Question: is problem is for the 2018 tax year. Alfred E. Old and Beulah A. Crane, each age 12, married on September 7, 2016. Alfred and

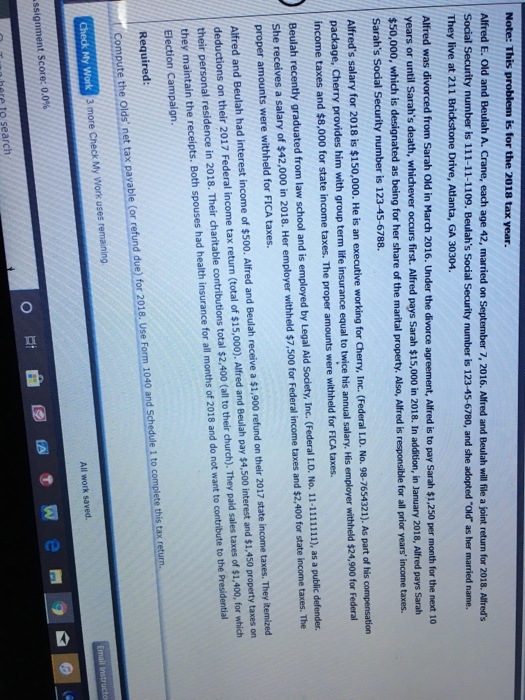

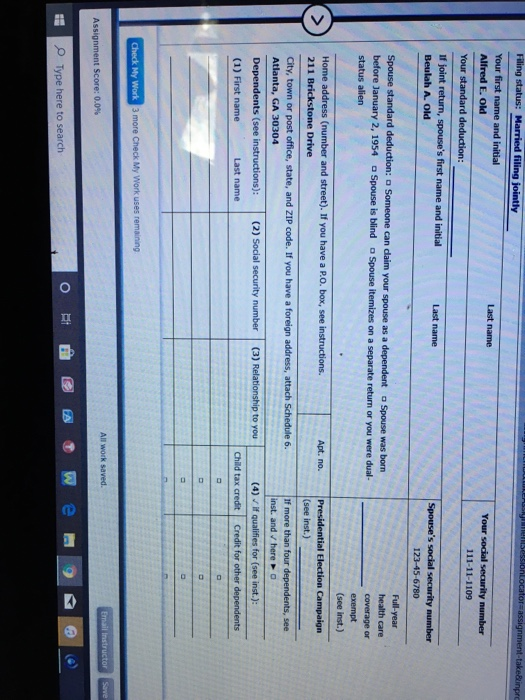

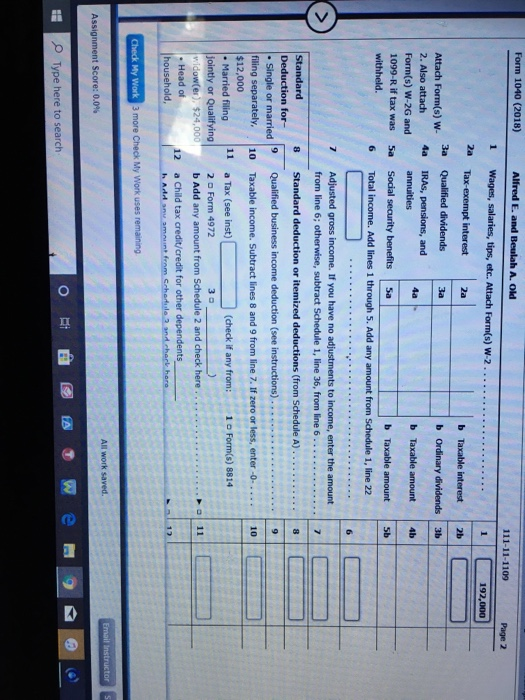

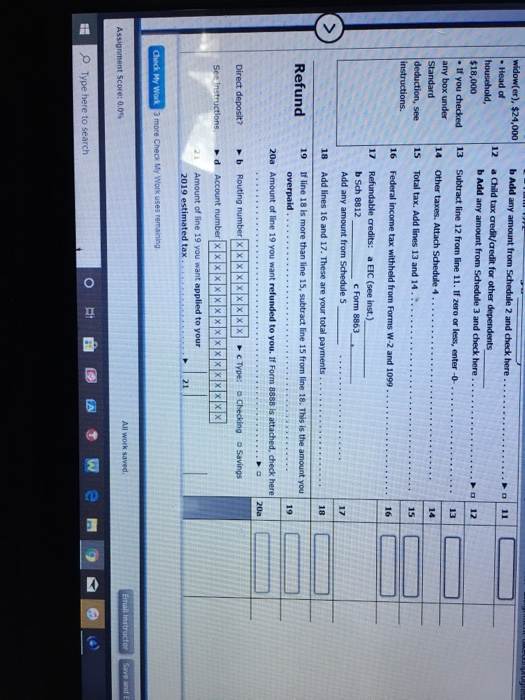

is problem is for the 2018 tax year. Alfred E. Old and Beulah A. Crane, each age 12, married on September 7, 2016. Alfred and Beulah will file a joint return for 2018. Alfred's Social Security number is 111-11-1109. Beulah's Social Security number is 123-45-6780, and she adopted old as her married name. They live at 211 Brickstone Drive, Atlanta, GA 30304 Alfred was divorced from Sarah Old in March 2016. Under the divorce agreement, Alfred is to pay Sarah $1,250 per month for the next 10 years or until Sarah's death, whichever occurs first. Alfred pays Sarah $15,000 in 2018. In addition, in January 2018, Alfred pays Sarah $50,000, which is designated as being for her share of the marital property. Also, Alfred is responsible for all prior years' income taxes Sarah's Social Security number is 123-45-6788. Alfred's salary for 2018 is $150,000. He is an executive working for Cherry, Inc. (Federal LD. No. 98-7654321). As part of his compensation package, Cherry provides him with group term life insurance equal to twice his annual salary. His employer withheld $24,900 for Federal income taxes and $8,000 for state income taxes. The proper amounts were withheld for FICA taxes Beulah recently graduated from law school and is employed by Legal Aid Society, Inc. (Federal LD. No. 11-1111111), as a public defender, She receives a salary of $42,000 in 2018. Her employer withheld $7,500 for Federal income taxes and $2,400 for state income taxes. The proper amounts were withheld for FICA taxes. Alfred and Beulah had interest income of $500. Alfred and Beulah receive a $1,900 refund on their 2017 state income taxes. They itemized deductions on their 2017 Federal income tax return (total of $15,000). Alfred and Beulah pay $4,500 interest and $1,450 property taxes on their personal residence in 2018. Their charitable contributions total $2,400 (all to their church). They paid sales taxes of $1,400, for which they maintain the receipts. Both spouses had health insurance for all months of 2018 and do not want to contribute to the Presidential Election Campaign Required: Compute the Olds' net tax payable (or refund due) for 2018. Use Form 1040 and Schedule 1 to complete this tax return. Check My Work 3 more Check My Work uses remaining Email instruct All work saved. ignment Score: 0.0% o BBW e m9 have to search Filing status: Married filing jointly e n session Locator assignment-take&inpro Last name Your social security number 111-11-1109 Your first name and initial Alfred E. Old Your standard deduction: If joint return, spouse's first name and initial Beulah A. Old Last name Spouse's social security number 123-45-6780 Full-year Spouse standard deduction: Someone can daim your spouse as a dependent Spouse was born health care before January 2, 1954 Spouse is blind Spouse itemizes on a separate return or you were dual coverage or status alien exempt (see inst.) Home address (number and street). If you have a P.O. box, see instructions. Apt. no. Presidential Election Campaign 211 Brickstone Drive (see inst.) City, town or post office, state, and ZIP code. If you have a foreign address, attach Schedule 6. If more than four dependents, see Atlanta, GA 30304 inst. and here Dependents (see instructions): (2) Social security number (4) if qualifies for (see inst.): (1) First name Last name Child tax credit Credit for other dependents Check My Work 3 more Check My Work uses remaining All work saved. Email Instructor Save Assignment Score: 0.0% Assignment score: 0.0% Type here to search of owe (@ Form 1040 (2018) Alfred E. and Beulah A. Old 111-11-1109 1 Wages, salaries, tips, etc. Attach Form(s) W-2.. 192,000 2a 3a 40 Attach Form(s) W- 2. Also attach Form(s) W-2G and 1099-R if tax was withheld. Tax-exempt interest b Taxable interest Qualified dividends b Ordinary dividends TRAS, pensions, and Taxable amount annuities Social security benefits b Taxable amount Total income. Add lines 1 through 5. Add any amount from Schedule 1, line 22 5a Adjusted gross income. If you have no adjustments to income, enter the amount from line 6; otherwise, subtract Schedule 1, line 36, from line 6.. 8 Standard deduction or itemized deductions (from Schedule A)... Qualified business income deduction (see instructions). 10 Taxable income. Subtract lines 8 and 9 from line 7. If zero or less, enter -0. Deduction for- Single or married Tiling separately. $12,000 . Married filing jointly or Qualifying widow(er). $24,000 Head of household, 11 1 Form(s) 8814 a Tax (see inst) (check if any from: 2 Form 4972 30 b Add any amount from Schedule 2 and check here .. a Child tax credit/credit for other dependents h Ad a munt from Cohortul and check here 12 Check My Work 3 more Check My Work uses remaining Assignment Score: 0.0% Email Instructor Type here to search OR_DEAT W e 9 @ @ 12 widow(er), $24,000 - Head of household, $18,000 - If you checked any box under Standard deduction, see instructions Add any amount from Schedule 2 and check here a Child tax credit/credit for other dependents b Add any amount from Schedule 3 and check here. Subtract line 12 from line 11. If zero or less, enter-o- Other taxes. Attach Schedule 4.. 13 14 15 Total tax. Add lines 13 and 14... 16 Federal income tax withheld from Forms W-2 and 1099 17 Refundable credits: a EIC (see Inst.) b Sch 8812 c Form 8863 Add any amount from Schedule 5 18 Add lines 16 and 17. These are your total payments. If line 18 is more than line 15, subtract line 15 from line 18. This is the amount you overpaid..... . .. 20a Amount of line 19 you want refunded to you. If Form 8888 is attached, check here Refund 19 200 Savings Direct deposit? See Instructions b Routing number x x x x xxxxx c Type: Checking Account number XXXXXXXXXXXXXXXXX Amount of line 19 you want applied to your 2019 estimated tax... Check My Work 3 more Check My Work uses remaining Assignment Score: 0.0% All work saved. Email Instructor Save and Type here to search o # We M9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts