Question: instructions Richaru's For W-2 Form 1040 Schedule 1 Schedule 2 Schedules Schedule A Schedules Schedule Sche Instructions Richard McCarthy (born 2/14/1966; Social Security number 100-10

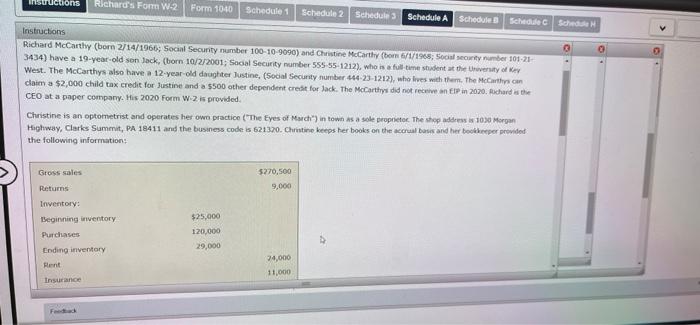

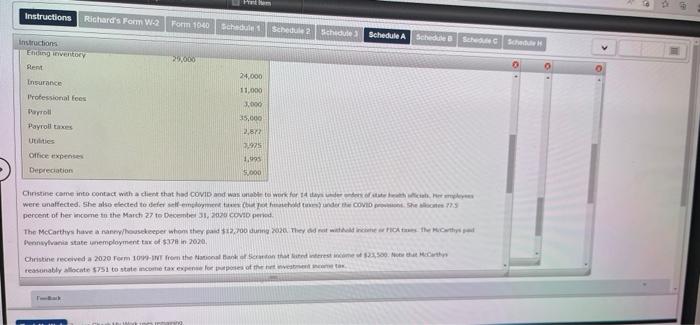

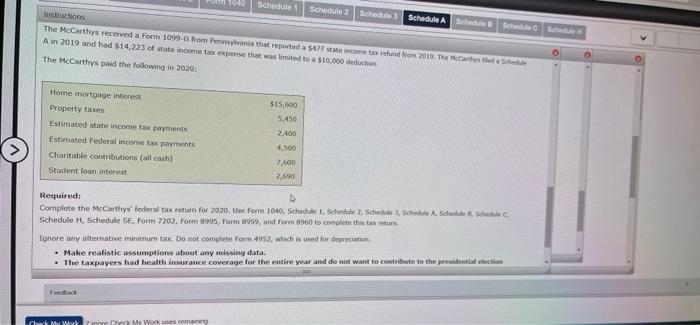

instructions Richaru's For W-2 Form 1040 Schedule 1 Schedule 2 Schedules Schedule A Schedules Schedule Sche Instructions Richard McCarthy (born 2/14/1966; Social Security number 100-10 9090) and Christine McCarthy (bom /1/1968; Social Security number 101-21 3434) have a 19-year-old son lack, (born 10/2/2001, Social Security number 555-55-1212), who is a full-time shadent at the Universty of Key West. The McCarthys also have a 12-year old daughter Justine, (Social Security number 444-23-1212), who lives with them. The McCarthy.com claim a $2,000 child tax credit for Justine and a $500 other dependent credit for Jack. The McCarthy did not receive an EP in 2020. Richard as the CEO at a paper company. His 2020 Form W-2 is provided Christine is an optometrist and operates her own practice ("The Eyes of March") in town as a sole proprietor. The shop address 1030 Morgan Highway, Clarks Summit, PA 18411 and the business code is 621320. Christine keeps her books on the accrual basis and her bookkeeper provided the following information: 5270,500 9,000 Gross sales Returns Inventory: Beginning inventory Purchases Ending inventory Rent $25.000 120,000 29,000 $ 24,000 11,000 Insurance Feed Instructions Richard's FormW-2 Form 1040 Schedule Schedule 2 Schedule Schedule A Schedule Sec Sche 29.000 Instructions Ending inventory Sent Insurance Professional fees Payroll Payroll taxes 24,000 11,000 3.000 35,000 2,872 Uties 3,975 Office expenses Depreciation 1.995 5.000 Christine came into contact with a dient that had COVID and was to work for 14 days of the were unaffected. She also elected to defensoothunder COVIO Shew percent of her income to the March 27 to December 31, 2020 COVID period The McCarthys have any housekeeper ther and 12,700 ng 2020. They ad it will come the mothy Pennsylvania state unemployment te of $37 in 2020, Christine received a 2020 Torm 10-IV from the one that we w 500 wth reasonably locatie $751 to state income tax expens for poses of the vete Um 100 Schedules Schedule 2 Sce Schedule A che so che Instructions The McCarthys received a Form 1099-6 from Pennsylvanis that reported a $477 state come and from 2013 the Match A in 2019 and had $14,223 of state income taxe pense that was limited to a $10,000 deduction The McCarthys paid the following in 2020: Home mortgage interest Property taxes Estimated state income tax payments Estimated Federal income tax payments Charitable contributions (all cash) Student loan interest $15.600 5,450 2.400 4.500 7.600 2,690 Required: D Complete the McCarthy' federal tax return for 2020. Use Form 1040, schedule 1, Schedule Schedule, schedule Schedule. She Schedule H, Schedule SE, Form 7202, Form 1995, Forin 8959, and Form 1960 to complete this tax return Ignore any alternative minimum tax. Do not complete Form 4952, which is used for deprecation Make realistic assumptions about any missing data. The taxpayers had health insurance coverage for the entire year and do not want to contribute to the presidential election Feedback My with mark My Worker

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts