: $2,000 deductible Question 1 Not yet answered Points out of 1.00 P Flag question Calculate construction cost for the current BFE. $ ft Question 2 not yet wwwered Points out of 200 that descon Calculate construction cost for the 2070 BFE. a. Record change in elevation as a result of Relative SLR from Activity 2 here: b. Calculate the construction cost for the extra elevation only using the construction cost calculated in question 1: Change in Elevation 0.0054Construction cost us c. Calculate the total construction cost for the home built to the 2070 BFE as the sum of the current BFE construction cost (answer to question 1) plus the cost for the extra elevation Construction cost Cost for extro elevation=5 - Question 3 hot yet annered Points out of 7.00 Flag question Calculate the change in the borrowed amount resulting from the additional construction cost using the following table. Current BFE 2070 BFE Construction Cost (from Questions 1 and 2 above) Down Payment (20% of Construction Cost) $ Loan Principal (Construction cost - Down Payment) $ How much more is needed for the down payment to include freeboard? Question 4 Not yet awered Points out of 200 Flag question Calculate the change in monthly mortgage payment for each scenario. To calculate the monthly mortgage payment, multiply the principal amount from question 3 by 0.0054. Note that full instructions to calculate the mortgage payment are provided at the end of the exercise for student information Monthly mortgage payment (do not include cents); House built to current BFE = 0.0054 current BFE loan principal = $ House built to 2070 BFE = 0.0054x2070 BFE loan principals Calculate the total cost for each scenario. For this exercise, we will consider the monthly mortgage premium and the monthly cost of NFIP flood insurance. Note that other costs may be considered, such as property taxes Recall V-zone NFIP premiums for elevated buildings free of obstruction are: $9,492/yr (BFE) OR $4,932/yr (BFE43' or greater) for $200,000 building coverage; $80,000 contents coverage, $2,000 deductible First, convert the annual NIP insurance premiums to a monthly cost (do not include cents) Current BFE monthly NFIP premium cost = (s/yn)/(12 months) /month 2070 BFE monthly NFIP premium cost = (5/y0/(12 months) /month Current BFE 2070 BFE $ $ Monthly Mortgage Payment (from Question 3 above) Monthly NFIP Premium Cost $ Monthly Cost (Sum of Mortgage and Premium) Instructions: Calculate cost-effectiveness for two elevation scenarios for a coastal home built in Charleston, SC. Using the results from Activity 2 we will consider a home built to the BFE or a home built to the expected BFE in 2070. We will only consider savings from NFIP premiums resulting from the increased elevation Home details: 2,000 st home Construction price: $150/sf (includes elevation to current EFE) Additional elevation cost: 0.5% increase in construction price for each extra foot Assume 30-year mortgage with 5% APR interest rate paid monthly, 20% down payment NFIP Insurance Coverage and Estimated Premiums: V-zone NFIP premiums for elevated buildings free of obstruction are: $9,492/yr (BFE) OR $4,932/yr (BFE+3' or greater) for $200,000 building coverage; $80,000 contents coverage: $2,000 deductible Question 1 Not yet answered Points out of 1.00 P Flag question Calculate construction cost for the current BFE. $ ft Question 2 not yet wwwered Points out of 200 that descon Calculate construction cost for the 2070 BFE. a. Record change in elevation as a result of Relative SLR from Activity 2 here: b. Calculate the construction cost for the extra elevation only using the construction cost calculated in question 1: Change in Elevation 0.0054Construction cost us c. Calculate the total construction cost for the home built to the 2070 BFE as the sum of the current BFE construction cost (answer to question 1) plus the cost for the extra elevation Construction cost Cost for extro elevation=5 - Question 3 hot yet annered Points out of 7.00 Flag question Calculate the change in the borrowed amount resulting from the additional construction cost using the following table. Current BFE 2070 BFE Construction Cost (from Questions 1 and 2 above) Down Payment (20% of Construction Cost) $ Loan Principal (Construction cost - Down Payment) $ How much more is needed for the down payment to include freeboard? Question 4 Not yet awered Points out of 200 Flag question Calculate the change in monthly mortgage payment for each scenario. To calculate the monthly mortgage payment, multiply the principal amount from question 3 by 0.0054. Note that full instructions to calculate the mortgage payment are provided at the end of the exercise for student information Monthly mortgage payment (do not include cents); House built to current BFE = 0.0054 current BFE loan principal = $ House built to 2070 BFE = 0.0054x2070 BFE loan principals Calculate the total cost for each scenario. For this exercise, we will consider the monthly mortgage premium and the monthly cost of NFIP flood insurance. Note that other costs may be considered, such as property taxes Recall V-zone NFIP premiums for elevated buildings free of obstruction are: $9,492/yr (BFE) OR $4,932/yr (BFE43' or greater) for $200,000 building coverage; $80,000 contents coverage, $2,000 deductible First, convert the annual NIP insurance premiums to a monthly cost (do not include cents) Current BFE monthly NFIP premium cost = (s/yn)/(12 months) /month 2070 BFE monthly NFIP premium cost = (5/y0/(12 months) /month Current BFE 2070 BFE $ $ Monthly Mortgage Payment (from Question 3 above) Monthly NFIP Premium Cost $ Monthly Cost (Sum of Mortgage and Premium)