Question: Interview Notes . Judy Young is 58 years old. . Judy is single, is not disabled, and has no dependents In 2017, she had earnings

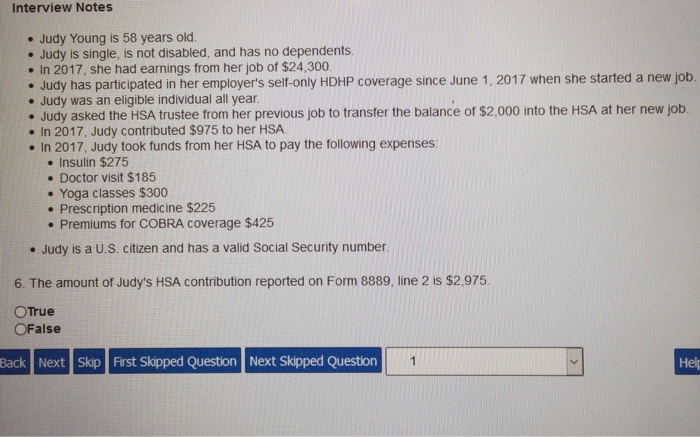

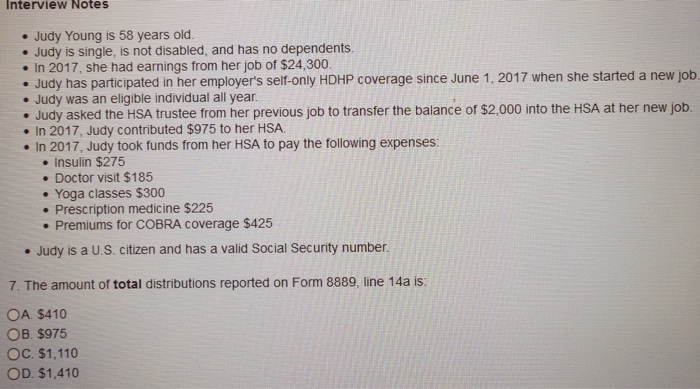

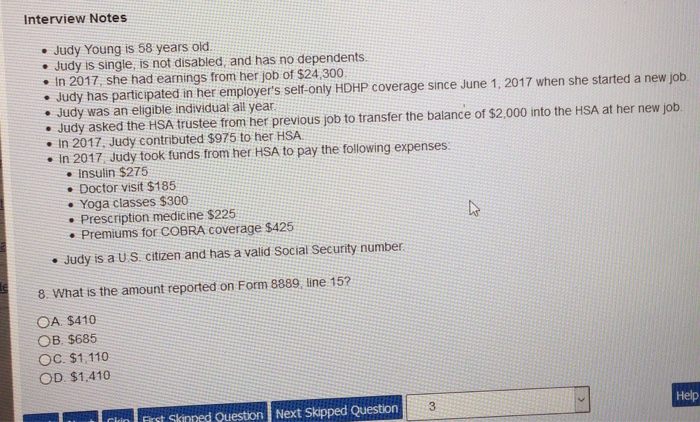

Interview Notes . Judy Young is 58 years old. . Judy is single, is not disabled, and has no dependents In 2017, she had earnings from her job of $24,300 . Judy has participated in her employer's self-only HDHP coverage since June 1, 2017 when she started a new job. . Judy was an eligible individual all year . Judy asked the HSA trustee from her previous job to transfer the balance of $2,000 into the HSA at her new jot . In 2017, Judy contributed $975 to her HSA . In 2017, Judy took funds from her HSA to pay the following expenses . Insulin $275 . Doctor visit $185 . Yoga classes $300 . Prescription medicine $225 . Premiums for COBRA coverage $425 . Judy is a U.S. citizen and has a valid Social Security number 6. The amount of Judy's HSA contribution reported on Form 8889, line 2 is $2.975. True OFalse Back Next Skip First Skipped Question Next Skipped Question Hel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts