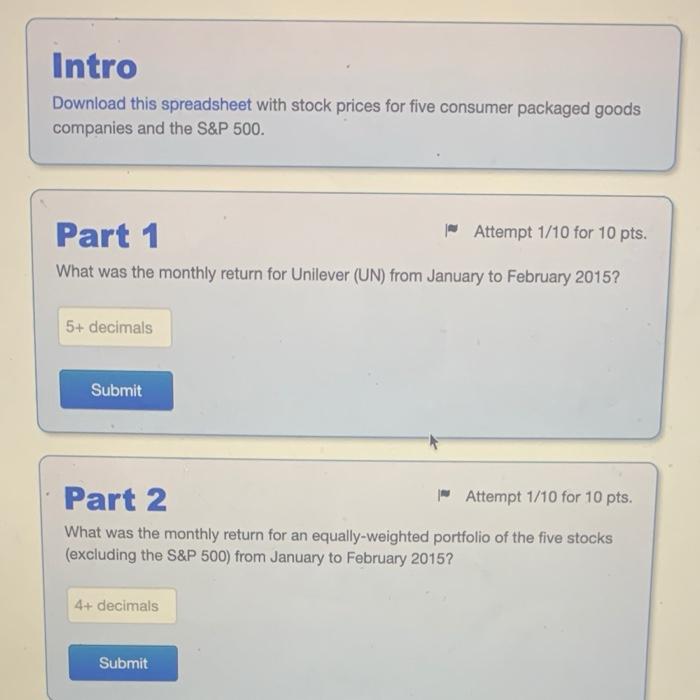

Question: Intro Download this spreadsheet with stock prices for five consumer packaged goods companies and the S&P 500. Part 1 and Attempt 1/10 for 10 pts.

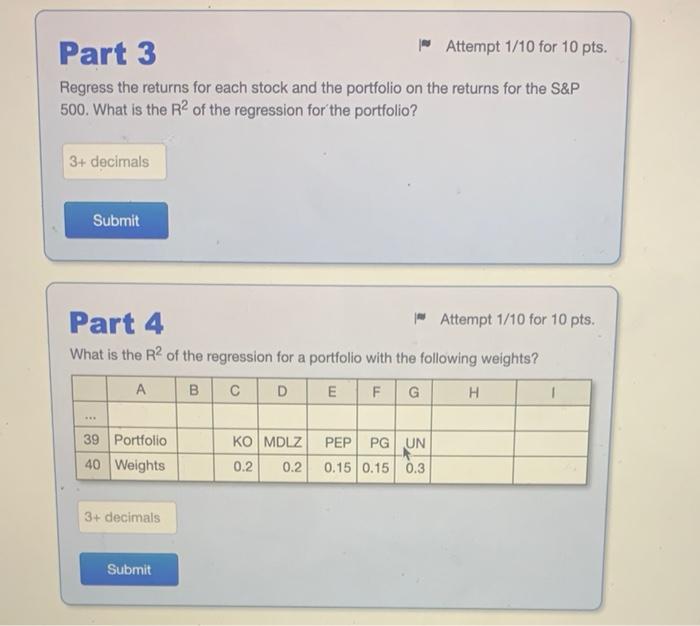

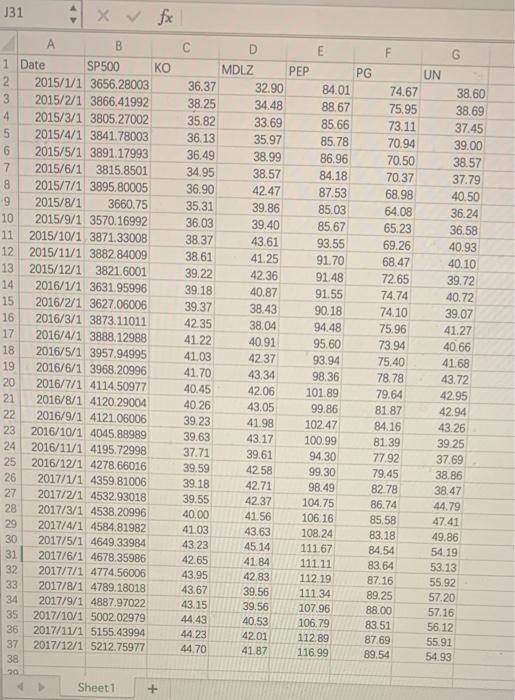

Intro Download this spreadsheet with stock prices for five consumer packaged goods companies and the S&P 500. Part 1 and Attempt 1/10 for 10 pts. What was the monthly return for Unilever (UN) from January to February 2015? 5+ decimals Submit Part 2 so Attempt 1/10 for 10 pts. What was the monthly return for an equally-weighted portfolio of the five stocks (excluding the S&P 500) from January to February 2015? 4+ decimals Submit Part 3 | Attempt 1/10 for 10 pts. Regress the returns for each stock and the portfolio on the returns for the S&P 500. What is the R2 of the regression for the portfolio? 3+ decimals Submit Part 4 pour Attempt 1/10 for 10 pts. What is the R2 of the regression for a portfolio with the following weights? A B D E F G H KO MDLZ 39 Portfolio 40 Weights PEP PG UN 0.15 0.15 0.3 0.2 0.2 3+ decimals Submit J31 x & fc B F G 1 Date SP500 KO 2 2015/1/1 3656.28003 3 2015/2/1 3866.41992 4 2015/3/1 3805.27002 5 2015/4/1 3841.78003 6 2015/5/1 3891.17993 7 2015/6/1 3815.8501 8 2015/7/1 3895.80005 .9 2015/8/1 3660.75 10 2015/9/1 3570.16992 11 2015/10/1 3871.33008 12 2015/11/1 3882.84009 13 2015/12/1 3821.6001 14 2016/1/1 3631.95996 15 2016/2/1 3627.06006 16 2016/3/1 3873.11011 17 2016/4/1 3888.12988 18 2016/5/1 3957.94995 19 2016/6/1 3968.20996 20 2016/7/1 4114.50977 21 2016/8/1 4120.29004 22 2016/9/1 4121.06006 23 2016/10/1 4045.88989 24 2016/11/14195.72998 25 2016/12/14278.66016 26 2017/1/1 4359.81006 27 2017/2/1 4532.93018 2017/3/1 4538.20996 29 2017/4/1 4584.81982 30 2017/5/1 4649.33984 31 2017/6/1 4678.35986 32 2017/7/1 4774.56006 33 2017/8/1 4789.18018 34 2017/9/1 4887.97022 35 2017/10/1 5002.02979 36 2017/11/1 5155.43994 37 2017/12/1 5212.75977 38 30 Sheet1 + D E MDLZ PEP PG UN 36.37 32.90 84.01 74.67 38.60 38.25 34.48 88.67 75.95 38.69 35.82 33.69 85.66 73.11 37.45 36.13 35.97 85.78 70.94 39.00 36.49 38.99 86.96 70.50 38.57 34.95 38.57 84.18 70.37 37.79 36.90 42.47 87.53 68.98 40.50 35.31 39.86 85.03 64.08 36.24 36.03 39.40 85.67 65.23 36.58 38.37 43.61 93.55 69.26 40.93 38.61 41.25 91.70 68.47 40.10 39.22 42.36 91.48 72.65 39.72 39.18 40.87 91.55 74.74 40.72 39.37 38.43 90.18 74.10 39.07 42.35 38.04 94.48 75.96 41.27 41.22 40.91 95.60 73.94 40.66 41.03 4237 93.94 75.40 41.68 41.70 43.34 98.36 78.78 43.72 40.45 42.06 101.89 79.64 42.95 40.26 43.05 99.86 81.87 42.94 39.23 41.98 102.47 84.16 43.26 39.63 43.17 100.99 81.39 39.25 37.71 39.61 94.30 77.92 37.69 39.59 42.58 99.30 79.45 38.86 39.18 42.71 98.49 82.78 38,47 39.55 42.37 104.75 86.74 44.79 40.00 41.56 106.16 85.58 47.41 41.03 43.63 108.24 83.18 49.86 43.23 45.14 111.67 84 54 54.19 42.65 41.84 111.11 83.64 53.13 43.95 42.83 112.19 87.16 55.92 43.67 39.56 111.34 89,25 57.20 43.15 39.56 107.96 88.00 57.16 44.43 40.53 106,79 83.51 56.12 44.23 4201 112.89 87.69 55.91 44,70 41.87 116.99 89.54 54.93 28 Intro Download this spreadsheet with stock prices for five consumer packaged goods companies and the S&P 500. Part 1 and Attempt 1/10 for 10 pts. What was the monthly return for Unilever (UN) from January to February 2015? 5+ decimals Submit Part 2 so Attempt 1/10 for 10 pts. What was the monthly return for an equally-weighted portfolio of the five stocks (excluding the S&P 500) from January to February 2015? 4+ decimals Submit Part 3 | Attempt 1/10 for 10 pts. Regress the returns for each stock and the portfolio on the returns for the S&P 500. What is the R2 of the regression for the portfolio? 3+ decimals Submit Part 4 pour Attempt 1/10 for 10 pts. What is the R2 of the regression for a portfolio with the following weights? A B D E F G H KO MDLZ 39 Portfolio 40 Weights PEP PG UN 0.15 0.15 0.3 0.2 0.2 3+ decimals Submit J31 x & fc B F G 1 Date SP500 KO 2 2015/1/1 3656.28003 3 2015/2/1 3866.41992 4 2015/3/1 3805.27002 5 2015/4/1 3841.78003 6 2015/5/1 3891.17993 7 2015/6/1 3815.8501 8 2015/7/1 3895.80005 .9 2015/8/1 3660.75 10 2015/9/1 3570.16992 11 2015/10/1 3871.33008 12 2015/11/1 3882.84009 13 2015/12/1 3821.6001 14 2016/1/1 3631.95996 15 2016/2/1 3627.06006 16 2016/3/1 3873.11011 17 2016/4/1 3888.12988 18 2016/5/1 3957.94995 19 2016/6/1 3968.20996 20 2016/7/1 4114.50977 21 2016/8/1 4120.29004 22 2016/9/1 4121.06006 23 2016/10/1 4045.88989 24 2016/11/14195.72998 25 2016/12/14278.66016 26 2017/1/1 4359.81006 27 2017/2/1 4532.93018 2017/3/1 4538.20996 29 2017/4/1 4584.81982 30 2017/5/1 4649.33984 31 2017/6/1 4678.35986 32 2017/7/1 4774.56006 33 2017/8/1 4789.18018 34 2017/9/1 4887.97022 35 2017/10/1 5002.02979 36 2017/11/1 5155.43994 37 2017/12/1 5212.75977 38 30 Sheet1 + D E MDLZ PEP PG UN 36.37 32.90 84.01 74.67 38.60 38.25 34.48 88.67 75.95 38.69 35.82 33.69 85.66 73.11 37.45 36.13 35.97 85.78 70.94 39.00 36.49 38.99 86.96 70.50 38.57 34.95 38.57 84.18 70.37 37.79 36.90 42.47 87.53 68.98 40.50 35.31 39.86 85.03 64.08 36.24 36.03 39.40 85.67 65.23 36.58 38.37 43.61 93.55 69.26 40.93 38.61 41.25 91.70 68.47 40.10 39.22 42.36 91.48 72.65 39.72 39.18 40.87 91.55 74.74 40.72 39.37 38.43 90.18 74.10 39.07 42.35 38.04 94.48 75.96 41.27 41.22 40.91 95.60 73.94 40.66 41.03 4237 93.94 75.40 41.68 41.70 43.34 98.36 78.78 43.72 40.45 42.06 101.89 79.64 42.95 40.26 43.05 99.86 81.87 42.94 39.23 41.98 102.47 84.16 43.26 39.63 43.17 100.99 81.39 39.25 37.71 39.61 94.30 77.92 37.69 39.59 42.58 99.30 79.45 38.86 39.18 42.71 98.49 82.78 38,47 39.55 42.37 104.75 86.74 44.79 40.00 41.56 106.16 85.58 47.41 41.03 43.63 108.24 83.18 49.86 43.23 45.14 111.67 84 54 54.19 42.65 41.84 111.11 83.64 53.13 43.95 42.83 112.19 87.16 55.92 43.67 39.56 111.34 89,25 57.20 43.15 39.56 107.96 88.00 57.16 44.43 40.53 106,79 83.51 56.12 44.23 4201 112.89 87.69 55.91 44,70 41.87 116.99 89.54 54.93 28

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts