Question

O1) the following transaction are occurred in net solution campany:- A, Nov.1, 2012 chris clark deposited $ 25000 in bank account in the name

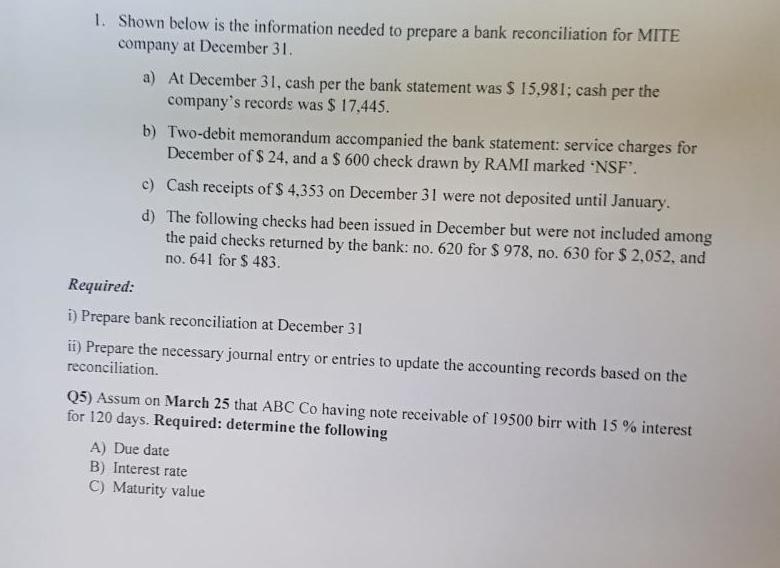

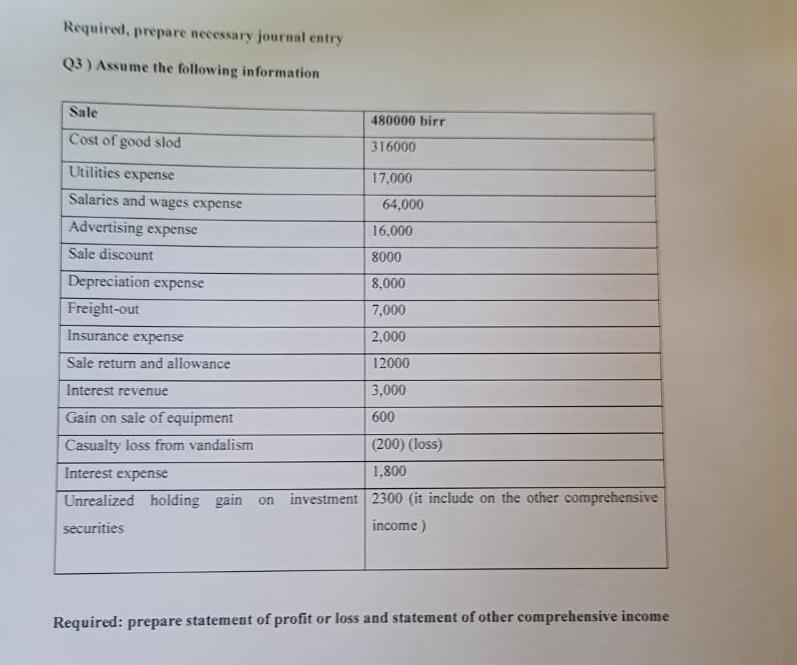

O1) the following transaction are occurred in net solution campany:- A, Nov.1, 2012 chris clark deposited $ 25000 in bank account in the name of net solution. B, Nov, 10, 2012 net solution paid $20000 for the purchase of land as a future building site. C, Nov, 10, 2012 net solution purchased supplied for $1350 and agreed to pay the supplier in the near future. D, Nov, 18, 2012 net solution received cash of $ 7500 for providing services to customers E. Nov 30, 2012 net solution paid the following expenses during the month wages, $2125, rent, 800, utilities, $450 miscellaneous expense, $275 F, Nov, 30, 2012, net solution pied creditors on account, $, 950 G, Nov, 30, 2012, chris clark determined that cost of supplies on hand at The end of the month was $, 550 H, Nov, 30, 2012, chris clark withdraw $2000 from net solution for personal use Required:-Seen the above transaction by tabular summery from (Accounting equation) and prepare income statement, owners' equity, balance sheet and statement of cash flow Q.2 Michelle Rodriguez started her own consulting firm, Rodriguez Consulting, on May 1, 2010. The following transactions occurred during the month of May. May 1 Michelle invested $7,000 cash in the business. 2 Paid $900 for office rent for the 2 month. 3 Purchased $600 of supplies on account. 5 Paid $125 to advertise in the County News. 9 Received $4,000 cash for services provided. 12 Withdrew $1,000 cash for personal use. 15 Performed $6,400 of services on account. 17 Paid $2,500 for employee salaries. 20 Paid for the supplies purchased on account on May 3. 23 Received a cash payment of S$4,000 for services provided on account on May 15. 26 Borrowed $5,000 from the bank on a note payable. 29 Purchased office equipment for $3,100 on account. 30 Paid $175 for utilities. 1. Shown below is the information needed to prepare a bank reconciliation for MITE company at December 31. a) At December 31, cash per the bank statement was $ 15,981; cash per the company's records was $ 17,445. b) Two-debit memorandum accompanied the bank statement: service charges for December of $ 24 , and a $ 600 check drawn by RAMI marked 'NSF. c) Cash receipts of $ 4,353 on December 31 were not deposited until January. d) The following checks had been issued in December but were not included among the paid checks returned by the bank: no. 620 for $ 978, no. 630 for $ 2,052, and no. 641 for $ 483. Required: i) Prepare bank reconciliation at December 31 ii) Prepare the necessary journal entry or entries to update the accounting records based on the reconciliation. Q5) Assum on March 25 that ABC Co having note receivable of 19500 birr with 15 % interest for 120 days. Required: determine the following A) Due date B) Interest rate C) Maturity value Required, prepare necessary journal entry Q3) Assume the following information Sale 480000 birr Cost of good slod 316000 Utilities expense 17.000 Salaries and wages expense 64,000 Advertising expense 16,000 Sale discount 8000 Depreciation expense 8,000 Freight-out 7,000 Insurance expense 2,000 Sale return and allowance 12000 Interest revenue 3,000 Gain on sale of equipment 600 Casualty loss from vandalism (200) (loss) Interest expense 1,800 Unrealized holding gain on investment 2300 (it include on the other comprehensive securities income) Required: prepare statement of profit or loss and statement of other comprehensive income

Step by Step Solution

3.36 Rating (137 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started