Question: intermediate accounting. chapter 5. need help. 14 D 1 B Question One Part One 2 Pinch Spices, Inc. has excess unrestricted cash and has decided

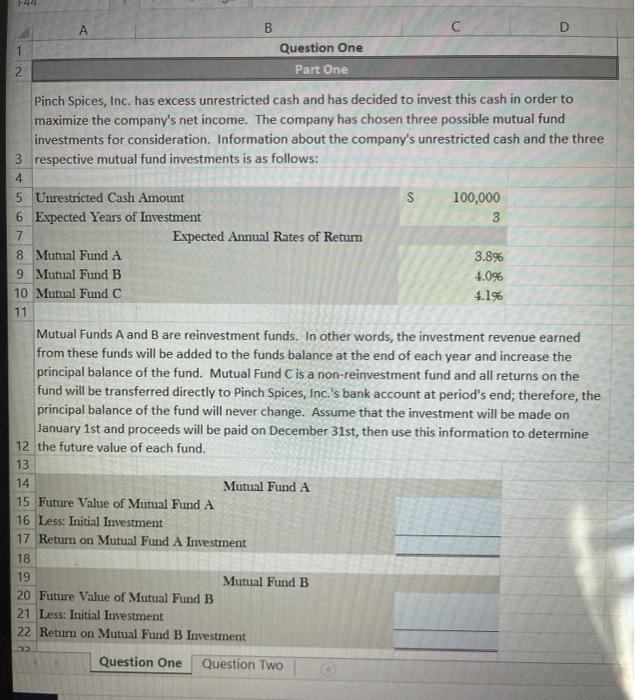

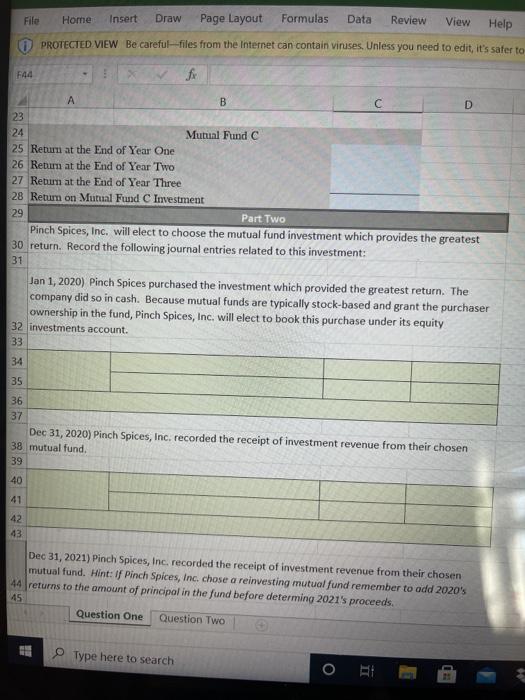

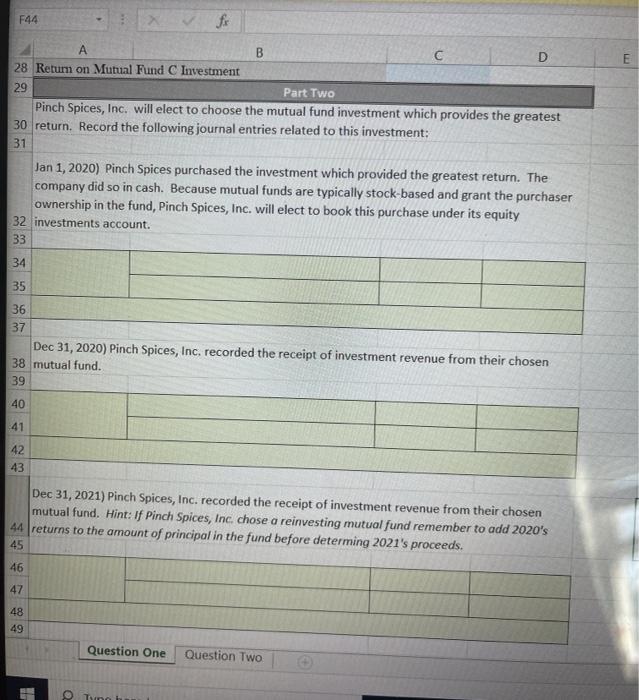

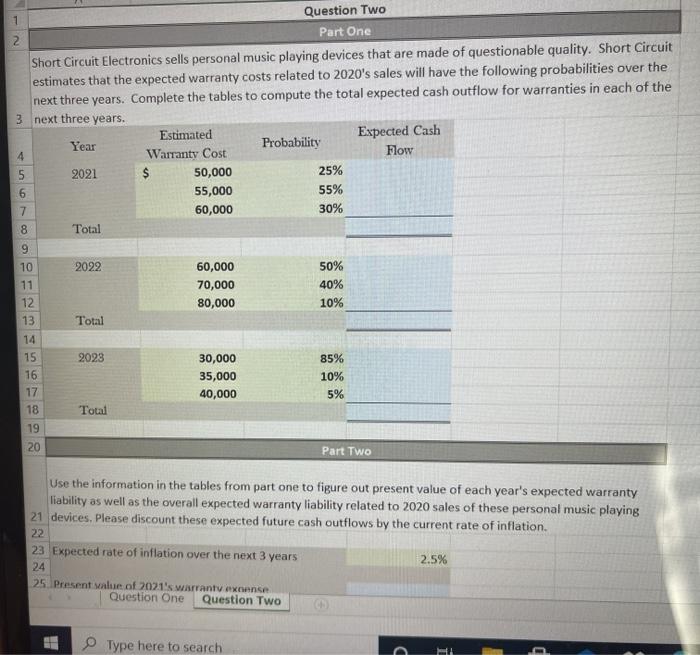

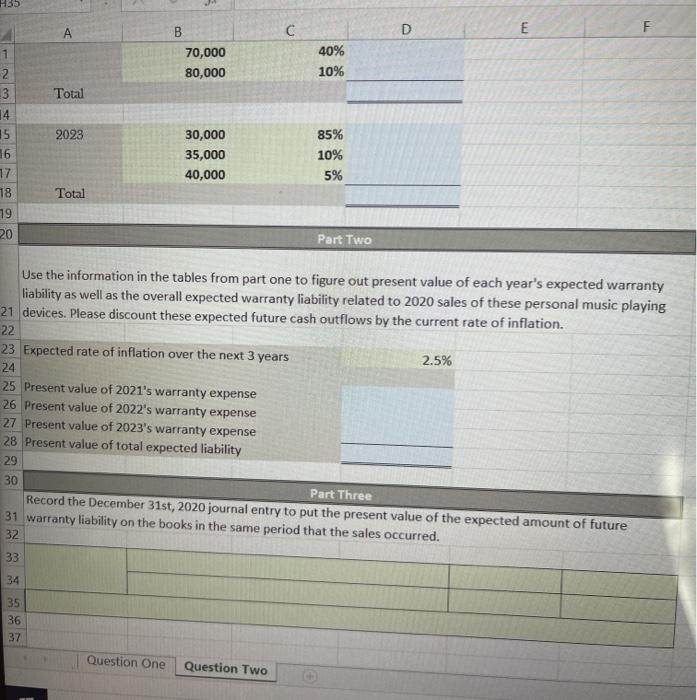

14 D 1 B Question One Part One 2 Pinch Spices, Inc. has excess unrestricted cash and has decided to invest this cash in order to maximize the company's net income. The company has chosen three possible mutual fund investments for consideration. Information about the company's unrestricted cash and the three 3 respective mutual fund investments is as follows: 4 S 100,000 3 5 Unrestricted Cash Amount 6 Expected Years of Investment 7 Expected Annual Rates of Return 8 Mutual Fund A 9 Mutual Fund B 10 Mutual Fund C 11 3.896 4.096 4.1% Mutual Funds A and B are reinvestment funds. In other words, the investment revenue earned from these funds will be added to the funds balance at the end of each year and increase the principal balance of the fund. Mutual Fund C is a non-reinvestment fund and all returns on the fund will be transferred directly to Pinch Spices, Inc.'s bank account at period's end; therefore, the principal balance of the fund will never change. Assume that the investment will be made on January 1st and proceeds will be paid on December 31st, then use this information to determine 12 the future value of each fund. 13 14 Mutual Fund A 15 Future Value of Mutual Fund A 16 Less: Initial Investment 17 Return on Mutual Fund A Investment 18 19 Mutual Fund B 20 Future Value of Mutual Fund B 21 Less: Initial Investment 22 Retum on Mutual Fund B Investment Question One Question Two File Home Insert Draw Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful--files from the Internet can contain viruses. Unless you need to edit, it's safer to F44 24 B D 23 Mutual Fund C 25 Return at the End of Year One 26 Return at the End of Year Two 27 Return at the End of Year Three 28 Retum on Mutual Fund C Investment 29 Part Two Pinch Spices, Inc. will elect to choose the mutual fund investment which provides the greatest 30 return. Record the following journal entries related to this investment: 31 Jan 1, 2020) Pinch Spices purchased the investment which provided the greatest return. The company did so in cash. Because mutual funds are typically stock-based and grant the purchaser ownership in the fund, Pinch Spices, Inc. will elect to book this purchase under its equity 32 investments account. 33 34 35 36 37 Dec 31, 2020) Pinch Spices, Inc. recorded the receipt of investment revenue from their chosen 38 mutual fund. 39 40 41 42 43 Dec 31, 2021) Pinch Spices, Inc. recorded the receipt of investment revenue from their chosen mutual fund. Hint: If Pinch Spices, Inc. chose a reinvesting mutual fund remember to add 2020's 44 returns to the amount of principal in the fund before determing 2021's proceeds. 45 Question One Question Two Type here to search F44 E B D 28 Return on Mutual Fund Investment 29 Part Two Pinch Spices, Inc. will elect to choose the mutual fund investment which provides the greatest 30 return. Record the following journal entries related to this investment: 31 Jan 1, 2020) Pinch Spices purchased the investment which provided the greatest return. The company did so in cash. Because mutual funds are typically stock-based and grant the purchaser ownership in the fund, Pinch Spices, Inc. will elect to book this purchase under its equity 32 investments account. 33 34 35 36 37 Dec 31, 2020) Pinch Spices, Inc. recorded the receipt of investment revenue from their chosen 38 mutual fund. 39 40 41 42 43 Dec 31, 2021) Pinch Spices, Inc. recorded the receipt of investment revenue from their chosen mutual fund. Hint: If Pinch Spices, Inc. chose a reinvesting mutual fund remember to add 2020's 44 returns to the amount of principal in the fund before determing 2021's proceeds. 45 46 47 48 49 Question One Question Two Tun 1 Question Two Part One Short Circuit Electronics sells personal music playing devices that are made of questionable quality. Short Circuit estimates that the expected warranty costs related to 2020's sales will have the following probabilities over the next three years. Complete the tables to compute the total expected cash outflow for warranties in each of the 3 next three years. Estimated Expected Cash Year Probability 4 Warranty Cost Flow 5 2021 $ 50,000 25% 6 55,000 55% 7 60,000 30% 8 Total 9 10 2022 60,000 50% 11 70,000 40% 12 80,000 10% 13 Total 14 15 2023 30,000 85% 16 35,000 10% 17 40,000 5% 18 Total 19 20 Part Two Use the information in the tables from part one to figure out present value of each year's expected warranty liability as well as the overall expected warranty liability related to 2020 sales of these personal music playing 21 devices. Please discount these expected future cash outflows by the current rate of inflation. 22 22 Expected rate of inflation over the next 3 years 2.5% 24 25 Present value of 2021's warranty excense Question One Question Two Type here to search C 1 H55 B D E F 70,000 80,000 40% 10% Total 2028 1 2 3 4 15 16 17 78 19 20 30,000 35,000 40,000 85% 10% 5% Total Part Two Use the information in the tables from part one to figure out present value of each year's expected warranty liability as well as the overall expected warranty liability related to 2020 sales of these personal music playing 21 devices. Please discount these expected future cash outflows by the current rate of inflation. 22 23 Expected rate of inflation over the next 3 years 2.5% 24 25 Present value of 2021's warranty expense 26 Present value of 2022's warranty expense 27 Present value of 2023's warranty expense 28 Present value of total expected liability 29 30 Part Three Record the December 31st, 2020 journal entry to put the present value of the expected amount of future 31 warranty liability on the books in the same period that the sales occurred. 32 33 34 35 36 37 Question One Question Two 14 D 1 B Question One Part One 2 Pinch Spices, Inc. has excess unrestricted cash and has decided to invest this cash in order to maximize the company's net income. The company has chosen three possible mutual fund investments for consideration. Information about the company's unrestricted cash and the three 3 respective mutual fund investments is as follows: 4 S 100,000 3 5 Unrestricted Cash Amount 6 Expected Years of Investment 7 Expected Annual Rates of Return 8 Mutual Fund A 9 Mutual Fund B 10 Mutual Fund C 11 3.896 4.096 4.1% Mutual Funds A and B are reinvestment funds. In other words, the investment revenue earned from these funds will be added to the funds balance at the end of each year and increase the principal balance of the fund. Mutual Fund C is a non-reinvestment fund and all returns on the fund will be transferred directly to Pinch Spices, Inc.'s bank account at period's end; therefore, the principal balance of the fund will never change. Assume that the investment will be made on January 1st and proceeds will be paid on December 31st, then use this information to determine 12 the future value of each fund. 13 14 Mutual Fund A 15 Future Value of Mutual Fund A 16 Less: Initial Investment 17 Return on Mutual Fund A Investment 18 19 Mutual Fund B 20 Future Value of Mutual Fund B 21 Less: Initial Investment 22 Retum on Mutual Fund B Investment Question One Question Two File Home Insert Draw Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful--files from the Internet can contain viruses. Unless you need to edit, it's safer to F44 24 B D 23 Mutual Fund C 25 Return at the End of Year One 26 Return at the End of Year Two 27 Return at the End of Year Three 28 Retum on Mutual Fund C Investment 29 Part Two Pinch Spices, Inc. will elect to choose the mutual fund investment which provides the greatest 30 return. Record the following journal entries related to this investment: 31 Jan 1, 2020) Pinch Spices purchased the investment which provided the greatest return. The company did so in cash. Because mutual funds are typically stock-based and grant the purchaser ownership in the fund, Pinch Spices, Inc. will elect to book this purchase under its equity 32 investments account. 33 34 35 36 37 Dec 31, 2020) Pinch Spices, Inc. recorded the receipt of investment revenue from their chosen 38 mutual fund. 39 40 41 42 43 Dec 31, 2021) Pinch Spices, Inc. recorded the receipt of investment revenue from their chosen mutual fund. Hint: If Pinch Spices, Inc. chose a reinvesting mutual fund remember to add 2020's 44 returns to the amount of principal in the fund before determing 2021's proceeds. 45 Question One Question Two Type here to search F44 E B D 28 Return on Mutual Fund Investment 29 Part Two Pinch Spices, Inc. will elect to choose the mutual fund investment which provides the greatest 30 return. Record the following journal entries related to this investment: 31 Jan 1, 2020) Pinch Spices purchased the investment which provided the greatest return. The company did so in cash. Because mutual funds are typically stock-based and grant the purchaser ownership in the fund, Pinch Spices, Inc. will elect to book this purchase under its equity 32 investments account. 33 34 35 36 37 Dec 31, 2020) Pinch Spices, Inc. recorded the receipt of investment revenue from their chosen 38 mutual fund. 39 40 41 42 43 Dec 31, 2021) Pinch Spices, Inc. recorded the receipt of investment revenue from their chosen mutual fund. Hint: If Pinch Spices, Inc. chose a reinvesting mutual fund remember to add 2020's 44 returns to the amount of principal in the fund before determing 2021's proceeds. 45 46 47 48 49 Question One Question Two Tun 1 Question Two Part One Short Circuit Electronics sells personal music playing devices that are made of questionable quality. Short Circuit estimates that the expected warranty costs related to 2020's sales will have the following probabilities over the next three years. Complete the tables to compute the total expected cash outflow for warranties in each of the 3 next three years. Estimated Expected Cash Year Probability 4 Warranty Cost Flow 5 2021 $ 50,000 25% 6 55,000 55% 7 60,000 30% 8 Total 9 10 2022 60,000 50% 11 70,000 40% 12 80,000 10% 13 Total 14 15 2023 30,000 85% 16 35,000 10% 17 40,000 5% 18 Total 19 20 Part Two Use the information in the tables from part one to figure out present value of each year's expected warranty liability as well as the overall expected warranty liability related to 2020 sales of these personal music playing 21 devices. Please discount these expected future cash outflows by the current rate of inflation. 22 22 Expected rate of inflation over the next 3 years 2.5% 24 25 Present value of 2021's warranty excense Question One Question Two Type here to search C 1 H55 B D E F 70,000 80,000 40% 10% Total 2028 1 2 3 4 15 16 17 78 19 20 30,000 35,000 40,000 85% 10% 5% Total Part Two Use the information in the tables from part one to figure out present value of each year's expected warranty liability as well as the overall expected warranty liability related to 2020 sales of these personal music playing 21 devices. Please discount these expected future cash outflows by the current rate of inflation. 22 23 Expected rate of inflation over the next 3 years 2.5% 24 25 Present value of 2021's warranty expense 26 Present value of 2022's warranty expense 27 Present value of 2023's warranty expense 28 Present value of total expected liability 29 30 Part Three Record the December 31st, 2020 journal entry to put the present value of the expected amount of future 31 warranty liability on the books in the same period that the sales occurred. 32 33 34 35 36 37 Question One Question Two

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts