Question: Instructions: Either by hand or using Excel calculate the Expected Returns, Standard Deviations, and Coeffiecent of Variation for the stocks and for the portfolio given

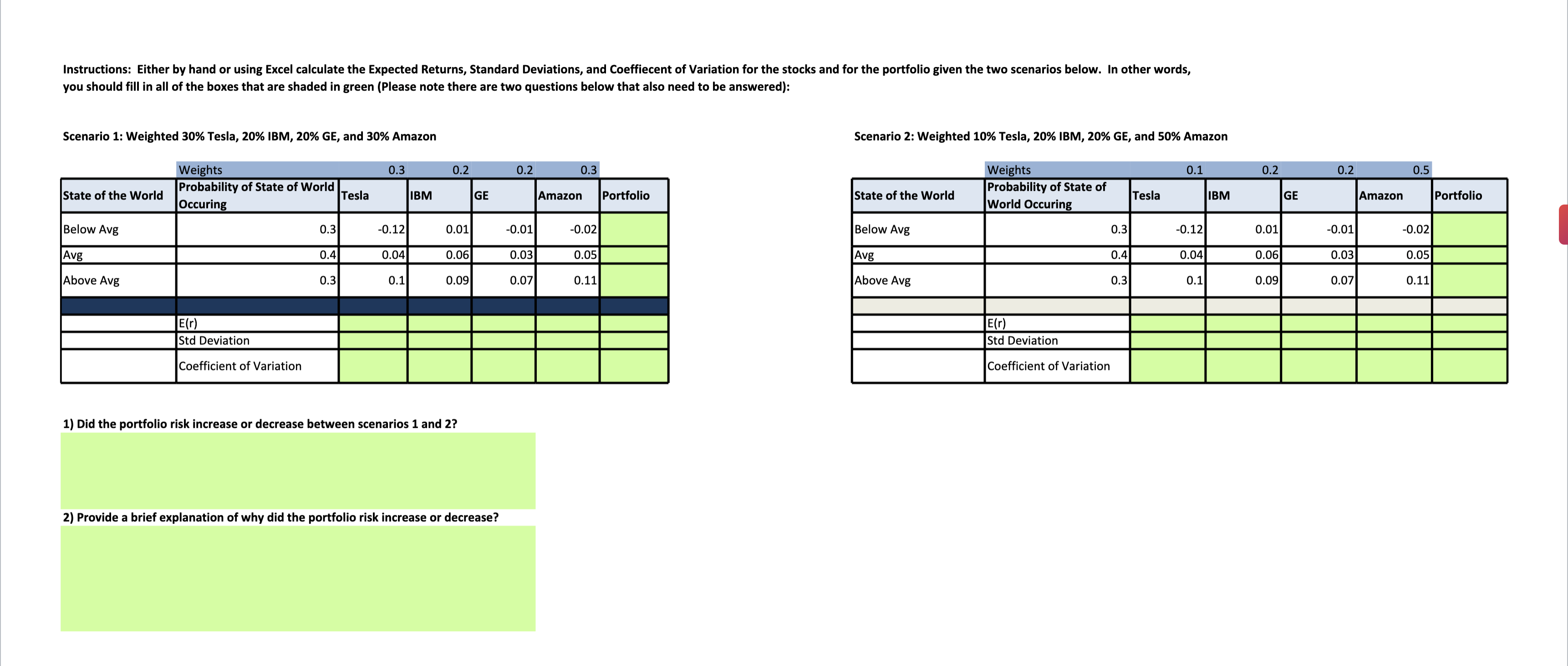

Instructions: Either by hand or using Excel calculate the Expected Returns, Standard Deviations, and Coeffiecent of Variation for the stocks and for the portfolio given the two scenarios below. In other words,

you should fill in all of the boxes that are shaded in green Please note there are two questions below that also need to be answered:

Scenario : Weighted Tesla, IBM, GE and Amazon Scenario : Weighted Tesla, IBM, GE and Amazon

Weights Weights

State of the World Probability of State of World

Occuring Tesla IBM GE Amazon Portfolio State of the World Probability of State of

World Occuring Tesla IBM GE Amazon Portfolio

Below Avg Below Avg

Avg Avg

Above Avg Above Avg

Er Er

Std Deviation Std Deviation

Coefficient of Variation Coefficient of Variation

Did the portfolio risk increase or decrease between scenarios and

Provide a brief explanation of why did the portfolio risk increase or decrease?you should fill in all of the boxes that are shaded in green Please note there are two questions below that also need to be answered:

Scenario : Weighted Tesla, IBM, GE and Amazon

Did the portfolio risk increase or decrease between scenarios and

Provide a brief explanation of why did the portfolio risk increase or decrease?

Scenario : Weighted Tesla, IBM, GE and Amazon

the portfolio risk increase or decrease between scenarios and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock