Question: Interest Rate Parity Suppose that on a given date the exchange rate between the US dollar and Japanese Yen is 100 JPY/USD, meaning 100 Japanese

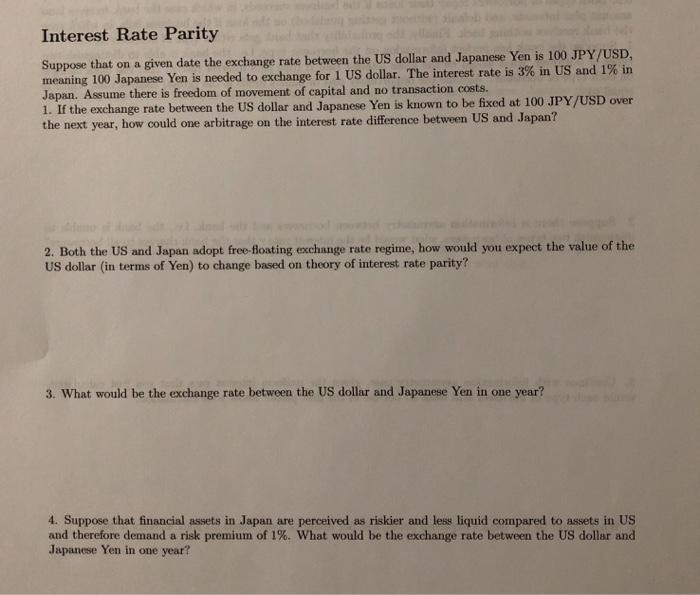

Interest Rate Parity Suppose that on a given date the exchange rate between the US dollar and Japanese Yen is 100 JPY/USD, meaning 100 Japanese Yen is needed to exchange for 1 US dollar. The interest rate is 3% in US and 1% in Japan. Assume there is freedom of movement of capital and no transaction costs. 1. If the exchange rate between the US dollar and Japanese Yen is known to be fixed at 100 JPY/USD over the next year, how could one arbitrage on the interest rate difference between US and Japan? 2. Both the US and Japan adopt free-floating exchange rate regime, how would you expect the value of the US dollar (in terms of Yen) to change based on theory of interest rate parity? 3. What would be the exchange rate between the US dollar and Japanese Yen in one year? 4. Suppose that financial assets in Japan are perceived as riskier and less liquid compared to assets in US and therefore demand a risk premium of 1%. What would be the exchange rate between the US dollar and Japanese Yen in one year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts