Question: Intro What is the primary difference between volatility risk and interest rate risk for bonds? Part 1 Volatility risk applies only to bonds with fixed

Intro

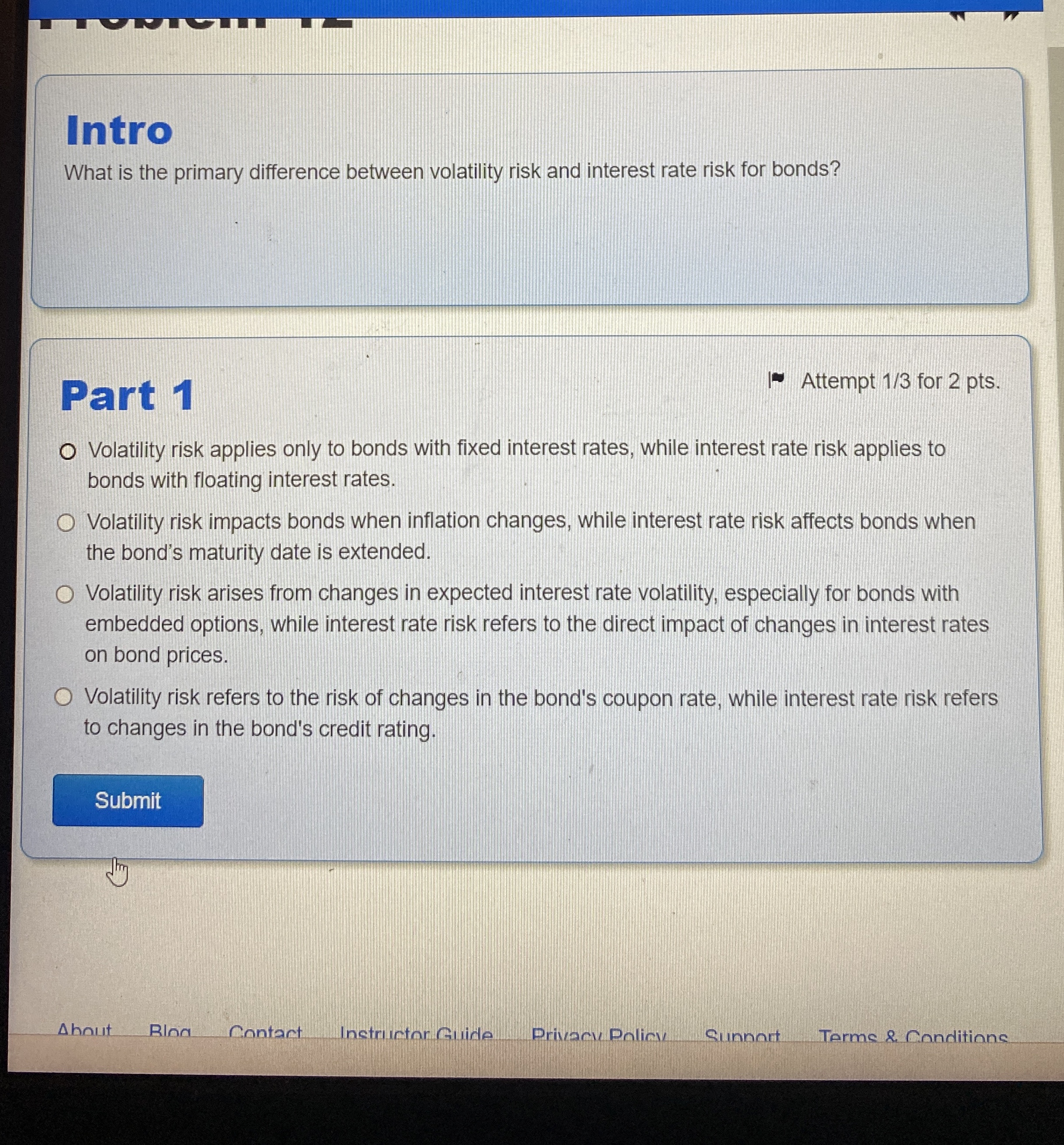

What is the primary difference between volatility risk and interest rate risk for bonds?

Part

Volatility risk applies only to bonds with fixed interest rates, while interest rate risk applies to

bonds with floating interest rates.

Volatility risk impacts bonds when inflation changes, while interest rate risk affects bonds when

the bond's maturity date is extended.

Volatility risk arises from changes in expected interest rate volatility, especially for bonds with

embedded options, while interest rate risk refers to the direct impact of changes in interest rates

on bond prices.

Volatility risk refers to the risk of changes in the bond's coupon rate, while interest rate risk refers

to changes in the bond's credit rating.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock