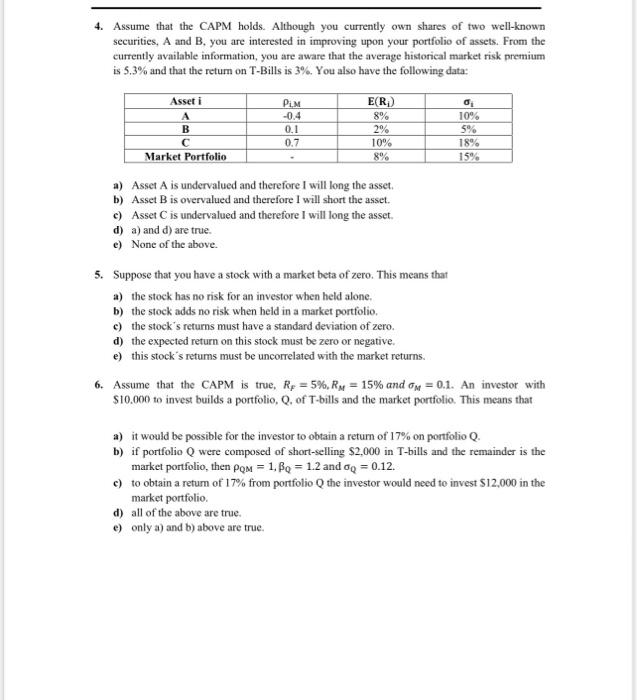

Question: INSTRUCTIONS: Do not round off any intermediate calculations. Final dollar answers should be rounded to two decimal places. Unless otherwise indicated, final interest rate answers

INSTRUCTIONS: Do not round off any intermediate calculations. Final dollar answers should be rounded to two decimal places. Unless otherwise indicated, final interest rate answers should be rounded to 6 decimal places if expressed as a decimal or 4 decimal places if expressed as a percent. You do not need to show "trailing zeros" (i.e., if no non-zero digits remain, 2.5% will do instead of 2.500000%) but make certain there are none. Include a timeline for obtain part-marks in the event that you misinterpret the problem. 4. Assume that the CAPM holds. Although you currently own shares of two well-known securities, A and B. you are interested in improving upon your portfolio of assets. From the currently available information, you are aware that the average historical market risk premium is 5.3% and that the return on T-Bills is 3%. You also have the following data: PM Asset i A B C -0.4 0.1 0.7 E(R) 8% 2% 10% 8% 0 10% 5% 18% 15% Market Portfolio a) Asset A is undervalued and therefore I will long the asset. b) Asset B is overvalued and therefore I will short the asset. c) Asset C is undervalued and therefore I will long the asset. d) a) and d) are true e) None of the above. 5. Suppose that you have a stock with a market beta of zero. This means that a) the stock has no risk for an investor when held alone. b) the stock adds no risk when held in a market portfolio c) the stock's returns must have a standard deviation of zero. d) the expected return on this stock must be zero or negative. e) this stock's retums must be uncorrelated with the market returns. 6. Assume that the CAPM is true. Rx = 5%, Ry = 15% and on = 0.1. An investor with $10.000 to invest builds a portfolio, Q, of T-bills and the market portfolio. This means that a) it would be possible for the investor to obtain a return of 17% on portfolio Q. b) if portfolio Qwere composed of short-selling $2,000 in T-bills and the remainder is the market portfolio, then Pom = 1. Bo = 1.2 and ag = 0.12. c) to obtain a return of 17% from portfolio Q the investor would need to invest $12,000 in the market portfolio d) all of the above are true e) only a) and b) above are true INSTRUCTIONS: Do not round off any intermediate calculations. Final dollar answers should be rounded to two decimal places. Unless otherwise indicated, final interest rate answers should be rounded to 6 decimal places if expressed as a decimal or 4 decimal places if expressed as a percent. You do not need to show "trailing zeros" (i.e., if no non-zero digits remain, 2.5% will do instead of 2.500000%) but make certain there are none. Include a timeline for obtain part-marks in the event that you misinterpret the problem. 4. Assume that the CAPM holds. Although you currently own shares of two well-known securities, A and B. you are interested in improving upon your portfolio of assets. From the currently available information, you are aware that the average historical market risk premium is 5.3% and that the return on T-Bills is 3%. You also have the following data: PM Asset i A B C -0.4 0.1 0.7 E(R) 8% 2% 10% 8% 0 10% 5% 18% 15% Market Portfolio a) Asset A is undervalued and therefore I will long the asset. b) Asset B is overvalued and therefore I will short the asset. c) Asset C is undervalued and therefore I will long the asset. d) a) and d) are true e) None of the above. 5. Suppose that you have a stock with a market beta of zero. This means that a) the stock has no risk for an investor when held alone. b) the stock adds no risk when held in a market portfolio c) the stock's returns must have a standard deviation of zero. d) the expected return on this stock must be zero or negative. e) this stock's retums must be uncorrelated with the market returns. 6. Assume that the CAPM is true. Rx = 5%, Ry = 15% and on = 0.1. An investor with $10.000 to invest builds a portfolio, Q, of T-bills and the market portfolio. This means that a) it would be possible for the investor to obtain a return of 17% on portfolio Q. b) if portfolio Qwere composed of short-selling $2,000 in T-bills and the remainder is the market portfolio, then Pom = 1. Bo = 1.2 and ag = 0.12. c) to obtain a return of 17% from portfolio Q the investor would need to invest $12,000 in the market portfolio d) all of the above are true e) only a) and b) above are true

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts