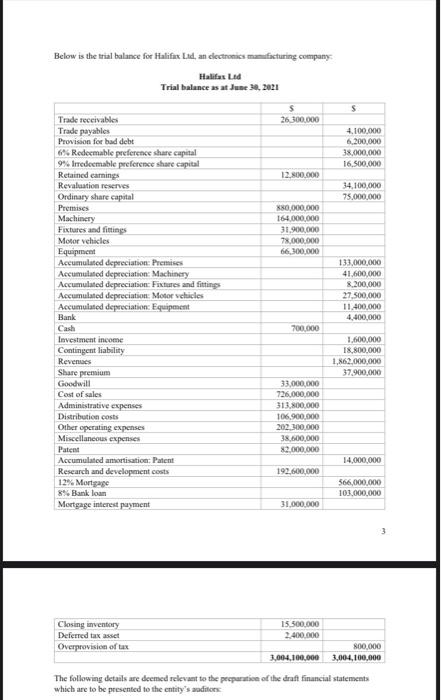

Question: Intermediate Financial Accouting Group Assignment Below is the trial balance for Halifax Lad, an electronics manufacturing company Halifas Led Trial balance as at June 10,

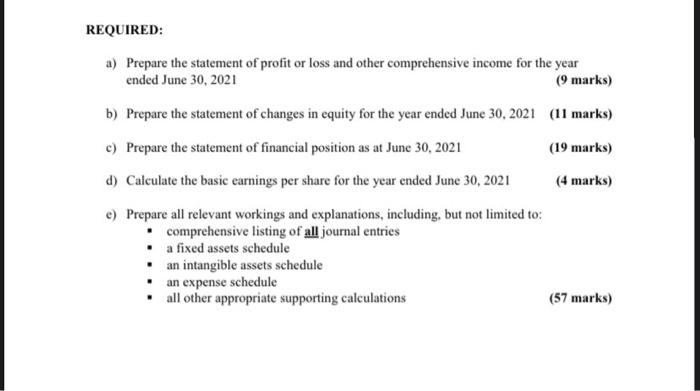

Below is the trial balance for Halifax Lad, an electronics manufacturing company Halifas Led Trial balance as at June 10, 2021 26 300,000 4,100,000 6,200,000 38,000,000 16,500,000 12.800.000 34,100,000 75,000,000 380,000,000 164.000.000 31,900,000 78,000,000 66.300.000 Trade receivables Trade payables Provision for bad debt 6% Redeemable preference share capital 9% Irredeemable preference share capital Retained earnings Revaluation reserves Ordinary share capital Premises Machinery Fixtures and fittings Motor vehicles Equipment Accumulated depreciation: Premises Accumulated depreciation Machinery Accumulated depreciation: Fixtures and fittings Accumulated depreciation: Motor vehicles Accumulated depreciation Equipment Bank Cash Investment income Contingent liability Revenues Share premium Goodwill Cost of sales Administrative expenses Distribution costs Other operating expenses Miscellaneous expenses Patent Accumulated amortisation: Patent Research and development costs 12% Mortgage 8% Bank loan Mortgage interest payment 133,000,000 41,600,000 8.200.000 27.500.000 11.400,000 4,400,000 700.000 1.600.000 18.800,000 1,862,000,000 37.900,000 33.000.000 726,000,000 313.800.000 106.900.000 202.200.000 38.600,000 82.000.000 14,000,000 192.600.000 566.000.000 103,000,000 31.000.000 Closing inventory Deferred tax asset Overprovision of tax 15.500.000 2.400.000 800,000 3,004,100,000 3.004.100.000 The following details are deemed relevant to the peepart of the draft financial statements which are to be presented to the entity's datos REQUIRED: a) Prepare the statement of profit or loss and other comprehensive income for the year ended June 30, 2021 (9 marks) b) Prepare the statement of changes in equity for the year ended June 30, 2021 (11 marks) c) Prepare the statement of financial position as at June 30, 2021 (19 marks) d) Calculate the basic earnings per share for the year ended June 30, 2021 (4 marks) e) Prepare all relevant workings and explanations, including, but not limited to: comprehensive listing of all journal entries . a fixed assets schedule an intangible assets schedule an expense schedule all other appropriate supporting calculations (57 marks) Below is the trial balance for Halifax Lad, an electronics manufacturing company Halifas Led Trial balance as at June 10, 2021 26 300,000 4,100,000 6,200,000 38,000,000 16,500,000 12.800.000 34,100,000 75,000,000 380,000,000 164.000.000 31,900,000 78,000,000 66.300.000 Trade receivables Trade payables Provision for bad debt 6% Redeemable preference share capital 9% Irredeemable preference share capital Retained earnings Revaluation reserves Ordinary share capital Premises Machinery Fixtures and fittings Motor vehicles Equipment Accumulated depreciation: Premises Accumulated depreciation Machinery Accumulated depreciation: Fixtures and fittings Accumulated depreciation: Motor vehicles Accumulated depreciation Equipment Bank Cash Investment income Contingent liability Revenues Share premium Goodwill Cost of sales Administrative expenses Distribution costs Other operating expenses Miscellaneous expenses Patent Accumulated amortisation: Patent Research and development costs 12% Mortgage 8% Bank loan Mortgage interest payment 133,000,000 41,600,000 8.200.000 27.500.000 11.400,000 4,400,000 700.000 1.600.000 18.800,000 1,862,000,000 37.900,000 33.000.000 726,000,000 313.800.000 106.900.000 202.200.000 38.600,000 82.000.000 14,000,000 192.600.000 566.000.000 103,000,000 31.000.000 Closing inventory Deferred tax asset Overprovision of tax 15.500.000 2.400.000 800,000 3,004,100,000 3.004.100.000 The following details are deemed relevant to the peepart of the draft financial statements which are to be presented to the entity's datos REQUIRED: a) Prepare the statement of profit or loss and other comprehensive income for the year ended June 30, 2021 (9 marks) b) Prepare the statement of changes in equity for the year ended June 30, 2021 (11 marks) c) Prepare the statement of financial position as at June 30, 2021 (19 marks) d) Calculate the basic earnings per share for the year ended June 30, 2021 (4 marks) e) Prepare all relevant workings and explanations, including, but not limited to: comprehensive listing of all journal entries . a fixed assets schedule an intangible assets schedule an expense schedule all other appropriate supporting calculations (57 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts