Question: intermediate accounting Shown below is the information needed to prepare the bank reconciliation for X Company at December 31, 2020 1. At December 31st, cash

intermediate accounting

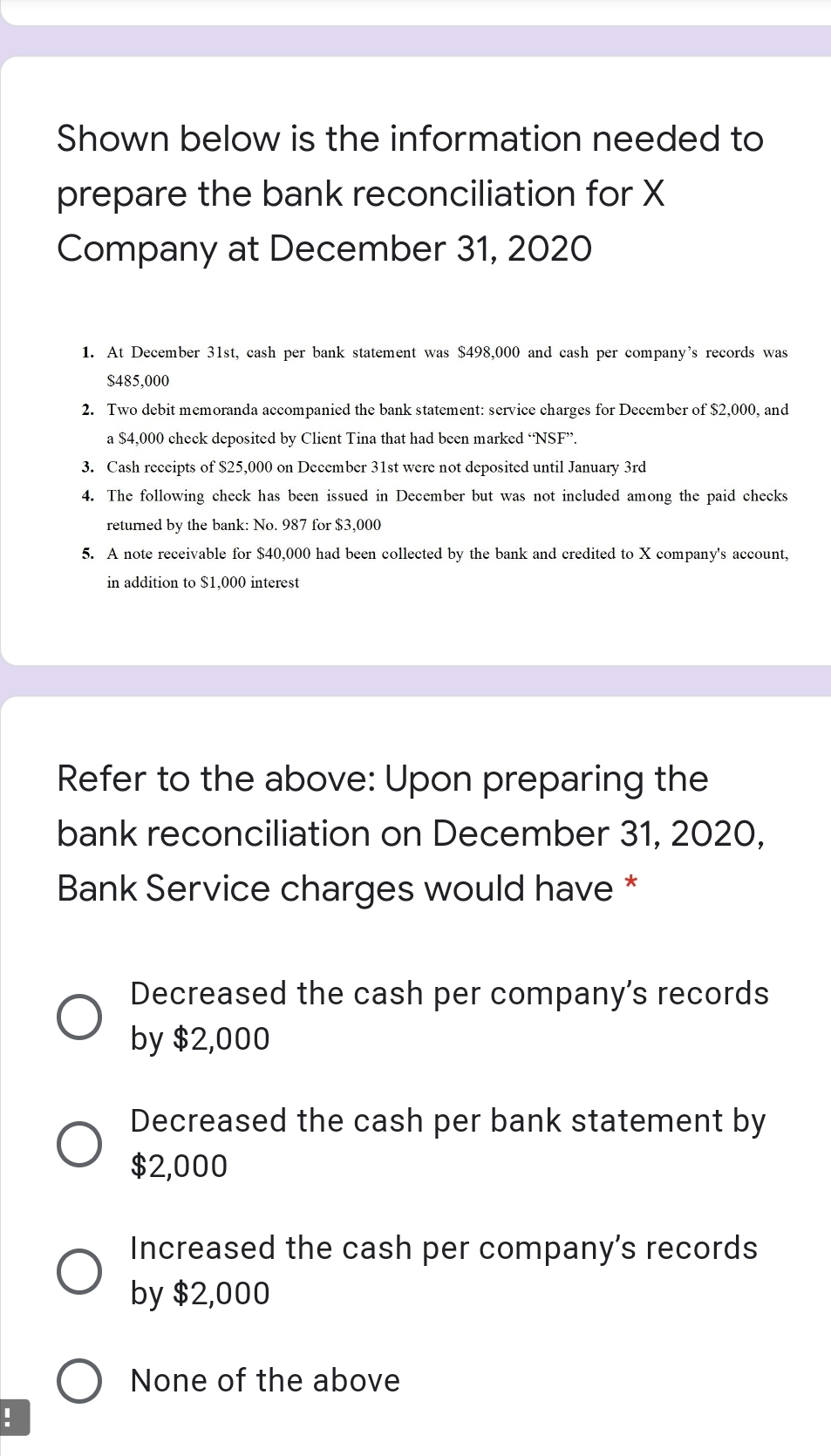

Shown below is the information needed to prepare the bank reconciliation for X Company at December 31, 2020 1. At December 31st, cash per bank statement was $498,000 and cash per company's records was $485,000 2. Two debit memoranda accompanied the bank statement: service charges for December of $2,000, and a $4,000 cheek deposited by Client Tina that had been marked \"NSF\". 3. Cash receipts of $25,000 on December 3 lst were not deposited until January 3rd 4. The following check has been issued in December but was not included among the paid cheeks returned by the bank: No. 987 for $3,000 5. A note receivable for $40,000 had been collected by the bank and credited to X company's account, in addition to $1,000 interest Refer to the above: Upon preparing the bank reconciliation on December 31, 2020, Bank Service charges would have * O Decreased the cash per company's records by $2,000 0 Decreased the cash per bank statement by $2,000 0 Increased the cash per company's records by $2,000 0 None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts