Question: Intel produces a moderate performance CDMA chip that competes with Qualcomm at the low end of the telecommunications market. Intel is gearing up to market

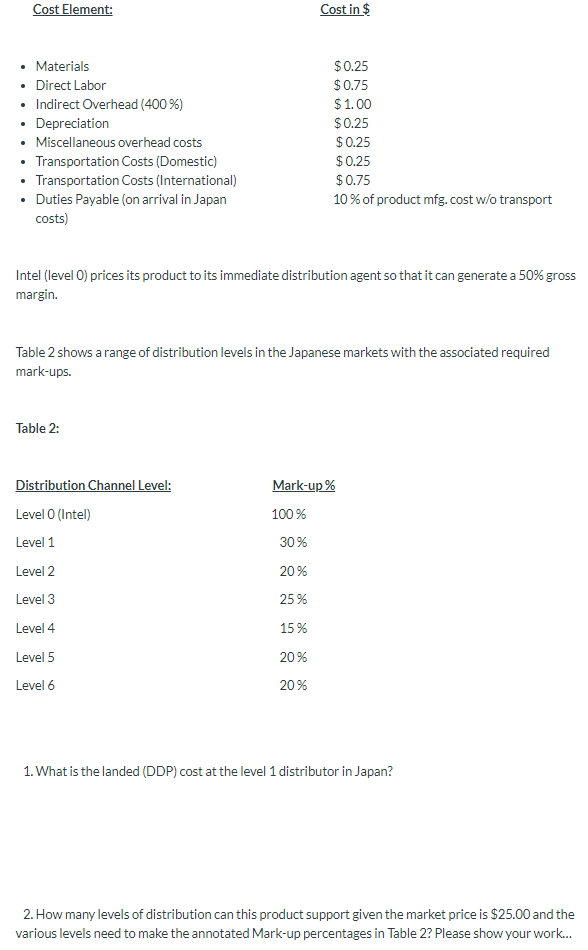

Intel produces a moderate performance CDMA chip that competes with Qualcomm at the low end of the telecommunications market. Intel is gearing up to market the chip in Japan where distribution channels are known to be long and complex. For purposes of determining product cost and transfer pricing, Intel uses fully burdened cost-plus pricing. Assume Intel covers all transportation and import / export expenditures to the customers dock (DDP). Table 1 shows selected cost information for the product:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts