Question: Instructions: Read the problem below and refer to the spreadsheet provided. The spreadsheet values highlighted in yellow can Questions: a . Janet thinks a coupon

Instructions:

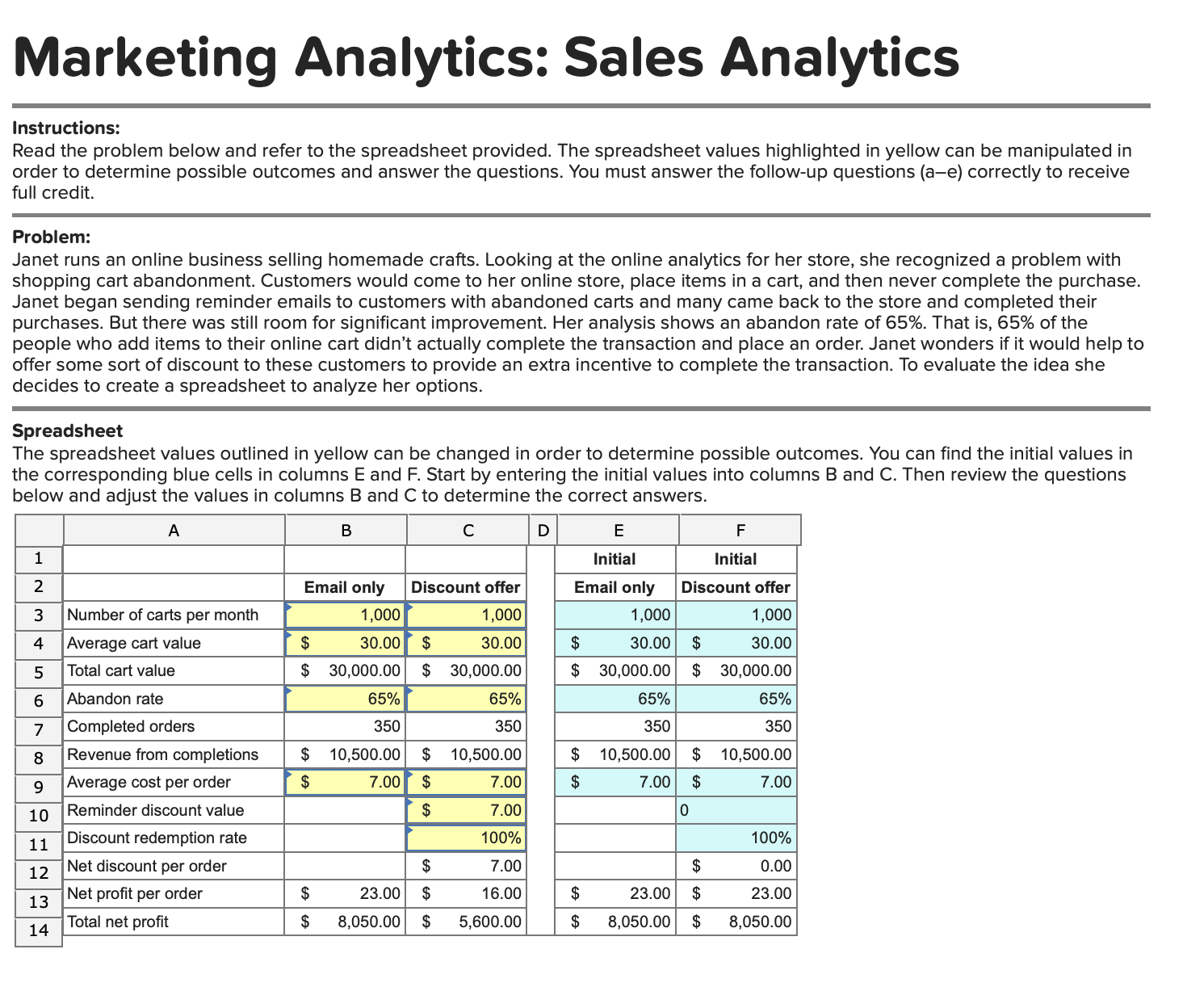

Read the problem below and refer to the spreadsheet provided. The spreadsheet values highlighted in yellow can

Questions:

a Janet thinks a coupon code providing a discount on the current order will decrease the abandon rate by What would that do to her total net profit?

multiple choice

$

$

$

$

$

b If the coupon code provided a discount, what is the maximum abandon rate that will still provide a better net profit than offering no discount?

multiple choice

c Instead of offering a discount on the purchase, if Janet offered free shipping a $ value she expects the abandon rate to be How would that compare to what she considered in scenario a above?

multiple choice

Offering the discount would be more profitable

Offering free shipping would be more profitable

Either option would provide the same total profit

d Instead of discounting the current order, Janet considers giving the customer a coupon code for $ off a future purchase. She expects that only of those coupon codes will be redeemed and she thinks the abandon rate will drop to Factoring the impact of the future discount into the current transaction, what would her net profit be

multiple choice

$

$

$

$

$

e One other idea was to offer a coupon code that applies a $ discount on the current purchase if the value of the items in the cart is $ Janet doesnt believe this will improve the abandonment rate versus a straight email reminder but it might provide more total profit. What would her total profit be

multiple choice

$

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock