Question: Instructions For calculation questions the final answer should be formatted in dollars too the nearest cent and percentage to two (2) decimal places. No rounding

| Instructions | For calculation questions the final answer should be formatted in dollars too the nearest cent and percentage to two (2) decimal places. No rounding of intermediate work. |

|---|

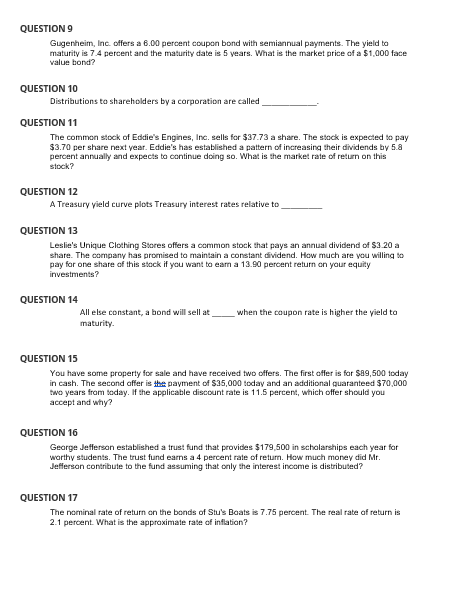

QUESTION 9 Gugenheim, Inc. offers a 6.00 percent coupon bond with semiannual payments. The yield to maturity is 7.4 percent and the maturity date is 5 vears. What is the market price of a $1,000 face value bond? QUESTION 10 Distributions to shareholders by a corporation are called QUESTION 11 The common stock of Eddie's Engines, Inc. sells for $37.73 a share. The stock is expected to pay $3.70 per share next vear. Eddie's has established a pattern of increasing their dividends by 5.8 percent annually and expects to continue doing so. What is the market rate of return on this sicck? QUESTION 12 A Treasury vield curve plots Treasury interest rates relative to QUESTION 13 Leslie's Unique Clothing Stores offers a common stock that pays an annual dividend of $3.20 a share. The company has promised to maintain a constant dividend. How much are you willing to pay for one share of this stock if you want to eam a 13.90 percent return on your equity investments? QUESTION 14 All else constant, a bond will sell at when the coupon rate is higher the vield to maturity. QUESTION 15 You have some property for sale and have received two offers. The first offer is for $89,500 today in cash. The second offer is the payment of $35,000 today and an additional puaranteed $70,000 two years from today. If the applicable discount rate is 11.5 percent, which offer should you accept and why? QUESTION 16 George Jefferson established a trust fund that provides $179,500 in scholarships each year for worthy students. The trust fund earns a 4 percent rate of retum. How much monev did Mr. Jefferson contribute to the fund assuming that coly the interest income is distribused? QUESTION 17 The nominal rate of return on the bonds of Stu's Boats is 7.75 percent. The real rate of return is 2.1 percent. What is the approximate rate of inflation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts