Question: Instructions: Use the balance sheet and income statement to answer questions A, B, C, and D below. Use the dropdowns to select line items. Provide

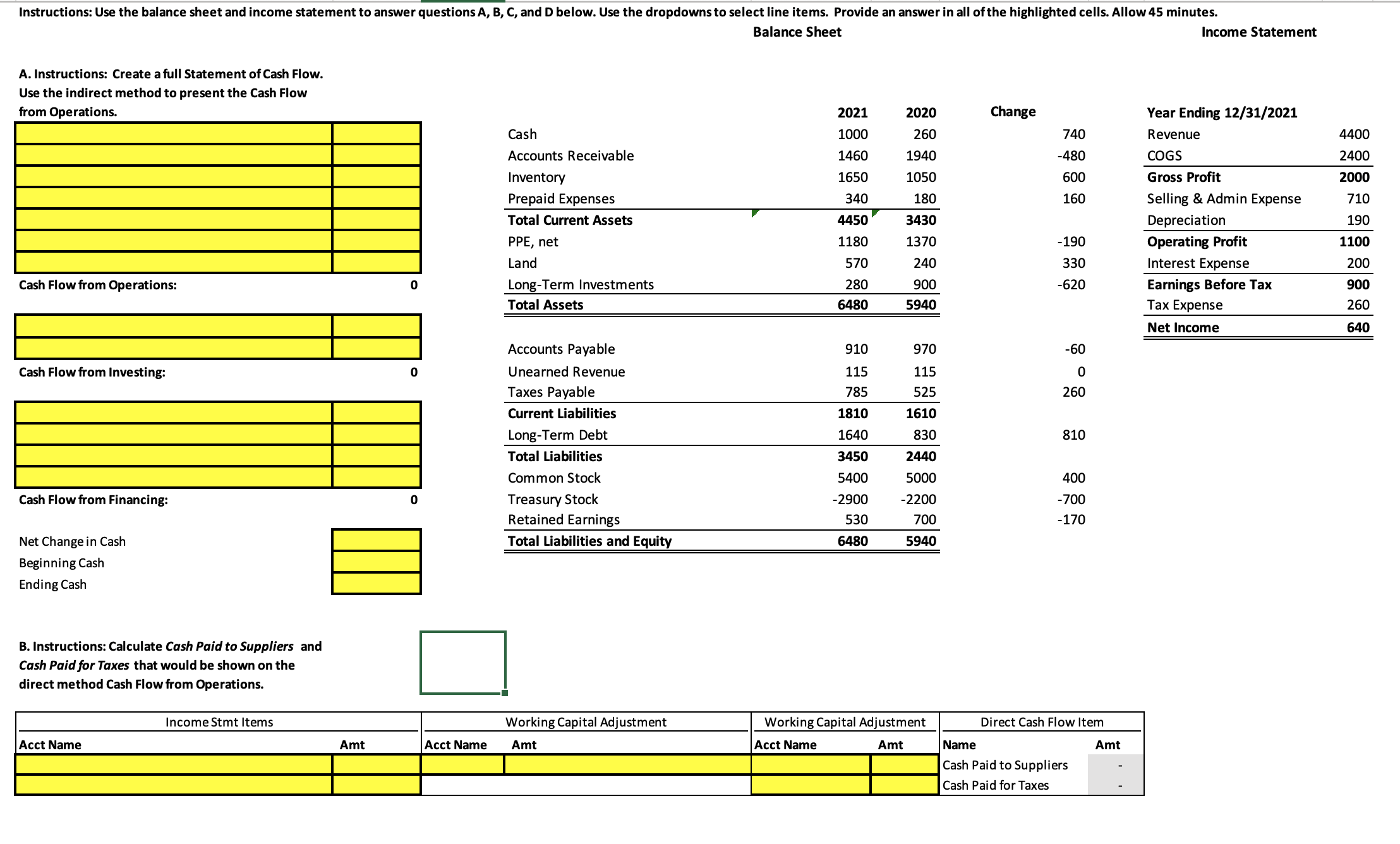

Instructions: Use the balance sheet and income statement to answer questions A, B, C, and D below. Use the dropdowns to select line items. Provide an answer in all of the highlighted cells. Allow 45 minutes. Balance Sheet Income Statement A. Instructions: Create a full Statement of Cash Flow. Use the indirect method to present the Cash Flow from Operations. 2021 2020 Change Year Ending 12/31/2021 Cash 1000 260 740 Revenue 4400 Accounts Receivable 1460 1940 -480 COGS 2400 Inventory 1650 1050 600 Gross Profit 2000 Prepaid Expenses 340 180 160 Selling & Admin Expense 710 Total Current Assets 4450 3430 Depreciation 190 PPE, net 1180 1370 190 Operating Profit 1100 Land 570 40 330 Interest Expense 200 Cash Flow from Operations: Long-Term Investments 280 900 -620 Earnings Before Tax 900 Total Assets 48 5940 Tax Expense 260 Net Income 640 Accounts Payable 910 970 -60 Cash Flow from Investing: Unearned Revenue 115 115 0 Taxes Payable 85 525 260 Current Liabilities 1810 1610 Long-Term Debt 1640 330 310 Total Liabilities 3450 2440 Common Stock 5400 5000 400 Cash Flow from Financing: Treasury Stock -2900 -2200 -700 Retained Earnings 530 700 170 Net Change in Cash Total Liabilities and Equity 6480 5940 Beginning Cash Ending Cash B. Instructions: Calculate Cash Paid to Suppliers and Cash Paid for Taxes that would be shown on the direct method Cash Flow from Operations. Income Stmt Items Working Capital Adjustment Working Capital Adjustment Direct Cash Flow Item Acct Name Amt Acct Name Amt Acct Name Amt Name Amt Cash Paid to Suppliers Cash Paid for Taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts