Question: Instructions : ONLY DO 3 . ( DO ALL PARTS OF 3 after Finding the Data Set And make sure its correct ) Consider an

Instructions : ONLY DO DO ALL PARTS OF after Finding the Data Set And make sure its correct

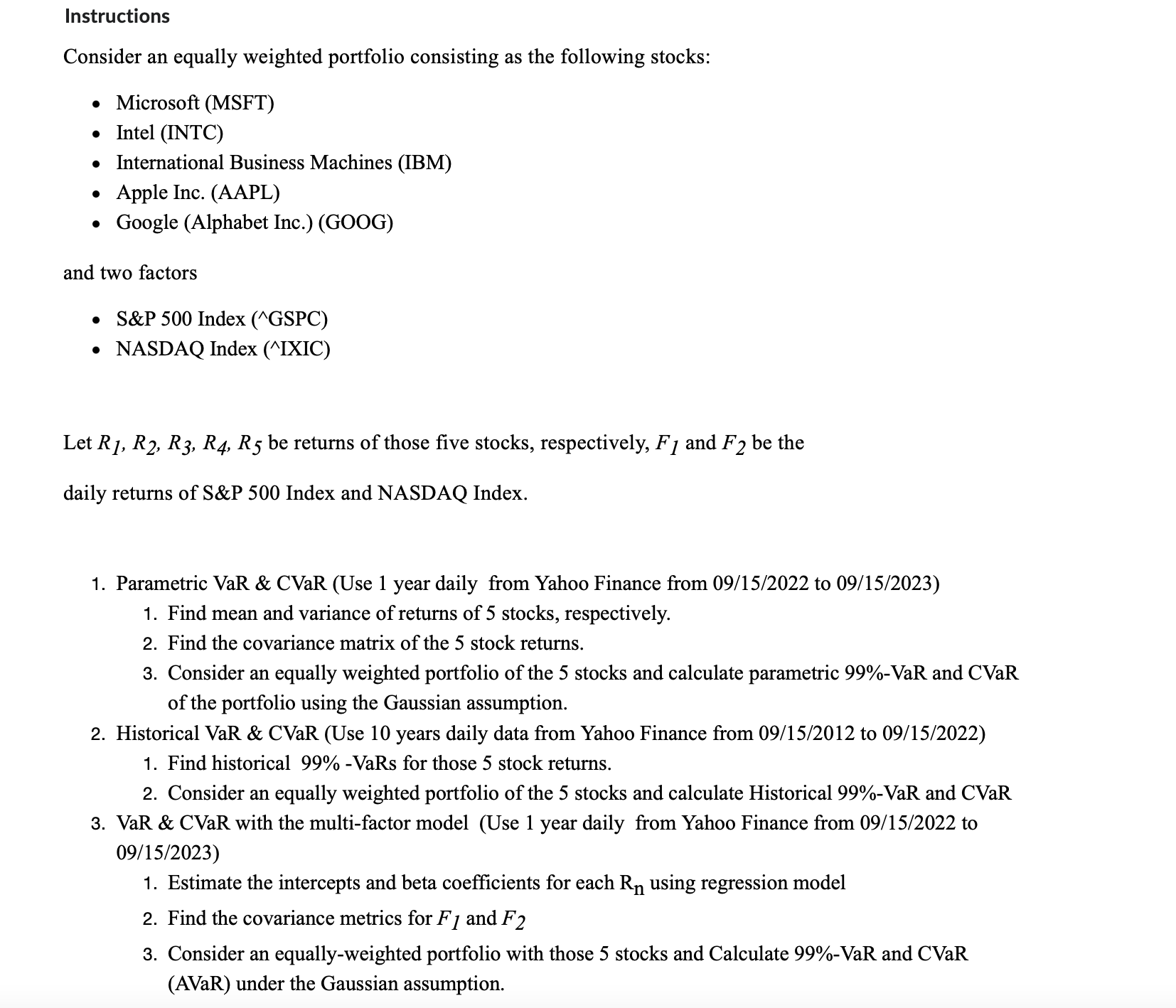

Consider an equally weighted portfolio consisting as the following stocks:

Microsoft MSFT

Intel INTC

International Business Machines IBM

Apple Inc. AAPL

Google Alphabet Inc.GOOG

and two factors

S&P Index GSPC

NASDAQ Index IXIC

Let be returns of those five stocks, respectively, and be the

daily returns of S&P Index and NASDAQ Index.

Parametric VaR & CVaR Use year daily from Yahoo Finance from to

Find mean and variance of returns of stocks, respectively.

Find the covariance matrix of the stock returns.

Consider an equally weighted portfolio of the stocks and calculate parametric VaR and CVaR

of the portfolio using the Gaussian assumption.

Historical VaR & CVaR Use years daily data from Yahoo Finance from to

Find historical VaRs for those stock returns.

Consider an equally weighted portfolio of the stocks and calculate Historical VaR and CVaR

VaR & CVaR with the multifactor model Use year daily from Yahoo Finance from to

Estimate the intercepts and beta coefficients for each using regression model

Find the covariance metrics for and

Consider an equallyweighted portfolio with those stocks and Calculate VaR and CVaR

AVaR under the Gaussian assumption.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock