Question: Integrated Mini Case for Chapter 1 0 : Loan Analysis As a senior loan officer at MC Bancorp, you have the following loan applications waiting

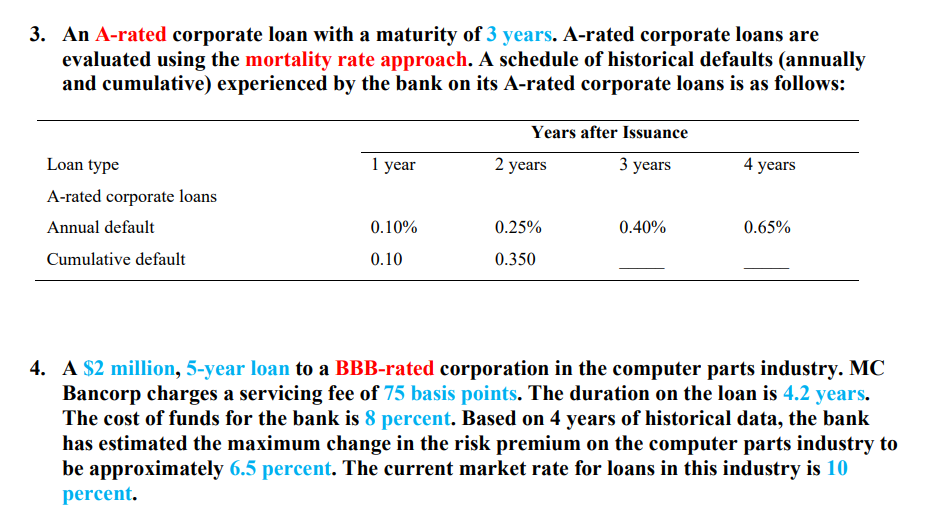

Integrated Mini Case for Chapter : Loan Analysis As a senior loan officer at MC Bancorp, you have the following loan applications waiting for review. The bank uses Altmans Z score, default probabilities, mortality rates, and RAROC to assess loan acceptability. The banks cost of equity the RAROC benchmark is percent. The banks loan policy states thatWhich of the following loans should be approved and which rejected? the maximum probability of default for loans by type is as follows:Which of the following loans should be approved and which rejected An AAArated, oneyear C&I loan to a firm with a liquidity ratio of a debttoasset ratio of percent, volatility in earnings of and a profit margin of percent. MAC Bancorp uses a linear probability model to evaluate AAArated loans as

follows:

PD X X X X

where X Liquidity ratio

X Debttoasset ratio

X Volatility in earnings

X Profit margin"?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock