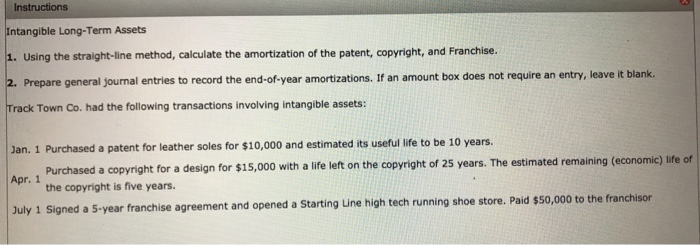

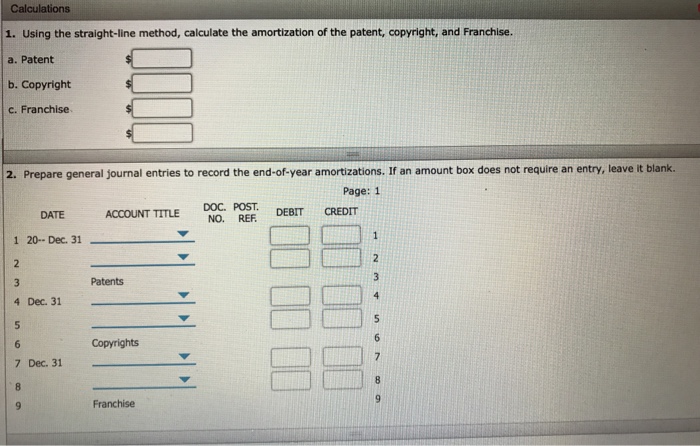

Question: Instructions Intangible Long-Term Assets 1. Using the straight-line method, calculate the amortization of the patent, copyright, and Franchise. leave it blank. 2. Prepare general journal

Instructions Intangible Long-Term Assets 1. Using the straight-line method, calculate the amortization of the patent, copyright, and Franchise. leave it blank. 2. Prepare general journal entries to record the end-of-year amortizations. If an amount box does not require an entry, Track Town Co. had the following transactions involving intangible assets: Jan. 1 Purchased a patent for leather soles for $10,000 and estimated its useful life to be 10 years Apr. 1 July 1 Signed a 5-year franchise agreement and opened a Purchased a copyright for a design for $15,000 with a life left on the copyright of 25 years. The estimated remaining (economic) life of the copyright is five years. 50,000 to the franchisor Starting Line high tech running shoe store. Paid $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts