Question: Instructions to Question 3: Intangible Assets (TOTAL 20 MARKS) Question 3 20 pts Temper Led. is developing a new product to be launched in the

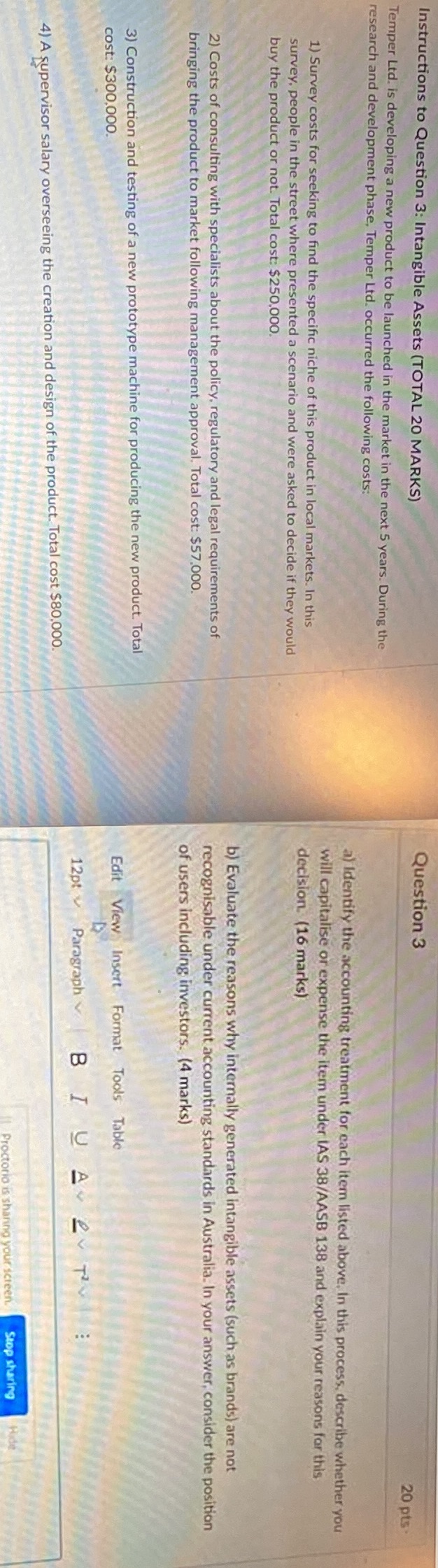

Instructions to Question 3: Intangible Assets (TOTAL 20 MARKS) Question 3 20 pts Temper Led. is developing a new product to be launched in the market in the next 5 years. During the research and development phase, Temper Led. occurred the following costs: a) Identify the accounting treatment for each item listed above. In this process, describe whether you 1) Survey costs for seeking to find the specific niche of this product in local markets. In this will capitalise or expense the item under IAS 38/AASB 138 and explain your reasons for this survey, people in the street where presented a scenario and were asked to decide if they would decision. (16 marks) buy the product or not. Total cost: $250.000. b) Evaluate the reasons why internally generated intangible assets (such as brands) are not 2) Costs of consulting with specialists about the policy, regulatory and legal requirements of recognisably under current accounting standards in Australia. In your answer, consider the position bringing the product to market following management approval. Total cost: $57,000. of users including investors. (4 marks) 3) Construction and testing of a new prototype machine for producing the new product. Total cost: $300,000. Edit View Insert Format Tools Table 12pt Paragraph BI U A evTV : 4) A supervisor salary overseeing the creation and design of the product. Total cost $80,000. ricteen. Stop sharing Hide

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts