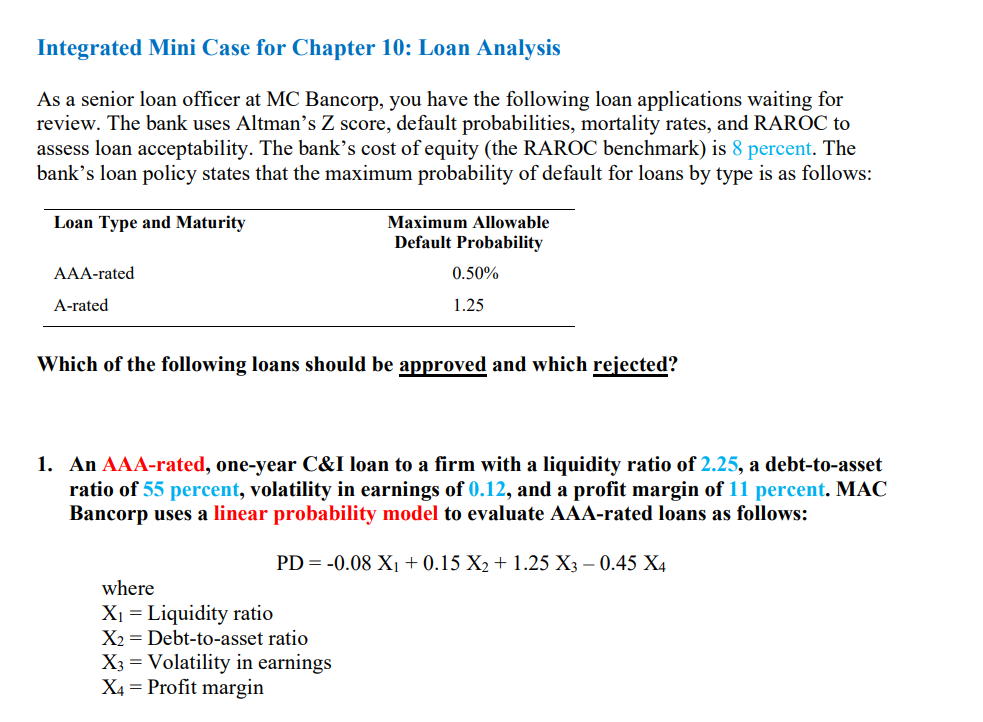

Question: Integrated Mini Case for Chapter 1 0 : Loan Analysis As a senior loan officer at MC Bancorp, you have the following loan applications waiting

Integrated Mini Case for Chapter : Loan Analysis

As a senior loan officer at MC Bancorp, you have the following loan applications waiting for

review. The bank uses Altman's Z score, default probabilities, mortality rates, and RAROC to

assess loan acceptability. The bank's cost of equity the RAROC benchmark is percent. The

bank's loan policy states that the maximum probability of default for loans by type is as follows:

Which of the following loans should be approved and which rejected?

An AAArated, oneyear C&I loan to a firm with a liquidity ratio of a debttoasset

ratio of percent, volatility in earnings of and a profit margin of percent. MAC

Bancorp uses a linear probability model to evaluate AAArated loans as follows:

where

Liquidity ratio

Debttoasset ratio

Volatility in earnings

Profit margin

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock