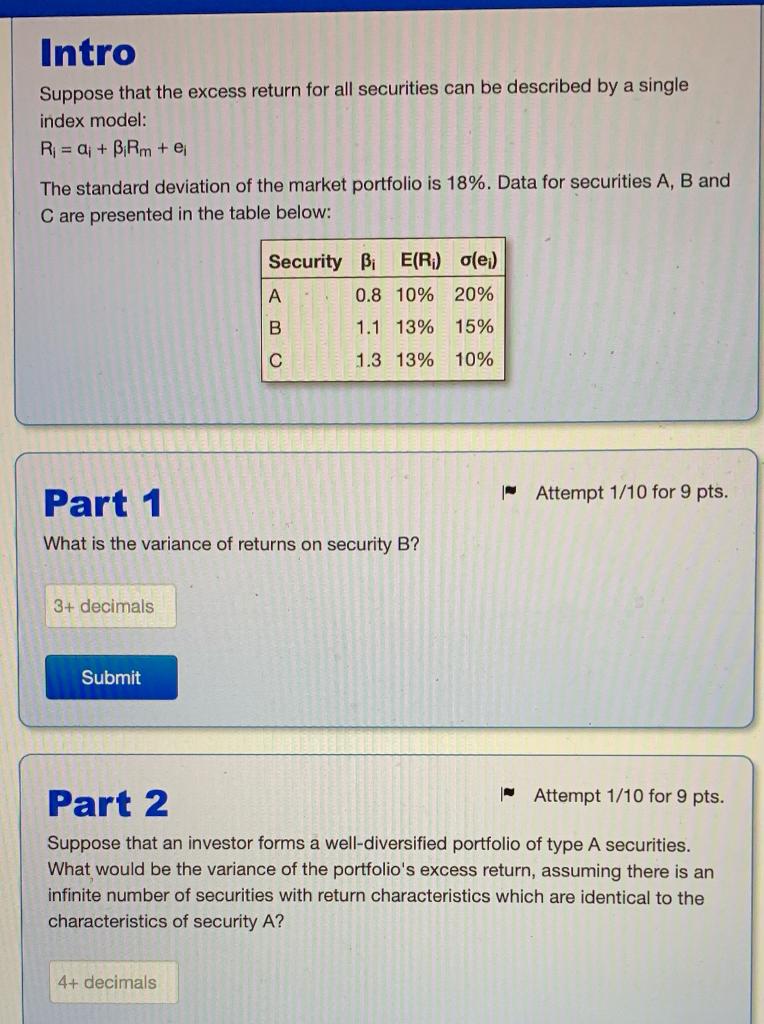

Question: Intro Suppose that the excess return for all securities can be described by a single index model: Ri= a + BiRm + e The standard

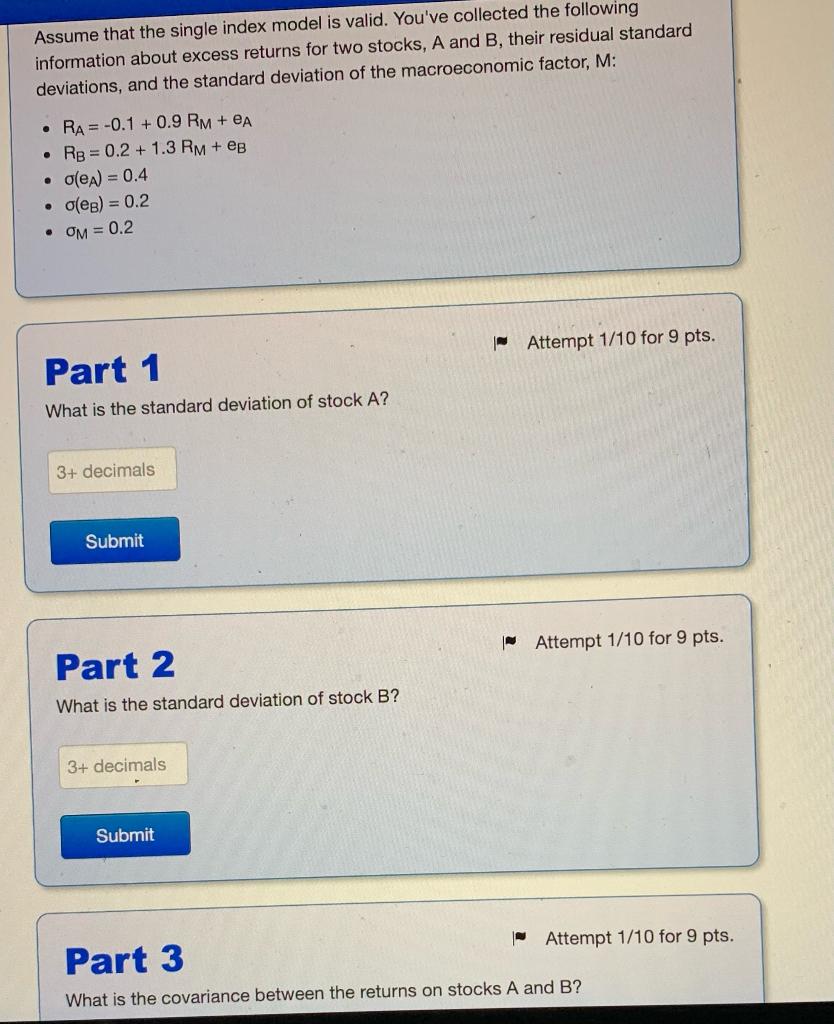

Intro Suppose that the excess return for all securities can be described by a single index model: Ri= a + BiRm + e The standard deviation of the market portfolio is 18%. Data for securities A, B and C are presented in the table below: Security Bi E(R) ole;) A 0.8 10% 20% B 1.1 13% 15% 1.3 13% 10% - Attempt 1/10 for 9 pts. Part 1 What is the variance of returns on security B? 3+ decimals Submit - Attempt 1/10 for 9 pts. Part 2 Suppose that an investor forms a well-diversified portfolio of type A securities. What would be the variance of the portfolio's excess return, assuming there is an infinite number of securities with return characteristics which are identical to the characteristics of security A? 4+ decimals Assume that the single index model is valid. You've collected the following information about excess returns for two stocks, A and B, their residual standard deviations, and the standard deviation of the macroeconomic factor, M: RA= -0.1 +0.9 RM + EA RB = 0.2 + 1.3 RM + eg (en) = 0.4 . (es) = 0.2 OM = 0.2 | Attempt 1/10 for 9 pts. Part 1 What is the standard deviation of stock A? 3+ decimals Submit - Attempt 1/10 for 9 pts. Part 2 What is the standard deviation of stock B? 3+ decimals Submit - Attempt 1/10 for 9 pts. Part 3 What is the covariance between the returns on stocks A and B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts