Question: Introduction Read the overview below and complete the activities that follow. Mailbox Rule A freak jet-ski accident caused the worldwide Internet and telephone system to

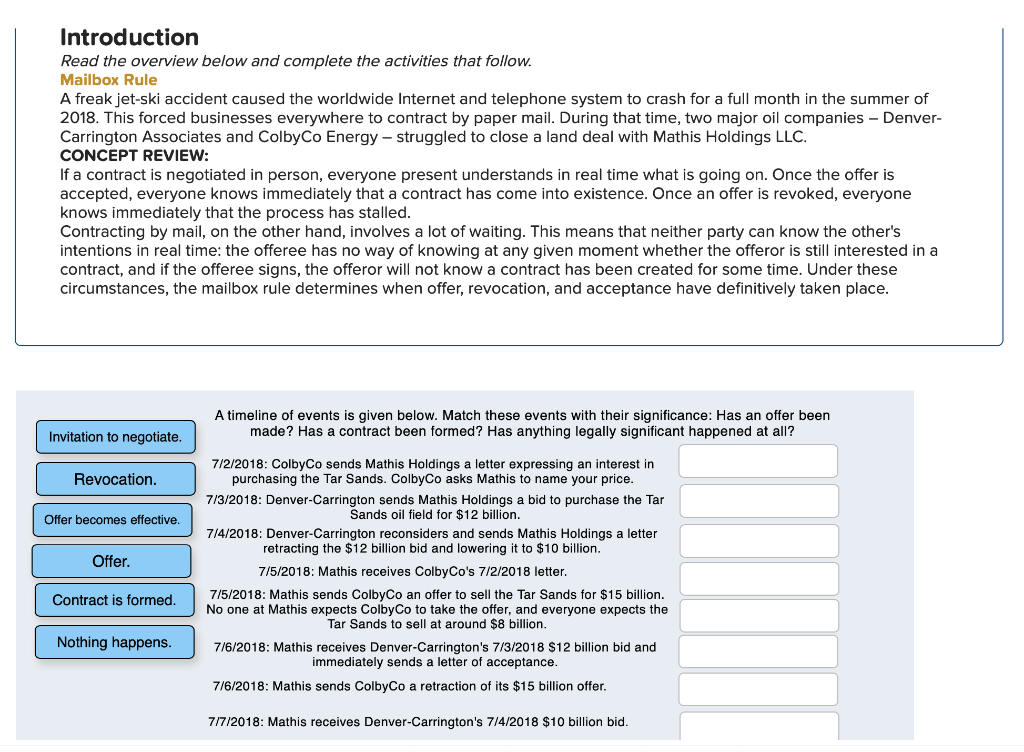

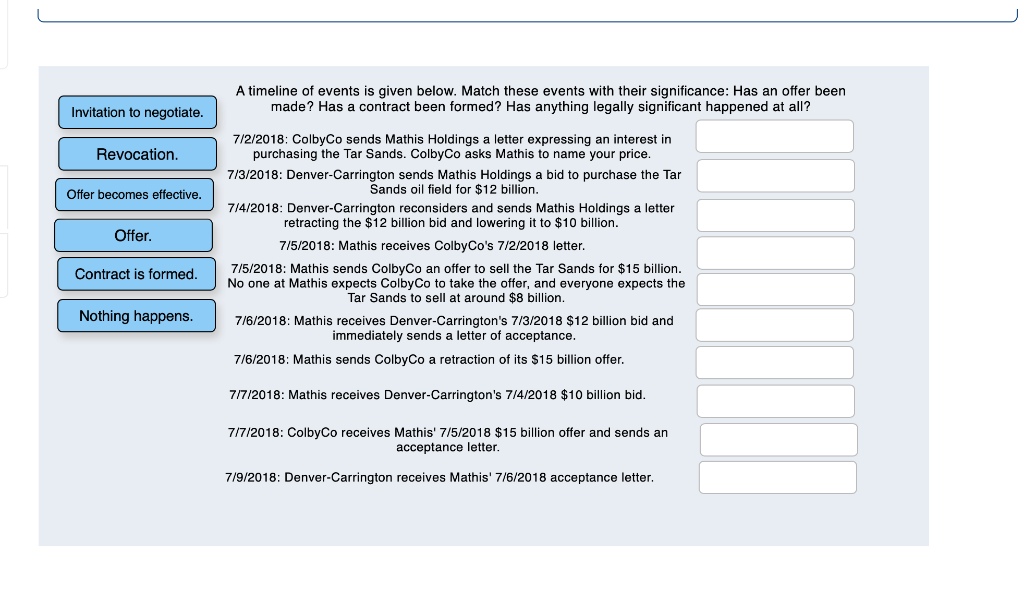

Introduction Read the overview below and complete the activities that follow. Mailbox Rule A freak jet-ski accident caused the worldwide Internet and telephone system to crash for a full month in the summer of 2018. This forced businesses everywhere to contract by paper mail. During that time, two major oil companies - Denver- Carrington Associates and ColbyCo Energy - struggled to close a land deal with Mathis Holdings LLC. CONCEPT REVIEW: If a contract is negotiated in person, everyone present understands in real time what is going on. Once the offer is accepted, everyone knows immediately that a contract has come into existence. Once an offer is revoked, everyone knows immediately that the process has stalled. Contracting by mail, on the other hand, involves a lot of waiting. This means that neither party can know the other's intentions in real time: the offeree has no way of knowing at any given moment whether the offeror is still interested in a contract, and if the offeree signs, the offeror will not know a contract has been created for some time. Under these circumstances, the mailbox rule determines when offer, revocation, and acceptance have definitively taken place. A timeline of events is given below. Match these events with their significance: Has an offer been made? Has a contract been formed? Has anything legally significant happened at all? Invitation to negotiate. Revocation. Offer becomes effective. Offer. 7/2/2018: Colby Co sends Mathis Holdings a letter expressing an interest in purchasing the Tar Sands. ColbyCo asks Mathis to name your price. 7/3/2018: Denver-Carrington sends Mathis Holdings a bid to purchase the Tar Sands oil field for $12 billion. 7/4/2018: Denver-Carrington reconsiders and sends Mathis Holdings a letter retracting the $12 billion bid and lowering it to $10 billion. 7/5/2018: Mathis receives Colby Co's 7/2/2018 letter. 7/5/2018: Mathis sends Colby Co an offer to sell the Tar Sands for $15 billion. No one at Mathis expects Colby Co to take the offer, and everyone expects the Tar Sands to sell at around $8 billion. 7/6/2018: Mathis receives Denver-Carrington's 7/3/2018 $12 billion bid and immediately sends a letter of acceptance. 7/6/2018: Mathis sends ColbyCo a retraction of its $15 billion offer. Contract is formed. Nothing happens. 7/7/2018: Mathis receives Denver-Carrington's 7/4/2018 $10 billion bid. A timeline of events is given below. Match these events with their significance: Has an offer been made? Has a contract been formed? Has anything legally significant happened at all? Invitation to negotiate. Revocation. Offer becomes effective. Offer. 7/2/2018: Colby Co sends Mathis Holdings a letter expressing an interest in purchasing the Tar Sands. Colby Co asks Mathis to name your price. 7/3/2018: Denver-Carrington sends Mathis Holdings a bid to purchase the Tar Sands oil field for $12 billion. 7/4/2018: Denver-Carrington reconsiders and sends Mathis Holdings a letter retracting the $12 billion bid and lowering it to $10 billion. 7/5/2018: Mathis receives Colby Co's 7/2/2018 letter. 7/5/2018: Mathis sends ColbyCo an offer to sell the Tar Sands for $15 billion. No one at Mathis expects Colby Co to take the offer, and everyone expects the Tar Sands to sell at around $8 billion. 7/6/2018: Mathis receives Denver-Carrington's 7/3/2018 $12 billion bid and immediately sends a letter of acceptance. 7/6/2018: Mathis sends ColbyCo a retraction of its $15 billion offer. Contract is formed. Nothing happens. 7/7/2018: Mathis receives Denver-Carrington's 7/4/2018 $10 billion bid. 7/7/2018: Colby Co receives Mathis' 7/5/2018 $15 billion offer and sends an acceptance letter. 7/9/2018: Denver-Carrington receives Mathis' 7/6/2018 acceptance letter. Introduction Read the overview below and complete the activities that follow. Mailbox Rule A freak jet-ski accident caused the worldwide Internet and telephone system to crash for a full month in the summer of 2018. This forced businesses everywhere to contract by paper mail. During that time, two major oil companies - Denver- Carrington Associates and ColbyCo Energy - struggled to close a land deal with Mathis Holdings LLC. CONCEPT REVIEW: If a contract is negotiated in person, everyone present understands in real time what is going on. Once the offer is accepted, everyone knows immediately that a contract has come into existence. Once an offer is revoked, everyone knows immediately that the process has stalled. Contracting by mail, on the other hand, involves a lot of waiting. This means that neither party can know the other's intentions in real time: the offeree has no way of knowing at any given moment whether the offeror is still interested in a contract, and if the offeree signs, the offeror will not know a contract has been created for some time. Under these circumstances, the mailbox rule determines when offer, revocation, and acceptance have definitively taken place. A timeline of events is given below. Match these events with their significance: Has an offer been made? Has a contract been formed? Has anything legally significant happened at all? Invitation to negotiate. Revocation. Offer becomes effective. Offer. 7/2/2018: Colby Co sends Mathis Holdings a letter expressing an interest in purchasing the Tar Sands. ColbyCo asks Mathis to name your price. 7/3/2018: Denver-Carrington sends Mathis Holdings a bid to purchase the Tar Sands oil field for $12 billion. 7/4/2018: Denver-Carrington reconsiders and sends Mathis Holdings a letter retracting the $12 billion bid and lowering it to $10 billion. 7/5/2018: Mathis receives Colby Co's 7/2/2018 letter. 7/5/2018: Mathis sends Colby Co an offer to sell the Tar Sands for $15 billion. No one at Mathis expects Colby Co to take the offer, and everyone expects the Tar Sands to sell at around $8 billion. 7/6/2018: Mathis receives Denver-Carrington's 7/3/2018 $12 billion bid and immediately sends a letter of acceptance. 7/6/2018: Mathis sends ColbyCo a retraction of its $15 billion offer. Contract is formed. Nothing happens. 7/7/2018: Mathis receives Denver-Carrington's 7/4/2018 $10 billion bid. A timeline of events is given below. Match these events with their significance: Has an offer been made? Has a contract been formed? Has anything legally significant happened at all? Invitation to negotiate. Revocation. Offer becomes effective. Offer. 7/2/2018: Colby Co sends Mathis Holdings a letter expressing an interest in purchasing the Tar Sands. Colby Co asks Mathis to name your price. 7/3/2018: Denver-Carrington sends Mathis Holdings a bid to purchase the Tar Sands oil field for $12 billion. 7/4/2018: Denver-Carrington reconsiders and sends Mathis Holdings a letter retracting the $12 billion bid and lowering it to $10 billion. 7/5/2018: Mathis receives Colby Co's 7/2/2018 letter. 7/5/2018: Mathis sends ColbyCo an offer to sell the Tar Sands for $15 billion. No one at Mathis expects Colby Co to take the offer, and everyone expects the Tar Sands to sell at around $8 billion. 7/6/2018: Mathis receives Denver-Carrington's 7/3/2018 $12 billion bid and immediately sends a letter of acceptance. 7/6/2018: Mathis sends ColbyCo a retraction of its $15 billion offer. Contract is formed. Nothing happens. 7/7/2018: Mathis receives Denver-Carrington's 7/4/2018 $10 billion bid. 7/7/2018: Colby Co receives Mathis' 7/5/2018 $15 billion offer and sends an acceptance letter. 7/9/2018: Denver-Carrington receives Mathis' 7/6/2018 acceptance letter

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts