Question: Intermediate Financial Reporting 2 Page 2 Question 2 (6 marks) Fiscella Landry Corp. (FLC) is a publicly accountable entity that operates a defined benefit plan

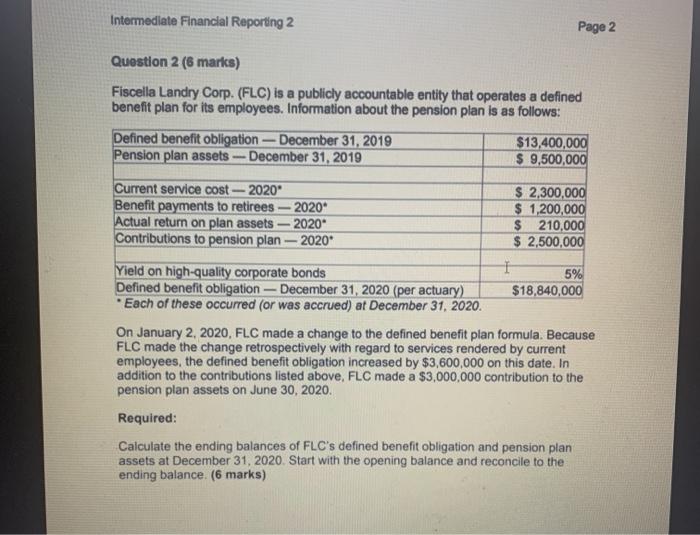

Intermediate Financial Reporting 2 Page 2 Question 2 (6 marks) Fiscella Landry Corp. (FLC) is a publicly accountable entity that operates a defined benefit plan for its employees. Information about the pension plan is as follows: Defined benefit obligation - December 31, 2019 $13,400,000 Pension plan assets -- December 31, 2019 $ 9,500,000 Current service cost-2020" $ 2,300,000 Benefit payments to retirees - 2020" $ 1,200,000 Actual return on plan assets 2020 $ 210,000 Contributions to pension plan - 2020 $ 2,500,000 Yield on high-quality corporate bonds 1 5% Defined benefit obligation --- December 31, 2020 (per actuary) $18,840,000 * Each of these occurred (or was accrued) at December 31, 2020. On January 2, 2020, FL.C made a change to the defined benefit plan formula. Because FLC made the change retrospectively with regard to services rendered by current employees, the defined benefit obligation increased by $3,600,000 on this date. In addition to the contributions listed above, FLC made a $3,000,000 contribution to the pension plan assets on June 30, 2020 Required: Calculate the ending balances of FLC's defined benefit obligation and pension plan assets at December 31, 2020. Start with the opening balance and reconcile to the ending balance. (6 marks) Intermediate Financial Reporting 2 Page 2 Question 2 (6 marks) Fiscella Landry Corp. (FLC) is a publicly accountable entity that operates a defined benefit plan for its employees. Information about the pension plan is as follows: Defined benefit obligation - December 31, 2019 $13,400,000 Pension plan assets -- December 31, 2019 $ 9,500,000 Current service cost-2020" $ 2,300,000 Benefit payments to retirees - 2020" $ 1,200,000 Actual return on plan assets 2020 $ 210,000 Contributions to pension plan - 2020 $ 2,500,000 Yield on high-quality corporate bonds 1 5% Defined benefit obligation --- December 31, 2020 (per actuary) $18,840,000 * Each of these occurred (or was accrued) at December 31, 2020. On January 2, 2020, FL.C made a change to the defined benefit plan formula. Because FLC made the change retrospectively with regard to services rendered by current employees, the defined benefit obligation increased by $3,600,000 on this date. In addition to the contributions listed above, FLC made a $3,000,000 contribution to the pension plan assets on June 30, 2020 Required: Calculate the ending balances of FLC's defined benefit obligation and pension plan assets at December 31, 2020. Start with the opening balance and reconcile to the ending balance. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts