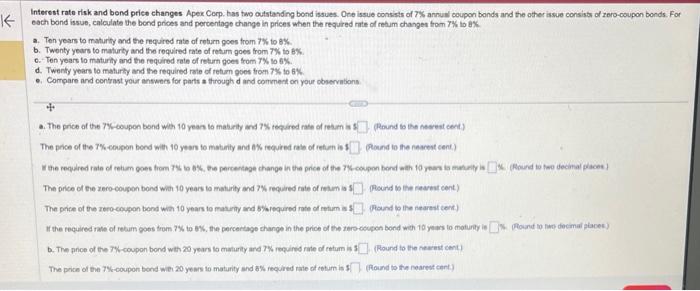

Question: Interest rate risk and bond priee changes Apex Corp. has two outstanding bond issues. Oee issue consists of 7% annuw coupon bonds and the other

Interest rate risk and bond priee changes Apex Corp. has two outstanding bond issues. Oee issue consists of 7% annuw coupon bonds and the other issue consistr of zero-coupon bonds. For each bond issue, calculate the bond prices and percentage change in prices when the requred rrite of rehum changet from 7% io 3%. a. Ten years to maturity and the required rate of return poes from 7% to 8%. b. Twenty years to maturty and the required rate of return goes from 7% to B%. c. Ten yoars to maturity and the required rate of retum goes trom 7% ow 6%. d. Twenty yoars to maturty and the required rate of retum goes from 7% to 6% -. Compare and contrast your answars for parts a through d and comvent on your observabons a. The price of the 7%-ooupon bond with 10 yean to mabirity and 7% tegired rate of ream is! Round to the hesest cent] The proe of the TWecupon bond with 10 yeare to matirity and a\% required rabe of retum is 5 (Pound io the nasest cent.) The price of tee zero-coupen bond with 10 years to maturity and 7% required eate of retum is 1 (Aourd be mene neareat cent) The price of the rero-coupon bond with 10 years to masuly ard sharequred rote of retum is (Plound bo the nearest cent) If the required rate of rehum gots trom 7% to 6%, the percertage change in the price of the tero ocupen bond weh 10 yeirs to moturity it b. The proe of the TW-coupon bond wth 20 years lo malurity and 7% repuines rule of retum in 3 (Round to the neasest cent) The price of the 7\%-coupon bond wiel 20 years to maturity and b\% required taie of cetum is 3 (Plound to the mearest cart)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts