Question: Question 2 (8 marks) Barron Corp. (BC), a publicly accountable entity, operates a defined benefit pension plan for its employees. At December 31, 2018, the

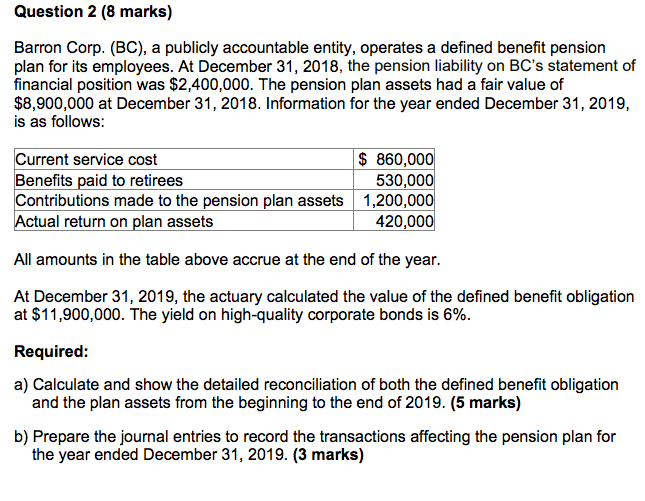

Question 2 (8 marks) Barron Corp. (BC), a publicly accountable entity, operates a defined benefit pension plan for its employees. At December 31, 2018, the pension liability on BC's statement of financial position was $2,400,000. The pension plan assets had a fair value of $8,900,000 at December 31, 2018. Information for the year ended December 31, 2019, is as follows: Current service cost $ 860,000 Benefits paid to retirees 530,000 Contributions made to the pension plan assets 1,200,000 Actual return on plan assets 420,000 All amounts in the table above accrue at the end of the year. At December 31, 2019, the actuary calculated the value of the defined benefit obligation at $11,900,000. The yield on high-quality corporate bonds is 6%. Required: a) Calculate and show the detailed reconciliation of both the defined benefit obligation and the plan assets from the beginning to the end of 2019. (5 marks) b) Prepare the journal entries to record the transactions affecting the pension plan for the year ended December 31, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts