Question: Internal controls ITGCs Part 2: ITGC basics Exercise 3 - Discussion questions Discuss the following questions as a small team. Identify one team member to

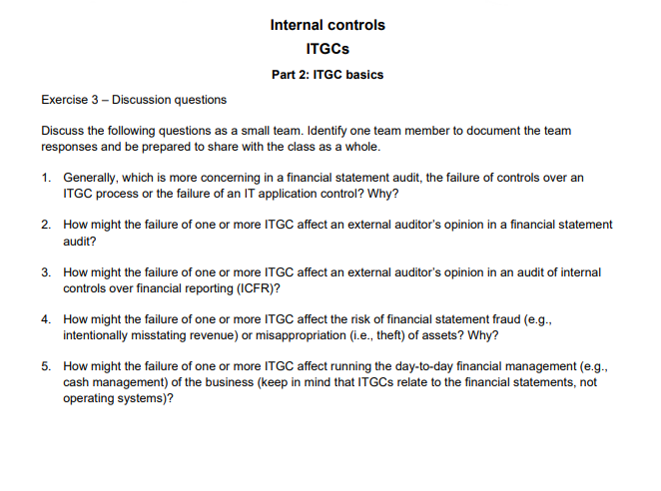

Internal controls ITGCs Part 2: ITGC basics Exercise 3 - Discussion questions Discuss the following questions as a small team. Identify one team member to document the team responses and be prepared to share with the class as a whole. 1. Generally, which is more concerning in a financial statement audit, the failure of controls over an ITGC process or the failure of an IT application control? Why? 2. How might the failure of one or more ITGC affect an external auditor's opinion in a financial statement audit? 3. How might the failure of one or more ITGC affect an external auditor's opinion in an audit of internal controls over financial reporting (ICFR)? 4. How might the failure of one or more ITGC affect the risk of financial statement fraud (e.g., intentionally misstating revenue) or misappropriation (i.e., theft) of assets? Why? 5. How might the failure of one or more ITGC affect running the day-to-day financial management (e.g., cash management) of the business (keep in mind that ITGCs relate to the financial statements, not operating systems)? Internal controls ITGCs Part 2: ITGC basics Exercise 3 - Discussion questions Discuss the following questions as a small team. Identify one team member to document the team responses and be prepared to share with the class as a whole. 1. Generally, which is more concerning in a financial statement audit, the failure of controls over an ITGC process or the failure of an IT application control? Why? 2. How might the failure of one or more ITGC affect an external auditor's opinion in a financial statement audit? 3. How might the failure of one or more ITGC affect an external auditor's opinion in an audit of internal controls over financial reporting (ICFR)? 4. How might the failure of one or more ITGC affect the risk of financial statement fraud (e.g., intentionally misstating revenue) or misappropriation (i.e., theft) of assets? Why? 5. How might the failure of one or more ITGC affect running the day-to-day financial management (e.g., cash management) of the business (keep in mind that ITGCs relate to the financial statements, not operating systems)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts