Question: Intermediate Accounting | Intermediate Accounting by c Get Homework Help With SPUS04 - An200408125 X C Get Homework Help With C C Intermediate Accounting |

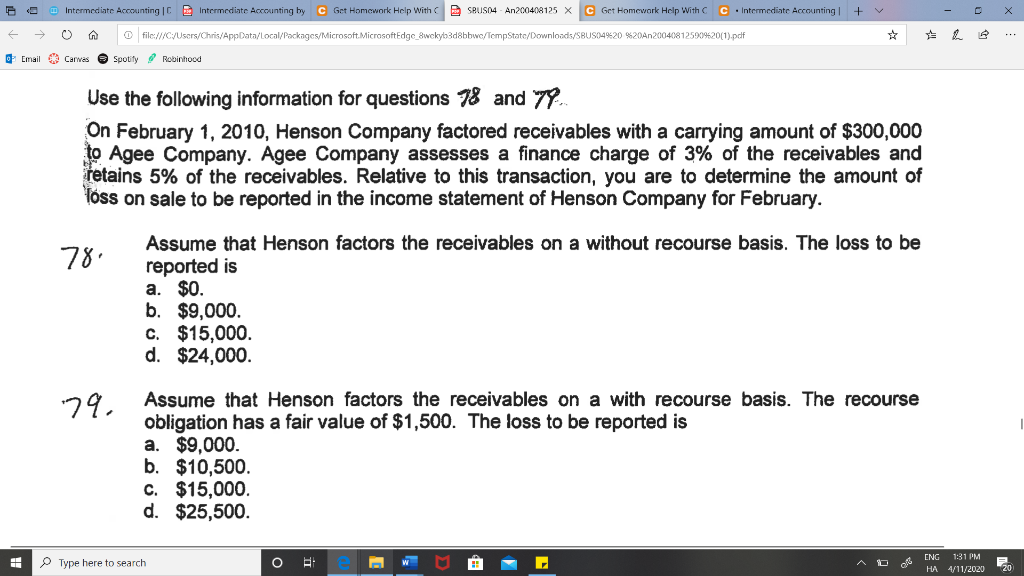

Intermediate Accounting | Intermediate Accounting by c Get Homework Help With SPUS04 - An200408125 X C Get Homework Help With C C Intermediate Accounting | + - X E 0 file:///C/Users/Chris/AppData/local/Packages/Microsoft MicrosoftEdge_8wckyb3d8bbwc/TempState/Downloads/SBUS04%20%20An 20040812590%20(1).pdf Email Carnes Spotify Robinhood ables with a carory of the receivamount of Use the following information for questions 78 and 79 On February 1, 2010, Henson Company factored receivables with a carrying amount of $300,000 to Agee Company. Agee Company assesses a finance charge of 3% of the receivables and retains 5% of the receivables. Relative to this transaction, you are to determine the amount of loss on sale to be reported in the income statement of Henson Company for February. 78 Assume that Henson factors the receivables on a without recourse basis. The loss to be reported is a. $0. b. $9,000. C. $15,000. d. $24,000. 79. Assume that Henson factors the receivables on a with recourse basis. The recourse obligation has a fair value of $1,500. The loss to be reported is a. $9,000. b. $10,500. c. $15,000. d. $25,500. : Type here to search o e W M ENG 131 PM HA 4/11/202020 Intermediate Accounting | Intermediate Accounting by Get Homework Help With C seus04 - An200408125 C Get Homework Help With C at the close of its first year + - X E 0 file:///C/Users/Chris/AppData/local/Packages/Microsoft MicrosoftEdge_8wckyb3d8bbwc/TempState/Downloads/SBUS04%20%20An 20040812590%20(1).pdf Email Carwas Spotify Robinhood C. $15,000. d. $24,000. 79, Assume that Henson factors the receivables on a with recourse basis. The recours obligation has a fair value of $1,500. The loss to be reported is a. $9,000. b. $10,500. c. $15,000. d. $25,500. Type here to search O e AD ING 1:16 PM HA 4/11/202020 Intermediate Accounting | Intermediate Accounting by c Get Homework Help With SPUS04 - An200408125 X C Get Homework Help With C C Intermediate Accounting | + - X E 0 file:///C/Users/Chris/AppData/local/Packages/Microsoft MicrosoftEdge_8wckyb3d8bbwc/TempState/Downloads/SBUS04%20%20An 20040812590%20(1).pdf Email Carnes Spotify Robinhood ables with a carory of the receivamount of Use the following information for questions 78 and 79 On February 1, 2010, Henson Company factored receivables with a carrying amount of $300,000 to Agee Company. Agee Company assesses a finance charge of 3% of the receivables and retains 5% of the receivables. Relative to this transaction, you are to determine the amount of loss on sale to be reported in the income statement of Henson Company for February. 78 Assume that Henson factors the receivables on a without recourse basis. The loss to be reported is a. $0. b. $9,000. C. $15,000. d. $24,000. 79. Assume that Henson factors the receivables on a with recourse basis. The recourse obligation has a fair value of $1,500. The loss to be reported is a. $9,000. b. $10,500. c. $15,000. d. $25,500. : Type here to search o e W M ENG 131 PM HA 4/11/202020 Intermediate Accounting | Intermediate Accounting by Get Homework Help With C seus04 - An200408125 C Get Homework Help With C at the close of its first year + - X E 0 file:///C/Users/Chris/AppData/local/Packages/Microsoft MicrosoftEdge_8wckyb3d8bbwc/TempState/Downloads/SBUS04%20%20An 20040812590%20(1).pdf Email Carwas Spotify Robinhood C. $15,000. d. $24,000. 79, Assume that Henson factors the receivables on a with recourse basis. The recours obligation has a fair value of $1,500. The loss to be reported is a. $9,000. b. $10,500. c. $15,000. d. $25,500. Type here to search O e AD ING 1:16 PM HA 4/11/202020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts