Question: Instructions Journalizing And Posting Payroll Entries Cascade Company has four employees. All are paid on a monthly basis. The fiscal year of the business is

Instructions

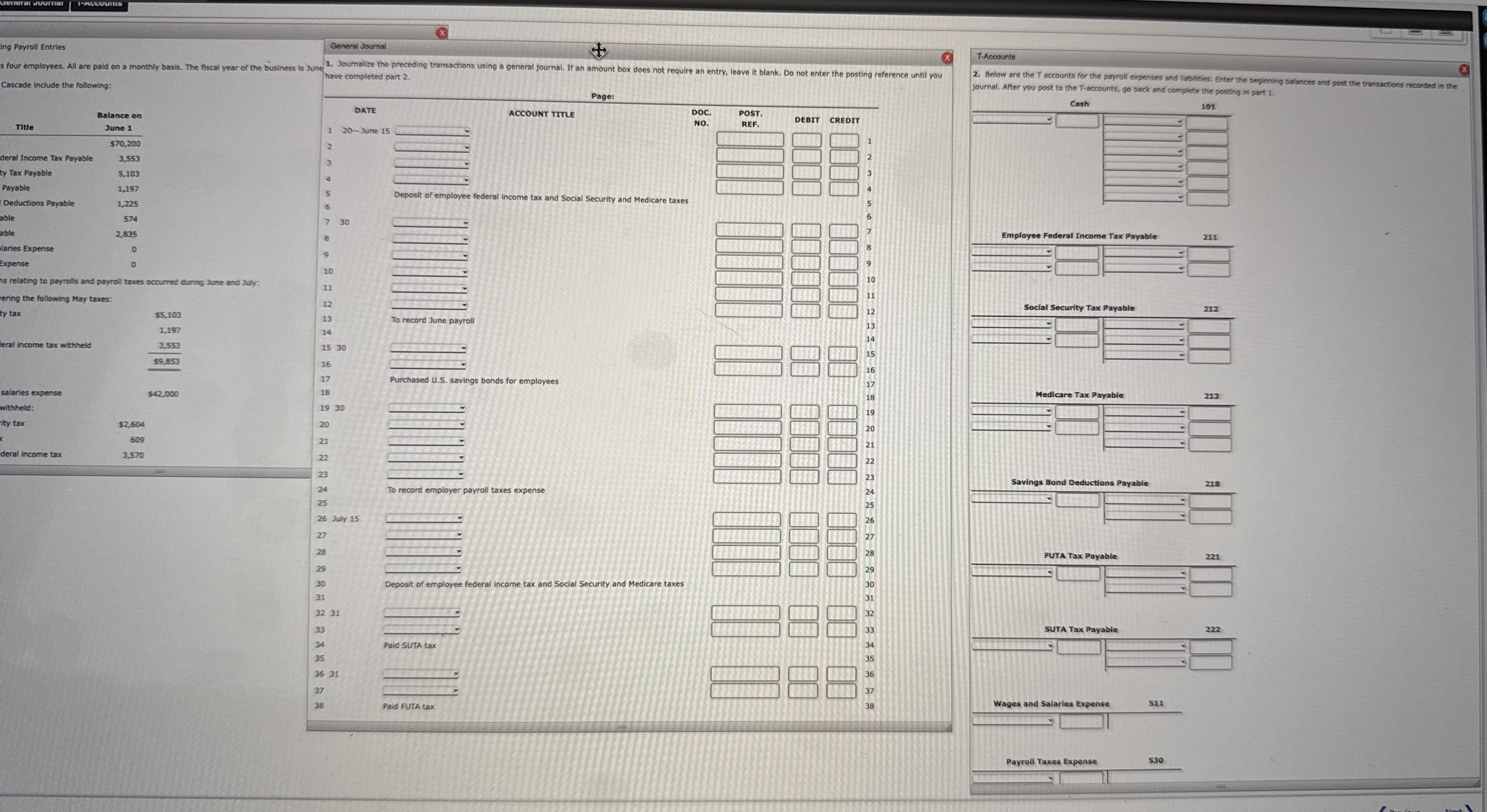

Journalizing And Posting Payroll Entries

Cascade Company has four employees. All are paid on a monthly basis. The fiscal year of the business is June to May

The accounts kept by cascade include the following:

tableAccount Number,Title,Balance on June Cash,$Employee Federal Income Tax Payable,Social Security Tax Payable,Medicare Tax Payable,Savings Bond Deductions Payable,FUTA Tax Payable,SUTA Tax Payable,Wages and Salaries Expense,Payroll Taxes Expense,

The following transactions relating to payrolls and payroll taves occurred during June and July:

une Paid $ covering the following May taxes:

tableSocial Security tax,$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock