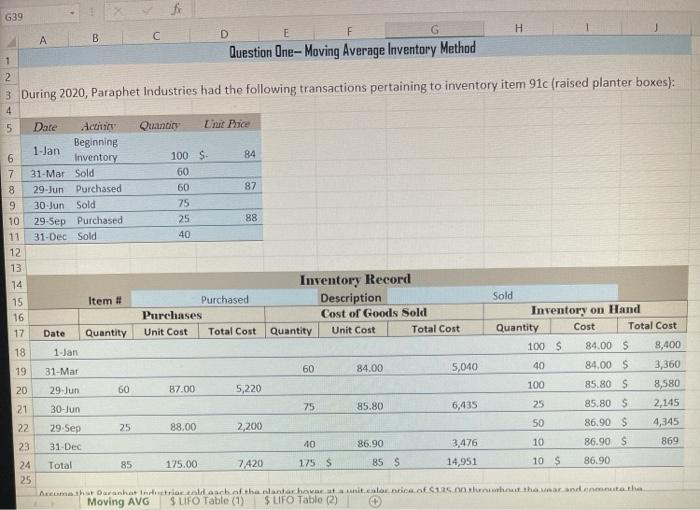

Question: Intermediate Accounting. need help with table 1/2. G39 B D E G H 1 Question One-- Moving Average Inventory Method 2 3. During 2020, Paraphet

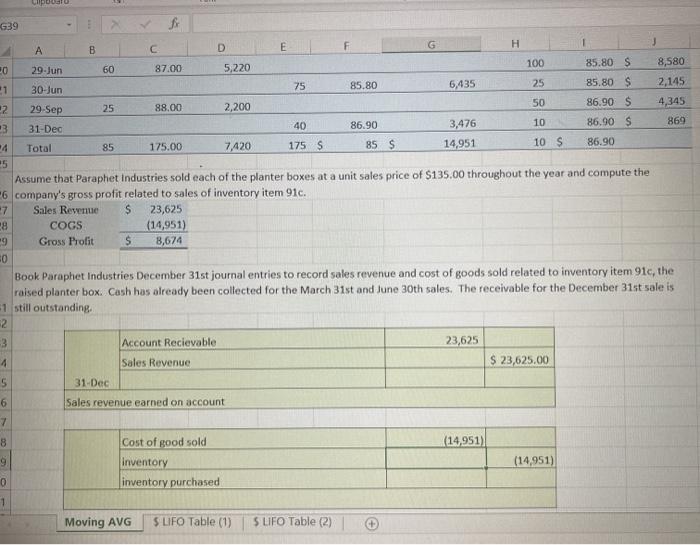

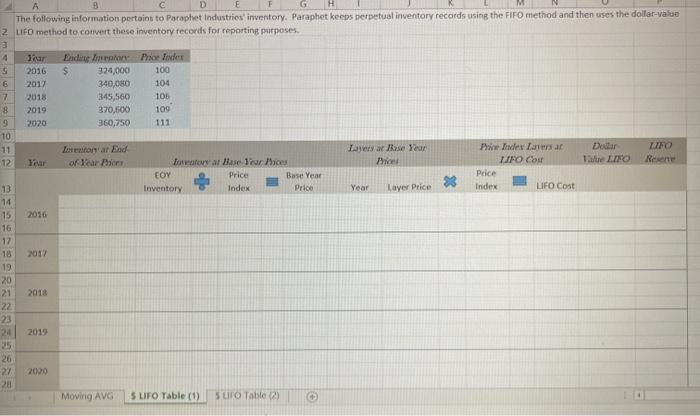

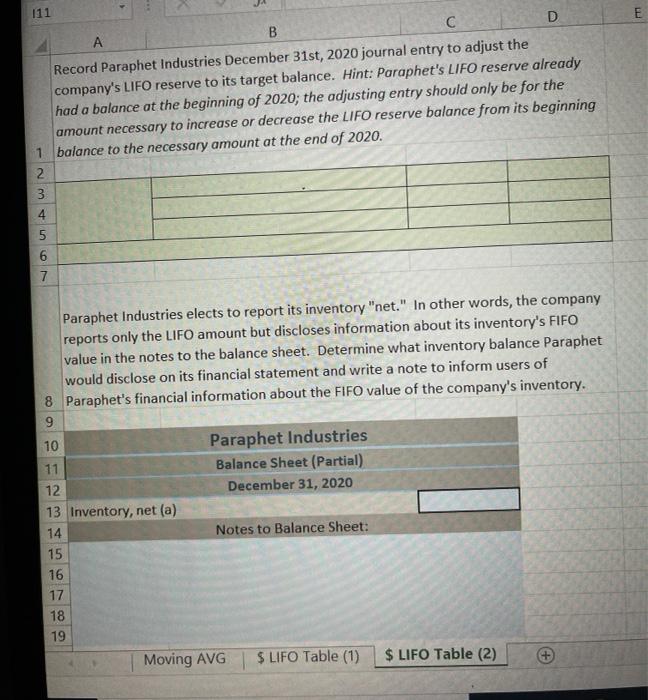

G39 B D E G H 1 Question One-- Moving Average Inventory Method 2 3. During 2020, Paraphet Industries had the following transactions pertaining to inventory item 91c (raised planter boxes): 4 5 Quantity Unit Price 84 Date Beginning 1-Jan Inventory 31-Mar Sold 29-Jun Purchased 30 Jun Sold 29-Sep Purchased 31-Dec Sold 6 7 8 9 10 11 12 13 14 87 100 S 60 60 75 25 40 88 Item # 15 16 17 Inventory Record Purchased Description Purchases Cost of Goods Sold Unit Cost Total Cost Quantity Unit Cost Total Cost Date Quantity 18 19 1-Jan 31-Mar 60 84.00 5,040 Sold Inventory on Hand Quantity Cost Total Cost 100 $ 84.00 $ 8,400 40 84.00 $ 3,360 100 85.80 S 8,580 25 85.80 $ 2,145 50 86.90 S 4,345 10 86.90 S 869 10 S 86.90 20 60 87.00 5,220 21 75 85.80 6,435 22 29-Jun 30-Jun 29 Sep 31-Dec Total 25 88.00 2,200 23 40 86.90 3,476 14,951 24 85 175.00 7.420 175 $ 85 $ 25 Arch Darahat restria anche aftalantar hava nitric 12. therandate the Moving AVG $LIFO Table (1) $ LIFO Tablo (2) poate G39 f B D E F G H 20 29-Jun 60 87.00 5,220 100 85.80 S 8,580 1 30-Jun 75 85.80 6,435 25 85.80 $ 2,145 2 29-Sep 25 88.00 2,200 50 86.90 $ 4,345 3 31-Dec 40 86.90 3,476 10 86.90 $ 869 Total 85 175.00 7,420 175 S 85 $ 14,951 10 S 86.90 15 Assume that Paraphet Industries sold each of the planter boxes at a unit sales price of $135.00 throughout the year and compute the 6 company's gross profit related to sales of inventory item 91c. -7 Sales Revenue S 23,625 28 COGS (14,951) *9 Gross Profit $ 8,674 0 Book Paraphet Industries December 31st journal entries to record sales revenue and cost of goods sold related to inventory item 91c, the raised planter box. Cash has already been collected for the March 31st and June 30th sales. The receivable for the December 31st sale is 1 still outstanding 2 3 Account Recievable 23,625 4 Sales Revenue $ 23,625.00 5 31-Dec 6 Sales revenue earned on account 7 8 (14,951) 9 Cost of good sold inventory inventory purchased (14,951) 0 1 Moving AVG $ LIFO Table (1) S LIFO Table (2) 8 D G The following information pertains to Paraphet Industries inventory. Paraphet keeps perpetual inventory records using the FIFO method and then uses the dollar-value 2 LIFO method to convert these inventory records for reporting purposes a 4 Bar idente Prender s 2016 $ 324,000 100 6 2012 340,080 104 7 2018 345,560 105 8 2019 370,600 100 9 2020 360,750 111 10 11 lorena End Lara Bose Tear Por Inderarters ar Dostlar LIFO 12 of Heart Tovar Base Bure Phi LIFO Cost Value LIFO Resente ECY Price Base Year Price 13 Inventory Index Price Year Layer Price 23 Index LIFO Cost 14 15 2016 16 17 18 2017 19 20 21 2018 22 23 2019 26 27 2020 Moving AVG 5 UFO Table (1) Suro Table (2) 111 E B A D C Record Paraphet Industries December 31st, 2020 journal entry to adjust the company's LIFO reserve to its target balance. Hint: Paraphet's LIFO reserve already had a balance at the beginning of 2020; the adjusting entry should only be for the amount necessary to increase or decrease the LIFO reserve balance from its beginning 1 balance to the necessary amount at the end of 2020. 2 3 2. 4 5 6 Paraphet Industries elects to report its inventory "net." In other words, the company reports only the LIFO amount but discloses information about its inventory's FIFO value in the notes to the balance sheet. Determine what inventory balance Paraphet would disclose on its financial statement and write a note to inform users of 8 Paraphet's financial information about the FIFO value of the company's inventory. 9 10 Paraphet Industries 11 Balance Sheet (Partial) 12 December 31, 2020 13 Inventory, net (a) 14 Notes to Balance Sheet: 15 16 17 18 19 Moving AVG $ LIFO Table (1) $ LIFO Table (2) G39 B D E G H 1 Question One-- Moving Average Inventory Method 2 3. During 2020, Paraphet Industries had the following transactions pertaining to inventory item 91c (raised planter boxes): 4 5 Quantity Unit Price 84 Date Beginning 1-Jan Inventory 31-Mar Sold 29-Jun Purchased 30 Jun Sold 29-Sep Purchased 31-Dec Sold 6 7 8 9 10 11 12 13 14 87 100 S 60 60 75 25 40 88 Item # 15 16 17 Inventory Record Purchased Description Purchases Cost of Goods Sold Unit Cost Total Cost Quantity Unit Cost Total Cost Date Quantity 18 19 1-Jan 31-Mar 60 84.00 5,040 Sold Inventory on Hand Quantity Cost Total Cost 100 $ 84.00 $ 8,400 40 84.00 $ 3,360 100 85.80 S 8,580 25 85.80 $ 2,145 50 86.90 S 4,345 10 86.90 S 869 10 S 86.90 20 60 87.00 5,220 21 75 85.80 6,435 22 29-Jun 30-Jun 29 Sep 31-Dec Total 25 88.00 2,200 23 40 86.90 3,476 14,951 24 85 175.00 7.420 175 $ 85 $ 25 Arch Darahat restria anche aftalantar hava nitric 12. therandate the Moving AVG $LIFO Table (1) $ LIFO Tablo (2) poate G39 f B D E F G H 20 29-Jun 60 87.00 5,220 100 85.80 S 8,580 1 30-Jun 75 85.80 6,435 25 85.80 $ 2,145 2 29-Sep 25 88.00 2,200 50 86.90 $ 4,345 3 31-Dec 40 86.90 3,476 10 86.90 $ 869 Total 85 175.00 7,420 175 S 85 $ 14,951 10 S 86.90 15 Assume that Paraphet Industries sold each of the planter boxes at a unit sales price of $135.00 throughout the year and compute the 6 company's gross profit related to sales of inventory item 91c. -7 Sales Revenue S 23,625 28 COGS (14,951) *9 Gross Profit $ 8,674 0 Book Paraphet Industries December 31st journal entries to record sales revenue and cost of goods sold related to inventory item 91c, the raised planter box. Cash has already been collected for the March 31st and June 30th sales. The receivable for the December 31st sale is 1 still outstanding 2 3 Account Recievable 23,625 4 Sales Revenue $ 23,625.00 5 31-Dec 6 Sales revenue earned on account 7 8 (14,951) 9 Cost of good sold inventory inventory purchased (14,951) 0 1 Moving AVG $ LIFO Table (1) S LIFO Table (2) 8 D G The following information pertains to Paraphet Industries inventory. Paraphet keeps perpetual inventory records using the FIFO method and then uses the dollar-value 2 LIFO method to convert these inventory records for reporting purposes a 4 Bar idente Prender s 2016 $ 324,000 100 6 2012 340,080 104 7 2018 345,560 105 8 2019 370,600 100 9 2020 360,750 111 10 11 lorena End Lara Bose Tear Por Inderarters ar Dostlar LIFO 12 of Heart Tovar Base Bure Phi LIFO Cost Value LIFO Resente ECY Price Base Year Price 13 Inventory Index Price Year Layer Price 23 Index LIFO Cost 14 15 2016 16 17 18 2017 19 20 21 2018 22 23 2019 26 27 2020 Moving AVG 5 UFO Table (1) Suro Table (2) 111 E B A D C Record Paraphet Industries December 31st, 2020 journal entry to adjust the company's LIFO reserve to its target balance. Hint: Paraphet's LIFO reserve already had a balance at the beginning of 2020; the adjusting entry should only be for the amount necessary to increase or decrease the LIFO reserve balance from its beginning 1 balance to the necessary amount at the end of 2020. 2 3 2. 4 5 6 Paraphet Industries elects to report its inventory "net." In other words, the company reports only the LIFO amount but discloses information about its inventory's FIFO value in the notes to the balance sheet. Determine what inventory balance Paraphet would disclose on its financial statement and write a note to inform users of 8 Paraphet's financial information about the FIFO value of the company's inventory. 9 10 Paraphet Industries 11 Balance Sheet (Partial) 12 December 31, 2020 13 Inventory, net (a) 14 Notes to Balance Sheet: 15 16 17 18 19 Moving AVG $ LIFO Table (1) $ LIFO Table (2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts