Question: Introduction This is your first 'brain stretching exercise. The intent of these assignments is to push you to explore and develop your skills, You are

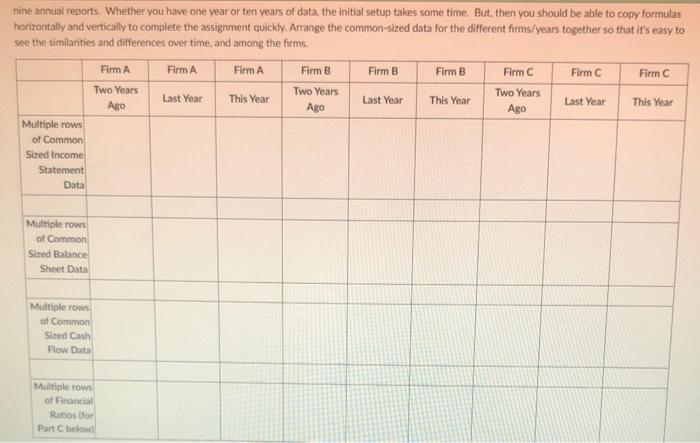

Introduction This is your first 'brain stretching exercise. The intent of these assignments is to push you to explore and develop your skills, You are welcome to invest whatever effort you like into these, but the purpose is not for you to sink days of effort into them. Most brain stretching exercises can be completed relatively quickly if you look for ways of being efficient in your work. le, if you are engaged in a highly repetitive task that seems like it will take hours to complete, there is likely a better way to proceed. My hope is that you will completely solve these challenges, but, I'll be lenient on the grading provided you've given it a real effort. I'm also willing to offer advice if you are stuck. If you've made some headway and aren't sure what to do next, please feel free to drop by my office (physically or via zoom), or reach out to schedule time to chat. Instructions: Select two publicly traded companies in the same industry companies which compete with one another), and a third company in an entirely different industry. For example, you might choose Walmart and Target (competitors), and General Electric (from a different industry). If the any of the companies you select don't have at least three years of publicly available financial data, select an alternate firm to make this exercise simpler. Part A Find the data from (at east) their three most recent annual reports, and prepare an excel analysis that compares the income statements, balance sheets, and statements of cash flow using the common size approach With at least three reports from three different companies, you'll have data for at least nine annual reports. Whether you have one year or ten years of data, the initial setup takes some time. But then you should be able to copy formulas horizontally and vertically to complete the assignment quickly. Arrange the common-sized data for the different hrms/years together so that it's easy to see the similarities and differences over time, and among the firms. Firm A Firm A Firm A Firm B Firm B Firm B Firma Firm C Firm C nine annual reports. Whether you have one year or ten years of data, the initial setup takes some time. But, then you should be able to copy formulas horizontally and vertically to complete the assignment quickly. Arrange the common-sized data for the different firms/years together so that it's easy to see the similarities and differences over time, and among the firms. Firma Firma FirmA Firm B Firm B Firm B Firm C Firm Firm Two Years Two Years Two Years Last Year This Year Last Year This Year Last Year This Year Ago Ago Ago Multiple rows of Common Sized Income Statement Data Multiple rows of Common Sized Balance Sheet Data Multiple rows of Common Suured Cash Flow Data Multiple rows of Financial Ratios for Part below Multiple rows of Financial Ratios (for Part below) Part B: Preparing a report is great, but, interpreting and explaining it makes it useful Review your data and interpret what you see. Are the common-sized numbers similar among the firms? Why or why not? Make some educated guesses about why there are or aren't differences, le explain the results of your analysis Part Select several of the financial ratios we discussed, and prepare a second report that compares these firms using these ratios. Part 1 Calculating the ratios is a relatively straightforward exercise once you have the data in hand. However, determining what those ratios tell us about the business Review your data and interpret what you see. Are the ratios similar between the firms? Why or why not? Make some educated guesses about why there are or aren't differences. Introduction This is your first 'brain stretching exercise. The intent of these assignments is to push you to explore and develop your skills, You are welcome to invest whatever effort you like into these, but the purpose is not for you to sink days of effort into them. Most brain stretching exercises can be completed relatively quickly if you look for ways of being efficient in your work. le, if you are engaged in a highly repetitive task that seems like it will take hours to complete, there is likely a better way to proceed. My hope is that you will completely solve these challenges, but, I'll be lenient on the grading provided you've given it a real effort. I'm also willing to offer advice if you are stuck. If you've made some headway and aren't sure what to do next, please feel free to drop by my office (physically or via zoom), or reach out to schedule time to chat. Instructions: Select two publicly traded companies in the same industry companies which compete with one another), and a third company in an entirely different industry. For example, you might choose Walmart and Target (competitors), and General Electric (from a different industry). If the any of the companies you select don't have at least three years of publicly available financial data, select an alternate firm to make this exercise simpler. Part A Find the data from (at east) their three most recent annual reports, and prepare an excel analysis that compares the income statements, balance sheets, and statements of cash flow using the common size approach With at least three reports from three different companies, you'll have data for at least nine annual reports. Whether you have one year or ten years of data, the initial setup takes some time. But then you should be able to copy formulas horizontally and vertically to complete the assignment quickly. Arrange the common-sized data for the different hrms/years together so that it's easy to see the similarities and differences over time, and among the firms. Firm A Firm A Firm A Firm B Firm B Firm B Firma Firm C Firm C nine annual reports. Whether you have one year or ten years of data, the initial setup takes some time. But, then you should be able to copy formulas horizontally and vertically to complete the assignment quickly. Arrange the common-sized data for the different firms/years together so that it's easy to see the similarities and differences over time, and among the firms. Firma Firma FirmA Firm B Firm B Firm B Firm C Firm Firm Two Years Two Years Two Years Last Year This Year Last Year This Year Last Year This Year Ago Ago Ago Multiple rows of Common Sized Income Statement Data Multiple rows of Common Sized Balance Sheet Data Multiple rows of Common Suured Cash Flow Data Multiple rows of Financial Ratios for Part below Multiple rows of Financial Ratios (for Part below) Part B: Preparing a report is great, but, interpreting and explaining it makes it useful Review your data and interpret what you see. Are the common-sized numbers similar among the firms? Why or why not? Make some educated guesses about why there are or aren't differences, le explain the results of your analysis Part Select several of the financial ratios we discussed, and prepare a second report that compares these firms using these ratios. Part 1 Calculating the ratios is a relatively straightforward exercise once you have the data in hand. However, determining what those ratios tell us about the business Review your data and interpret what you see. Are the ratios similar between the firms? Why or why not? Make some educated guesses about why there are or aren't differences

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts