Question: INSTRUCTIONS: COMPLETE FORM 1040 FOR CHRIS, SCHEDULES 1, B, & C AND FORM 8829. PLEASE FILL ALL FORMS OUT COMPELTELY USING THE INFORMATION PROVIDED BELOW.

INSTRUCTIONS: COMPLETE FORM 1040 FOR CHRIS, SCHEDULES 1, B, & C AND FORM 8829. PLEASE FILL ALL FORMS OUT COMPELTELY USING THE INFORMATION PROVIDED BELOW.

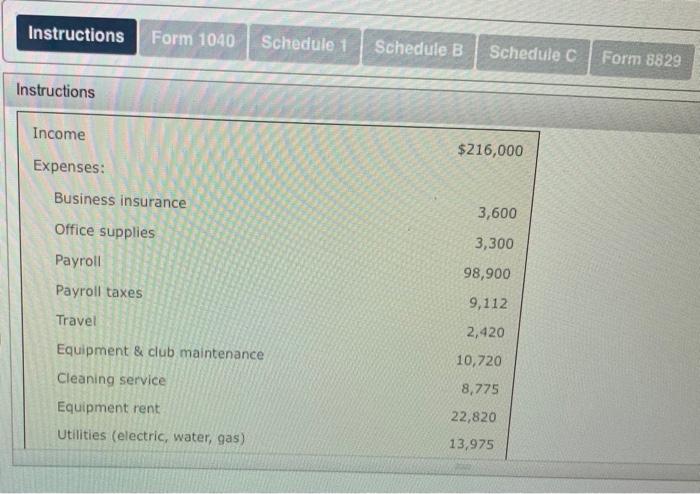

Christopher Crosphit (birthdate April 28, 1978) owns and operates a health club called "Catawba Fitness". The business is located at 4321 New Cut Road, Spartanburg, SC 29303. The principal business code is 812190 and the EIN is 12-3456789. Chris had the following income and expenses from the health club:

|

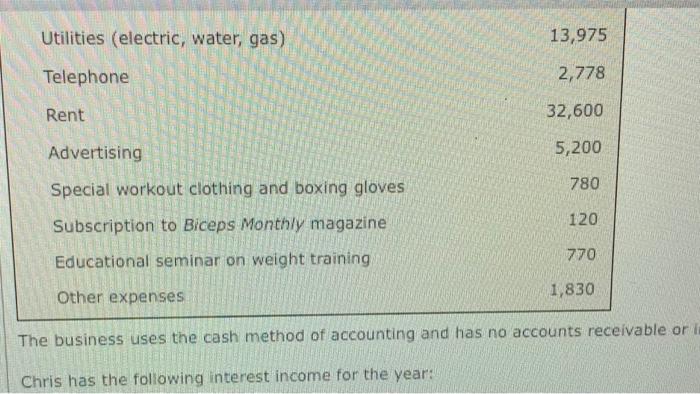

The business uses the cash method of accounting and has no accounts receivable or inventory held for resale.

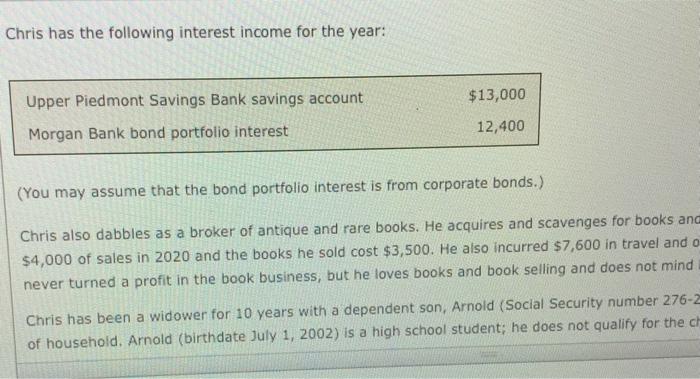

Chris has the following interest income for the year:

|

(You may assume that the bond portfolio interest is from corporate bonds.)

Chris also dabbles as a broker of antique and rare books. He acquires and scavenges for books and then sells them on the Internet. He generated $4,000 of sales in 2020 and the books he sold cost $3,500. He also incurred $7,600 in travel and other expenses related to this activity. Chris has never turned a profit in the book business, but he loves books and book selling and does not mind losing money doing it.

Chris has been a widower for 10 years with a dependent son, Arnold (Social Security number 276-23-3954), and Chris files his tax return as head of household. Arnold (birthdate July 1, 2002) is a high school student; he does not qualify for the child tax credit but does qualify for the $500 other dependent credit. They live next door to the health club at 4323 New Cut Road. Chris does all the administrative work for the health club out of an office in his home. The room is 171 square feet and the house has a total of 1,800 square feet. Chris pays $20,000 per year in rent and $4,000 in utilities.

Chris' Social Security number is 565-12-6789. He made an estimated tax payment to the IRS of $500 on April 15, 2020. Chris received a $1,700 EIP in 2020.

Required:

COMPLETE FORM 1040 FOR CHRIS, SCHEDULES 1, B, & C AND FORM 8829. PLEASE FILL ALL FORMS OUT COMPELTELY. Assume the taxpayer had full-year health coverage and does not want to contribute to the presidential election campaign.

- Make realistic assumptions about any missing data.

- If required, enter a "loss" as a negative number on the tax form. Do not enter deductions or other amounts as negative numbers.

- If an amount box does not require an entry or the answer is zero, enter "0".

- Round any percentages to two decimal places.

- Round any dollar amounts to the nearest dollar.

Instructions Form 1040 Schedule 1 Schedule B Schedule c Form 8829 Instructions Income $216,000 Expenses: Business insurance Office supplies 3,600 3,300 Payroll 98,900 Payroll taxes 9,112 Travel 2,420 10,720 Equipment & club maintenance Cleaning service Equipment rent Utilities (electric, water, gas) 8,775 22,820 13,975 Utilities (electric, water, gas) 13,975 Telephone 2,778 Rent 32,600 Advertising 5,200 Special workout clothing and boxing gloves 780 Subscription to Biceps Monthly magazine 120 770 Educational seminar on weight training Other expenses 1,830 The business uses the cash method of accounting and has no accounts receivable or i Chris has the following interest income for the year: Chris has the following interest income for the year: $13,000 Upper Piedmont Savings Bank savings account Morgan Bank bond portfolio interest 12,400 (You may assume that the bond portfolio interest is from corporate bonds.) Chris also dabbles as a broker of antique and rare books. He acquires and scavenges for books ana $4,000 of sales in 2020 and the books he sold cost $3,500. He also incurred $7,600 in travel and o never turned a profit in the book business, but he loves books and book selling and does not mind Chris has been a widower for 10 years with a dependent son, Arnold (Social Security number 276-2 of household. Arnold (birthdate July 1, 2002) is a high school student; he does not qualify for the ch

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts