Question: Instructions for Chapter 10 Excel Problems You con oppeat thil ertipine by epening the tertpiate bgain. Excel Tips Format ell dellar a mount celle weh

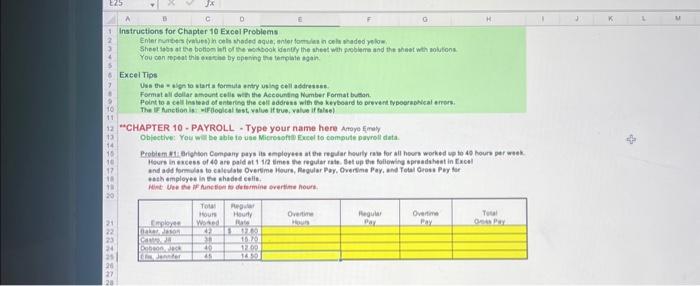

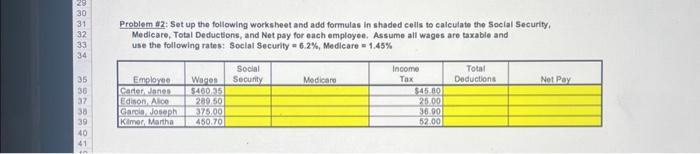

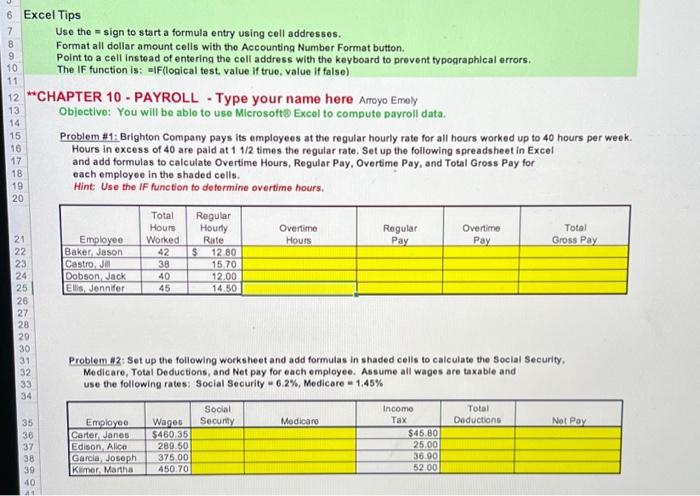

Instructions for Chapter 10 Excel Problems You con oppeat thil ertipine by epening the tertpiate bgain. Excel Tips Format ell dellar a mount celle weh the Accountng Number Format busan. "CHAPTER 10 - PAYROLL - TYPe your name here Amoyo Emely Oblecthe: Your will be able io ues Microsofte Excel to compude povroll data. Hours in okcess of 49 are paid at 1 In times the regular rate. Set up Do follewirg opreadahest in fxcel and add formulas to calesdobe Overtme Bours, Regulor Pay. Overdme Poy. and Tetal Oeaso Pey for: obth employee in the shaded ceili. Wint Uoe the if Hunetioti to dotermine srertien hourt. Problem an: Set up the following worksheet and add formulas in shaded cells to calculate the Soclal Security, Medicare, Total Deductons, and Net pay for each employee. Assume all wages are taxable and use the following rates: Soclal Security = 6.2%, Medleare =1.45% Use the = sign to start a formula entry using cell addresses. Format all dollar amount cells with the Accounting Number Format button. Point to a cell instead of entering the cell address with the keyboard to prevent fypographical errors. The IF function is: =IF(logical test, value if true, value if false) CHAPTER 10 - PAYROLL - Type your name here Arroyo Emoly Objectivo: You will be able to use Microsofte Excol to compute payroll data. Problem \#1: Brighton Company pays its employees at the regular hourly rate for all hours worked up to 40 hours per week. Hours in excess of 40 are paid at 11/2 times the regular rate. Set up the following spreadsheet in Excel and add formulas to calculate Overtime Hours, Regular Pay, Overtime Pay, and Total Gross Pay for each employee in the shaded cells. Hint: Use the IF function to defermine overtime hours. Problem i2: Set up the following worksheet and add formulas in shaded cells to calculate the Soclal Security, Medicare, Total Deductions, and Net pay for each employee. Assume all wages are taxable and use the following rates: Social Security =6.2%, Medicare =1.45%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts