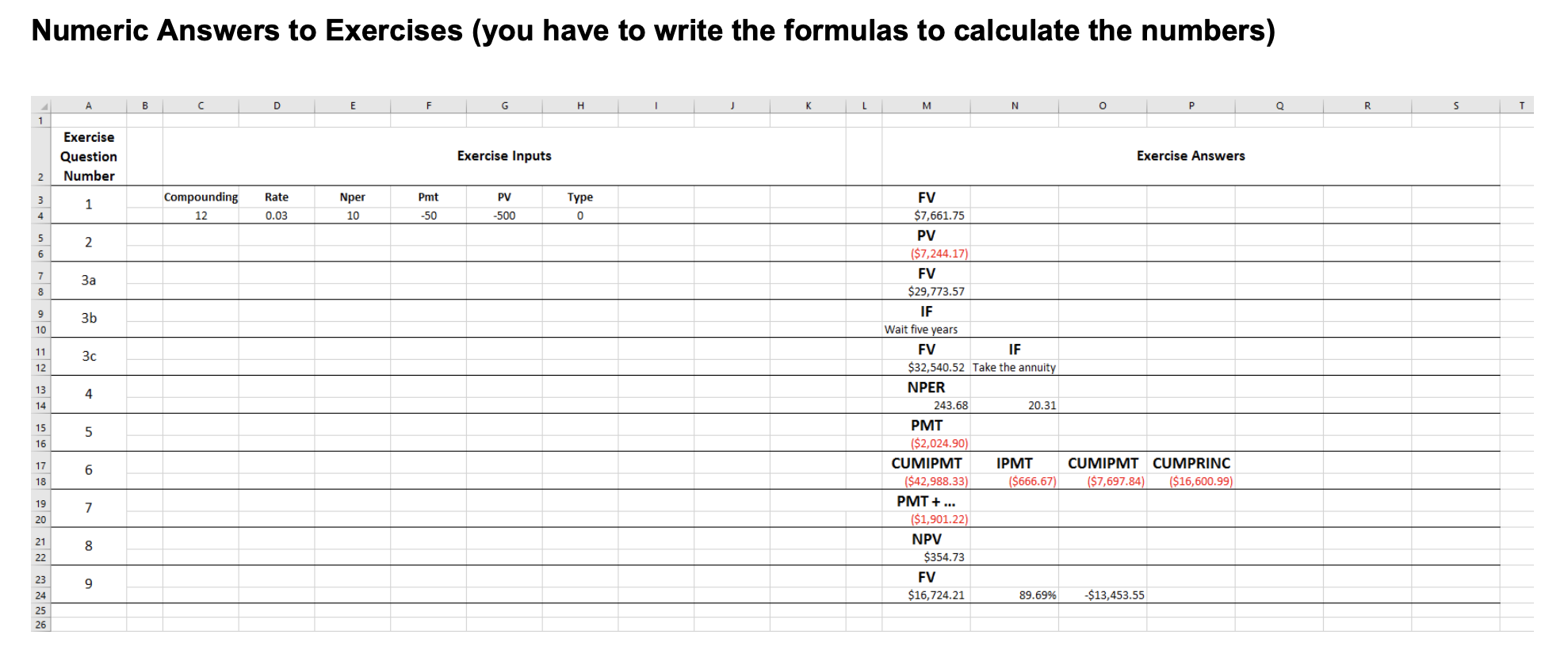

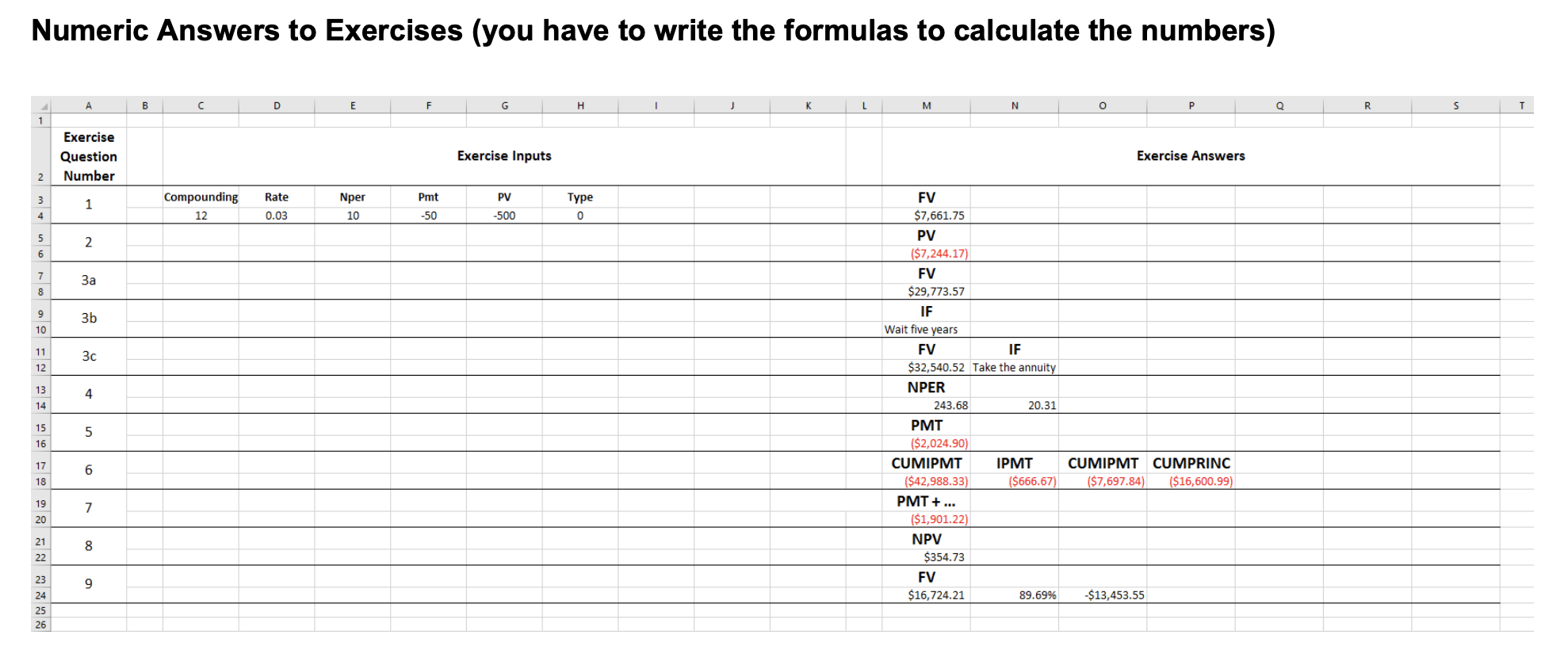

Question: instructions: Create a new Excel workbook with a blank worksheet. Look at the image below. Type in the information in Column A and Row 2.

instructions:

Create a new Excel workbook with a blank worksheet. Look at the image below. Type in the information in Column A and Row 2. The Merge & Center and Wrap Text buttons should be useful in formatting the cells.

Now start writing the formula described below.

Now start writing the formula described below.

1. How much would a savings account be worth if the initial balance is $500 and you deposit $50/month for 10 years at an annual interest rate of 3% compounded monthly? (Hint: Use the FV function)

Please show work and formulas in excel

Create a new Excel workbook with a blank worksheet. Look at the image below. Type in the information in Column A and Row 2. The Merge & Center and Wrap Text buttons should be useful in formatting the cells.

Now start writing the formula described below.

Now start writing the formula described below.

1. How much would a savings account be worth if the initial balance is $500 and you deposit $50/month for 10 years at an annual interest rate of 3% compounded monthly? (Hint: Use the FV function)

Please show work and formulas in excel

Numeric Answers to Exercises (you have to write the formulas to calculate the numbers) B D H K L M N Q R S 1 Exercise Question Number Exercise Inputs Exercise Answers 2 PV 3 4 1 Compounding 12 Rate 0.03 Nper 10 Pmt -50 Type 0 -500 5 2 6 7 8 9 3b 10 FV $7,661.75 PV ($7,244.17) FV $29,773.57 IF Wait five years FV IF $32,540.52 Take the annuity NPER 243.68 20.31 PMT ($2,024.90) CUMIPMT IPMT ($42,988.33) ($666.67) 11 3c 12 13 4 14 15 5 16 17 6 CUMIPMT CUMPRINC ($7,697.84) ($16,600.99) 18 19 PMT + ... 7 20 21 8 22 ($1,901.22) NPV $354.73 FV $16,724.21 23 9 24 89.69% $13,453.55 25 26 Numeric Answers to Exercises (you have to write the formulas to calculate the numbers) B D H K L M N Q R S 1 Exercise Question Number Exercise Inputs Exercise Answers 2 PV 3 4 1 Compounding 12 Rate 0.03 Nper 10 Pmt -50 Type 0 -500 5 2 6 7 8 9 3b 10 FV $7,661.75 PV ($7,244.17) FV $29,773.57 IF Wait five years FV IF $32,540.52 Take the annuity NPER 243.68 20.31 PMT ($2,024.90) CUMIPMT IPMT ($42,988.33) ($666.67) 11 3c 12 13 4 14 15 5 16 17 6 CUMIPMT CUMPRINC ($7,697.84) ($16,600.99) 18 19 PMT + ... 7 20 21 8 22 ($1,901.22) NPV $354.73 FV $16,724.21 23 9 24 89.69% $13,453.55 25 26 Numeric Answers to Exercises (you have to write the formulas to calculate the numbers) B D H K L M N Q R S 1 Exercise Question Number Exercise Inputs Exercise Answers 2 PV 3 4 1 Compounding 12 Rate 0.03 Nper 10 Pmt -50 Type 0 -500 5 2 6 7 8 9 3b 10 FV $7,661.75 PV ($7,244.17) FV $29,773.57 IF Wait five years FV IF $32,540.52 Take the annuity NPER 243.68 20.31 PMT ($2,024.90) CUMIPMT IPMT ($42,988.33) ($666.67) 11 3c 12 13 4 14 15 5 16 17 6 CUMIPMT CUMPRINC ($7,697.84) ($16,600.99) 18 19 PMT + ... 7 20 21 8 22 ($1,901.22) NPV $354.73 FV $16,724.21 23 9 24 89.69% $13,453.55 25 26 Numeric Answers to Exercises (you have to write the formulas to calculate the numbers) B D H K L M N Q R S 1 Exercise Question Number Exercise Inputs Exercise Answers 2 PV 3 4 1 Compounding 12 Rate 0.03 Nper 10 Pmt -50 Type 0 -500 5 2 6 7 8 9 3b 10 FV $7,661.75 PV ($7,244.17) FV $29,773.57 IF Wait five years FV IF $32,540.52 Take the annuity NPER 243.68 20.31 PMT ($2,024.90) CUMIPMT IPMT ($42,988.33) ($666.67) 11 3c 12 13 4 14 15 5 16 17 6 CUMIPMT CUMPRINC ($7,697.84) ($16,600.99) 18 19 PMT + ... 7 20 21 8 22 ($1,901.22) NPV $354.73 FV $16,724.21 23 9 24 89.69% $13,453.55 25 26Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts