Question: You are about to read a short case exploring global trade in semiconductors. Demand for semiconductor chips has soared in recent years and is expected

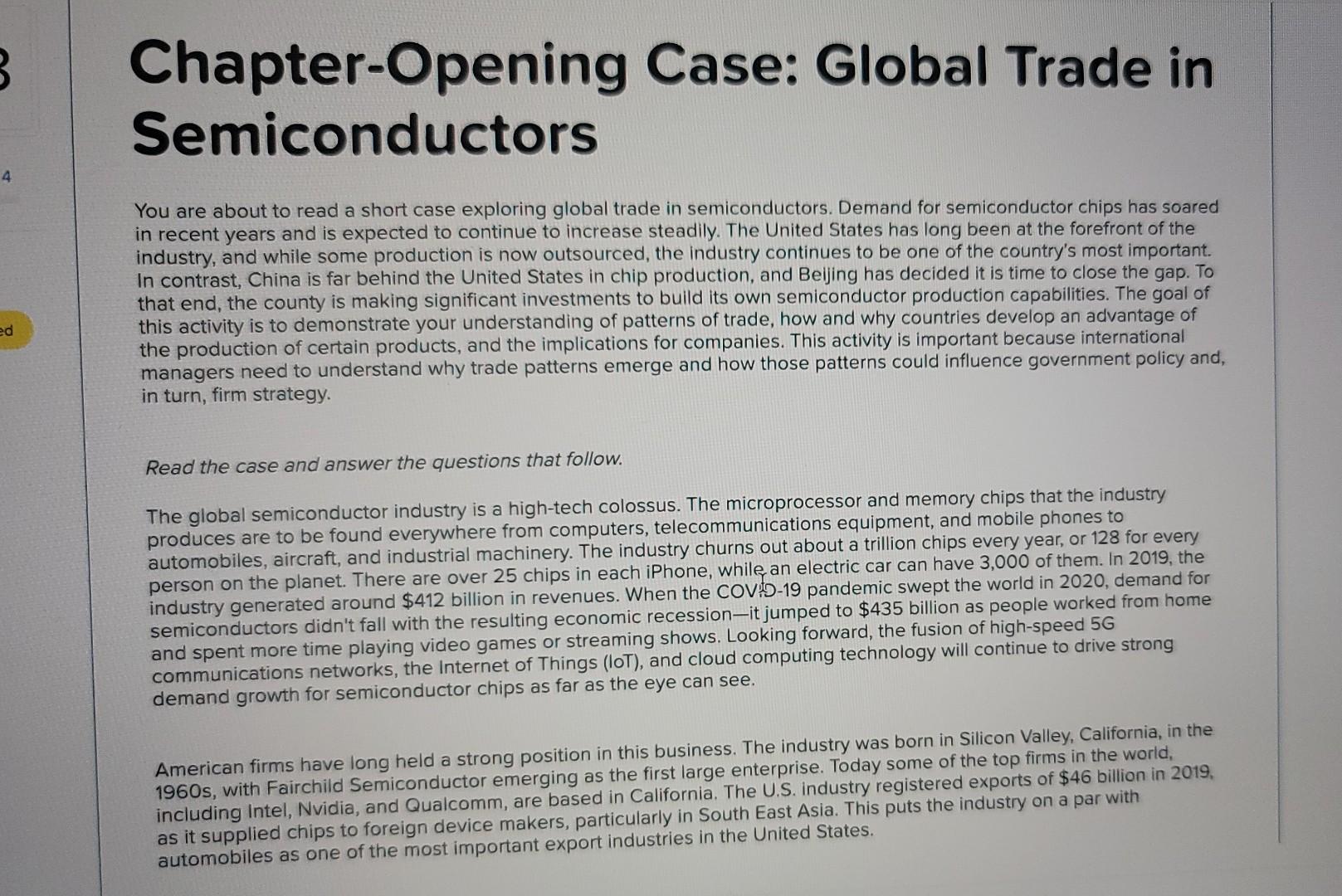

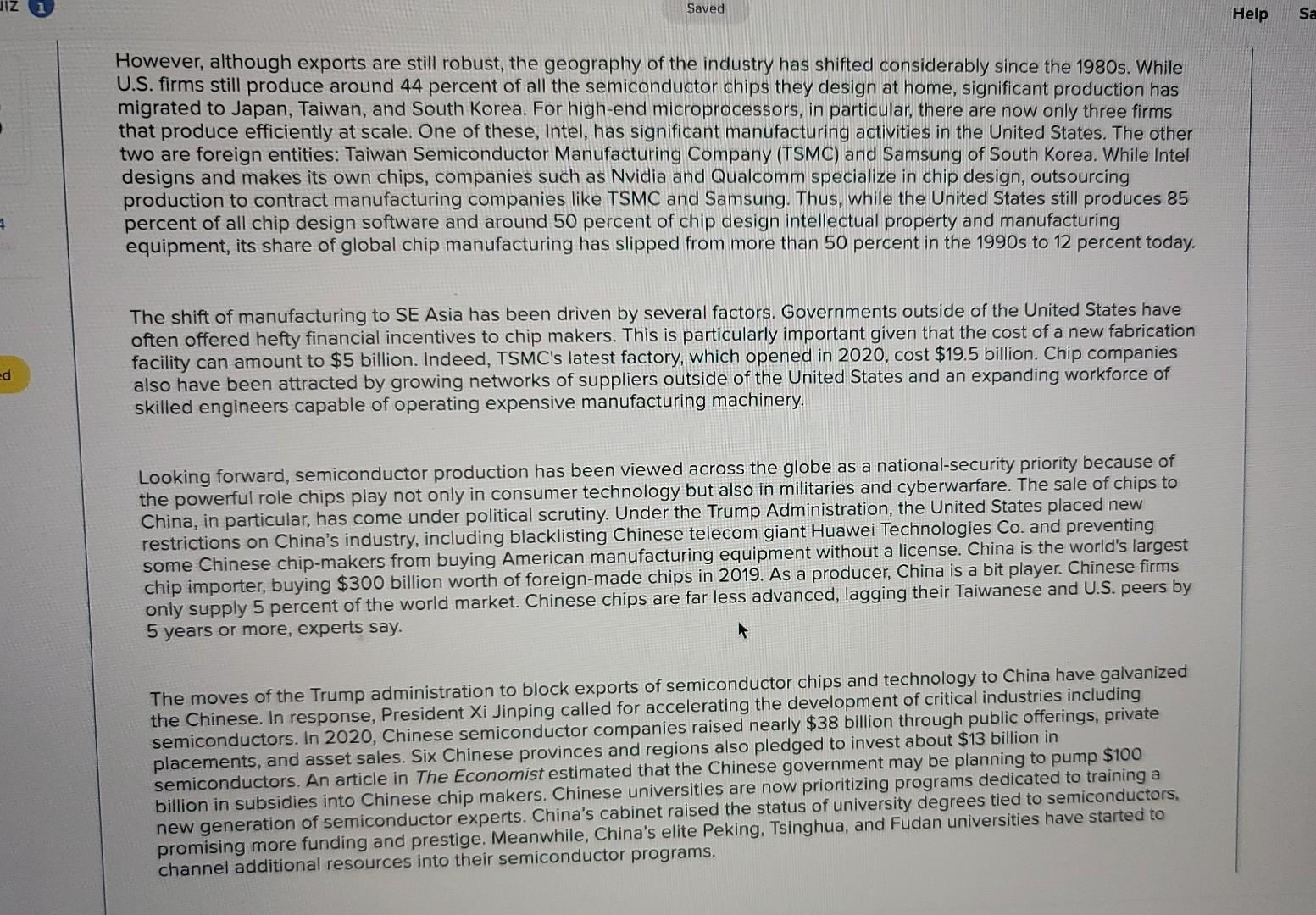

You are about to read a short case exploring global trade in semiconductors. Demand for semiconductor chips has soared in recent years and is expected to continue to increase steadily. The United States has long been at the forefront of the industry, and while some production is now outsourced, the industry continues to be one of the country's most important. In contrast, China is far behind the United States in chip production, and Beijing has decided it is time to close the gap. To that end, the county is making significant investments to build its own semiconductor production capabilities. The goal of this activity is to demonstrate your understanding of patterns of trade, how and why countries develop an advantage of the production of certain products, and the implications for companies. This activity is important because international managers need to understand why trade patterns emerge and how those patterns could influence government policy and, in turn, firm strategy. Read the case and answer the questions that follow. The global semiconductor industry is a high-tech colossus. The microprocessor and memory chips that the industry produces are to be found everywhere from computers, telecommunications equipment, and mobile phones to automobiles, aircraft, and industrial machinery. The industry churns out about a trillion chips every year, or 128 for every person on the planet. There are over 25 chips in each iPhone, while an electric car can have 3,000 of them. In 2019 , the industry generated around $412 billion in revenues. When the COV $19 pandemic swept the world in 2020 , demand for semiconductors didn't fall with the resulting economic recession-it jumped to $435 billion as people worked from home and spent more time playing video games or streaming shows. Looking forward, the fusion of high-speed 5G communications networks, the Internet of Things (loT), and cloud computing technology will continue to drive strong demand growth for semiconductor chips as far as the eye can see. American firms have long held a strong position in this business. The industry was born in Silicon Valley, California, in the 1960 s, with Fairchild Semiconductor emerging as the first large enterprise. Today some of the top firms in the world, including Intel, Nvidia, and Qualcomm, are based in California. The U.S. industry registered exports of $46 billion in 2019 , as it supplied chips to foreign device makers, particularly in South East Asia. This puts the industry on a par with automobiles as one of the most important export industries in the United States. However, although exports are still robust, the geography of the industry has shifted considerably since the 1980 s. While U.S. firms still produce around 44 percent of all the semiconductor chips they design at home, significant production has migrated to Japan, Taiwan, and South Korea. For high-end microprocessors, in particular, there are now only three firms that produce efficiently at scale. One of these, Intel, has significant manufacturing activities in the United States. The other two are foreign entities: Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung of South Korea. While Intel designs and makes its own chips, companies such as Nvidia and Qualcomm specialize in chip design, outsourcing production to contract manufacturing companies like TSMC and Samsung. Thus, while the United States still produces 85 percent of all chip design software and around 50 percent of chip design intellectual property and manufacturing equipment, its share of global chip manufacturing has slipped from more than 50 percent in the 1990 s to 12 percent today. The shift of manufacturing to SE Asia has been driven by several factors. Governments outside of the United States have often offered hefty financial incentives to chip makers. This is particularly important given that the cost of a new fabrication facility can amount to $5 billion. Indeed, TSMC's latest factory, which opened in 2020 , cost $19.5 billion. Chip companies also have been attracted by growing networks of suppliers outside of the United States and an expanding workforce of skilled engineers capable of operating expensive manufacturing machinery. Looking forward, semiconductor production has been viewed across the globe as a national-security priority because of the powerful role chips play not only in consumer technology but also in militaries and cyberwarfare. The sale of chips to China, in particular, has come under political scrutiny. Under the Trump Administration, the United States placed new restrictions on China's industry, including blacklisting Chinese telecom giant Huawei Technologies Co. and preventing some Chinese chip-makers from buying American manufacturing equipment without a license. China is the world's largest chip importer, buying $300 billion worth of foreign-made chips in 2019 . As a producer, China is a bit player. Chinese firms only supply 5 percent of the world market. Chinese chips are far less advanced, lagging their Taiwanese and U.S. peers by 5 years or more, experts say. The moves of the Trump administration to block exports of semiconductor chips and technology to China have galvanized the Chinese. In response, President Xi Jinping called for accelerating the development of critical industries including semiconductors. In 2020 , Chinese semiconductor companies raised nearly $38 billion through public offerings, private placements, and asset sales. Six Chinese provinces and regions also pledged to invest about $13 billion in semiconductors. An article in The Economist estimated that the Chinese government may be planning to pump $100 billion in subsidies into Chinese chip makers. Chinese universities are now prioritizing programs dedicated to training a new generation of semiconductor experts. China's cabinet raised the status of university degrees tied to semiconductors, promising more funding and prestige. Meanwhile, China's elite Peking. Tsinghua, and Fudan universities have started to channel additional resources into their semiconductor programs. 7c. Many of the top chip-producing firms in the world are... Many of the top chip-producing firms in the world are located in California's Silicon Valley, and the semiconductor industry is one of the most impor export industries for the United States. This suggests Multiple Choice the United States should use government policy to protect its chip industry. the United States has a monopoly in chip production. the United States has a competitive disadvantage in the production of chips. the United States is dependent on the chip industry. 7d. U.S. exports of semiconductor chips to China are... U.S. exports of semiconductor chips to China are recorded in the of the U.S. balance of payments. Multiple Choice capital account financial account ordinary export account international account current account

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock