Question: intangible Long-Terrmi Assets Instructions Intangible Long-Term Assets 1. Using the straight-line method, calculate the amortization of the patent, copyright, and Franchise. 2. Prepare general journal

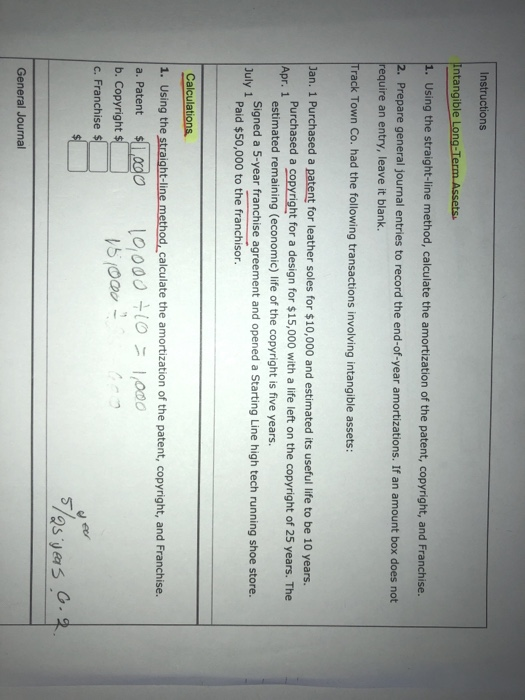

Instructions Intangible Long-Term Assets 1. Using the straight-line method, calculate the amortization of the patent, copyright, and Franchise. 2. Prepare general journal entries to record the end-of-year amortizations. If an amount box does not require an entry, leave it blank. Track Town Co. had the following transactions involving intangible assets: Jan. 1 Purchased a patent for leather soles for $10,000 and estimated its useful life to be 10 years. Purchased a copyright for a design for $15,000 with a life left on the copyright of 25 years. The Apr. 1 estimated remaining (economic) life of the copyright is five years. Signed a 5-year franchise agreement and opened a Starting Line high tech running shoe store. July 1 Paid $50,000 to the franchisor. Calculations 1. Using the straight-line method, calculate the amortization of the patent, copyright, and Franchise. $L.cdo b. Copyright $ 10000 +10 = 1o00 51000 a. Patent C. Franchise $ General Journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts