Question: Instructions Solve the tasks. You will get five points for every of them and the premium of two additional points for solving them during the

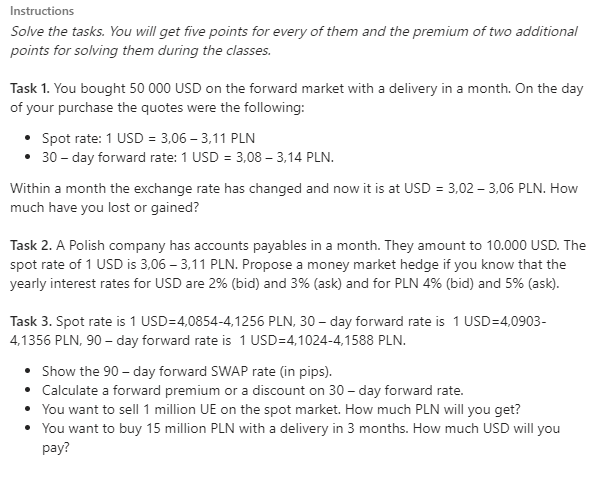

Instructions Solve the tasks. You will get five points for every of them and the premium of two additional points for solving them during the classes. Task 1. You bought 50 000 USD on the forward market with a delivery in a month. On the day of your purchase the quotes were the following: Spot rate: 1 USD = 3,06 - 3,11 PLN 30-day forward rate: 1 USD = 3,08 - 3,14 PLN. Within a month the exchange rate has changed and now it is at USD = 3.02 - 3,06 PLN. How much have you lost or gained? Task 2. A Polish company has accounts payables in a month. They amount to 10.000 USD. The spot rate of 1 USD is 3,06 - 3,11 PLN. Propose a money market hedge if you know that the yearly interest rates for USD are 2% (bid) and 3% (ask) and for PLN 4% (bid) and 5% (ask). Task 3. Spot rate is 1 USD=4,0854-4,1256 PLN, 30-day forward rate is 1 USD=4,0903- 4,1356 PLN, 90 - day forward rate is 1 USD=4,1024-4,1588 PLN. Show the 90-day forward SWAP rate (in pips). Calculate a forward premium or a discount on 30-day forward rate. You want to sell 1 million UE on the spot market. How much PLN will you get? You want to buy 15 million PLN with a delivery in 3 months. How much USD will you pay? Instructions Solve the tasks. You will get five points for every of them and the premium of two additional points for solving them during the classes. Task 1. You bought 50 000 USD on the forward market with a delivery in a month. On the day of your purchase the quotes were the following: Spot rate: 1 USD = 3,06 - 3,11 PLN 30-day forward rate: 1 USD = 3,08 - 3,14 PLN. Within a month the exchange rate has changed and now it is at USD = 3.02 - 3,06 PLN. How much have you lost or gained? Task 2. A Polish company has accounts payables in a month. They amount to 10.000 USD. The spot rate of 1 USD is 3,06 - 3,11 PLN. Propose a money market hedge if you know that the yearly interest rates for USD are 2% (bid) and 3% (ask) and for PLN 4% (bid) and 5% (ask). Task 3. Spot rate is 1 USD=4,0854-4,1256 PLN, 30-day forward rate is 1 USD=4,0903- 4,1356 PLN, 90 - day forward rate is 1 USD=4,1024-4,1588 PLN. Show the 90-day forward SWAP rate (in pips). Calculate a forward premium or a discount on 30-day forward rate. You want to sell 1 million UE on the spot market. How much PLN will you get? You want to buy 15 million PLN with a delivery in 3 months. How much USD will you pay

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts