Question: Instructions: Write True if the statement is true. Write False if the statement if false, if false write the word/words that makes the statement false.

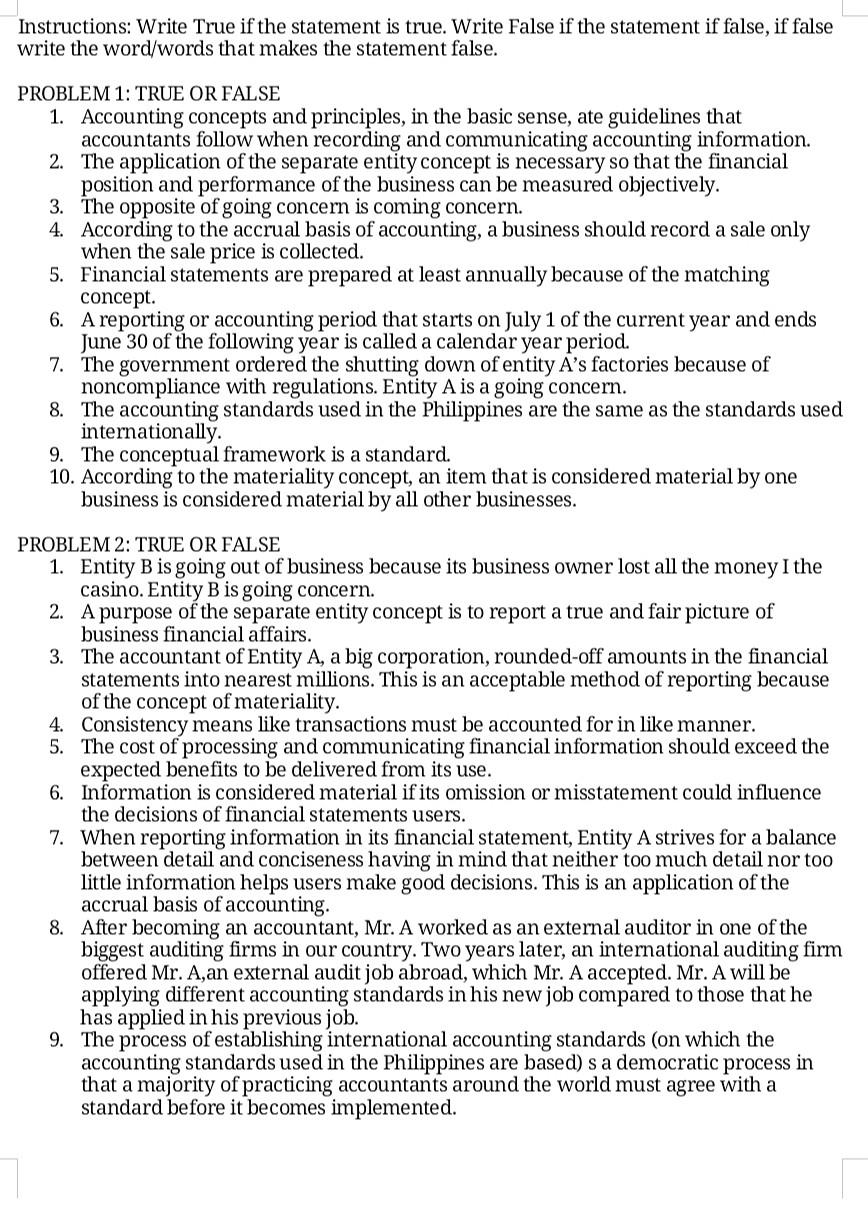

Instructions: Write True if the statement is true. Write False if the statement if false, if false write the word/words that makes the statement false. PROBLEM 1: TRUE OR FALSE 1. Accounting concepts and principles, in the basic sense, ate guidelines that accountants follow when recording and communicating accounting information. 2. The application of the separate entity concept is necessary so that the financial position and performance of the business can be measured objectively. 3. The opposite of going concern is coming concern. 4. According to the accrual basis of accounting, a business should record a sale only when the sale price is collected. 5. Financial statements are prepared at least annually because of the matching concept. 6. A reporting or accounting period that starts on July 1 of the current year and ends June 30 of the following year is called a calendar year period. 7. The government ordered the shutting down of entity A's factories because of noncompliance with regulations. Entity A is a going concern. 8. The accounting standards used in the Philippines are the same as the standards used internationally. 9. The conceptual framework is a standard. 10. According to the materiality concept, an item that is considered material by one business is considered material by all other businesses. PROBLEM 2: TRUE OR FALSE 1. Entity B is going out of business because its business owner lost all the money I the casino. Entity B is going concern. 2. A purpose of the separate entity concept is to report a true and fair picture of business financial affairs. 3. The accountant of Entity A, a big corporation, rounded-off amounts in the financial statements into nearest millions. This is an acceptable method of reporting because of the concept of materiality. 4. Consistency means like transactions must be accounted for in like manner. 5. The cost of processing and communicating financial information should exceed the expected benefits to be delivered from its use. 6. Information is considered material if its omission or misstatement could influence the decisions of financial statements users. 7. When reporting information in its financial statement, Entity A strives for a balance between detail and conciseness having in mind that neither too much detail nor too little information helps users make good decisions. This is an application of the accrual basis of accounting. 8. After becoming an accountant, Mr. A worked as an external auditor in one of the biggest auditing firms in our country. Two years later, an international auditing firm offered Mr. A,an external audit job abroad, which Mr. A accepted. Mr. A will be applying different accounting standards in his new job compared to those that he has applied in his previous job. 9. The process of establishing international accounting standards (on which the accounting standards used in the Philippines are based) sa democratic process in that a majority of practicing accountants around the world must agree with a standard before it becomes implemented

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts