Question: Instructions Note: This problem is for the 2 0 2 3 tax year. Alfred E . Old and Beulah A . Crane, each age 4

Instructions

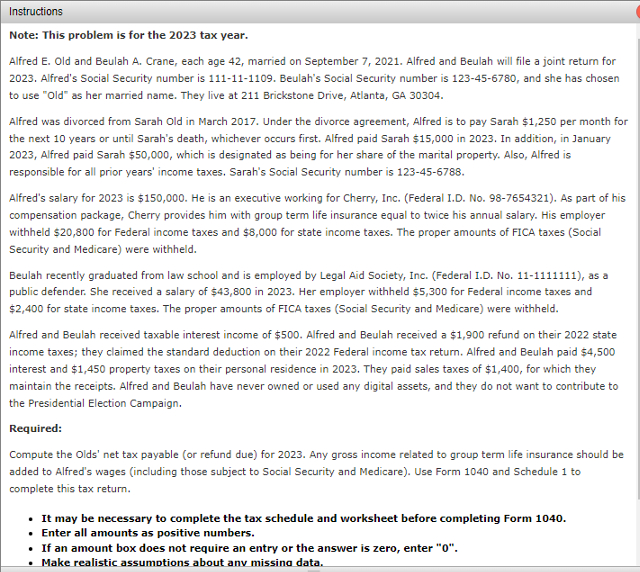

Note: This problem is for the tax year.

Alfred E Old and Beulah A Crane, each age married on September Alfred and Beulah will file a joint return for

Alfred's Social Security number is Beulah's Social Security number is and she has chosen

to use "Old" as her married name. They live at Brickstone Drive, Atlanta, GA

Alfred was divorced from Sarah Old in March Under the divorce agreement, Alfred is to pay Sarah $ per month for

the next years or until Sarah's death, whichever occurs first. Alfred paid Sarah $ in In addition, in January

Alfred paid Sarah $ which is designated as being for her share of the marital property. Also, Alfred is

responsible for all prior years' income taxes. Sarah's Social Security number is

Alfred's salary for is $ He is an executive working for Cherry, Inc. Federal I.D No As part of his

compensation package, Cherry provides him with group term life insurance equal to twice his annual salary. His employer

withheld $ for Federal income taxes and $ for state income taxes. The proper amounts of FICA taxes Social

Security and Medicare were withheld.

Beulah recently graduated from law school and is employed by Legal Aid Society, Inc. Federal I.D No as a

public defender. She received a salary of $ in Her employer withheld $ for Federal income taxes and

$ for state income taxes. The proper amounts of FICA taxes Social Security and Medicare were withheld.

Alfred and Beulah received taxable interest income of $ Alfred and Beulah received a $ refund on their state

income taxes; they claimed the standard deduction on their Federal income tax return. Alfred and Beulah paid $

interest and $ property taxes on their personal residence in They paid sales taxes of $ for which they

maintain the receipts. Alfred and Beulah have never owned or used any digital assets, and they do not want to contribute to

the Presidential Election Campaign.

Required:

Compute the Olds' net tax payable or refund due for Any gross income related to group term life insurance should be

added to Alfred's wages including those subject to Social Security and Medicare Use Form and Schedule to

complete this tax return.

It may be necessary to complete the tax schedule and worksheet before completing Form

Enter all amounts as positive numbers.

If an amount box does not require an entry or the answer is zero, enter

Make realistic assumptions about any missing data.

Form

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock