Question: Interview Notes Chloe is single, a U . S . citizen, and has a valid Social Security number. No one else lives in the household

Interview Notes

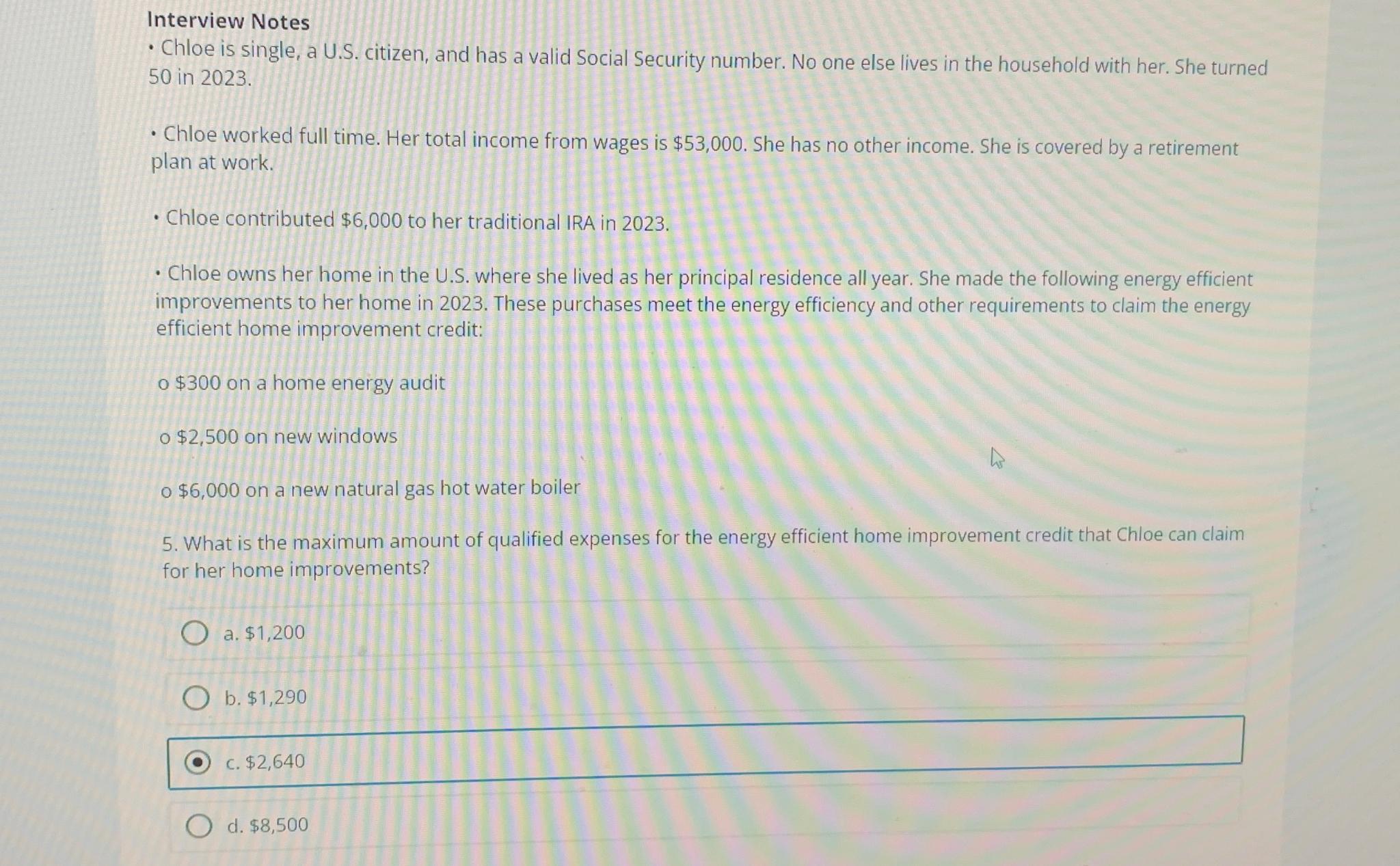

Chloe is single, a US citizen, and has a valid Social Security number. No one else lives in the household with her. She turned in

Chloe worked full time. Her total income from wages is $ She has no other income. She is covered by a retirement plan at work.

Chloe contributed $ to her traditional IRA in

Chloe owns her home in the US where she lived as her principal residence all year. She made the following energy efficient improvements to her home in These purchases meet the energy efficiency and other requirements to claim the energy efficient home improvement credit:

o $ on a home energy audit

o $ on new windows

$ on a new natural gas hot water boiler

What is the maximum amount of qualified expenses for the energy efficient home improvement credit that Chloe can claim for her home improvements?

a $

b $

c $

d $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock