Question: Interest capitalization question On July 1, 2012, Bashful Co. contracts with Doc Co. to build Bashful's new factory. Doc began work immediately on the factory

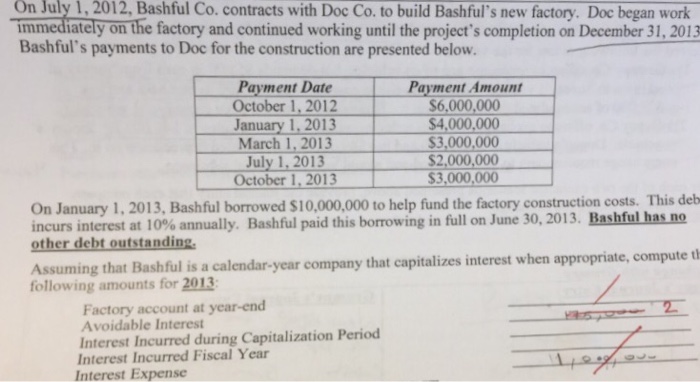

On July 1, 2012, Bashful Co. contracts with Doc Co. to build Bashful's new factory. Doc began work immediately on the factory and continued working until the project's completion on December 31, 2013 Bashful's payments to Doc for the construction are presented below. Payment Date October 1,2012 January 1, 2013 March 1, 2013 July 1, 2013 October 1, 2013 Payment Amount $6,000,000 $4,000,000 $3,000,000 $2,000,000 S3,000,000 On January 1, 2013, Bashful borrowed $10,000,000 to help fund the factory construction costs. This deb incurs interest at 10% annually. Bashful paid this borrowing in full on June 30, 2013, Bashful hasno other debt outstanding r company that capitalizes interest when appropriate, compute th following amounts for 2013 Factory account at year-end Avoidable Interest Interest Incurred during Capitalization Period Interest Incurred Fiscal Year Interest Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts